Banque de France Bulletin no. 233: Article 1 The financial health of VSEs-SMEs: an essential determinant of their credit access

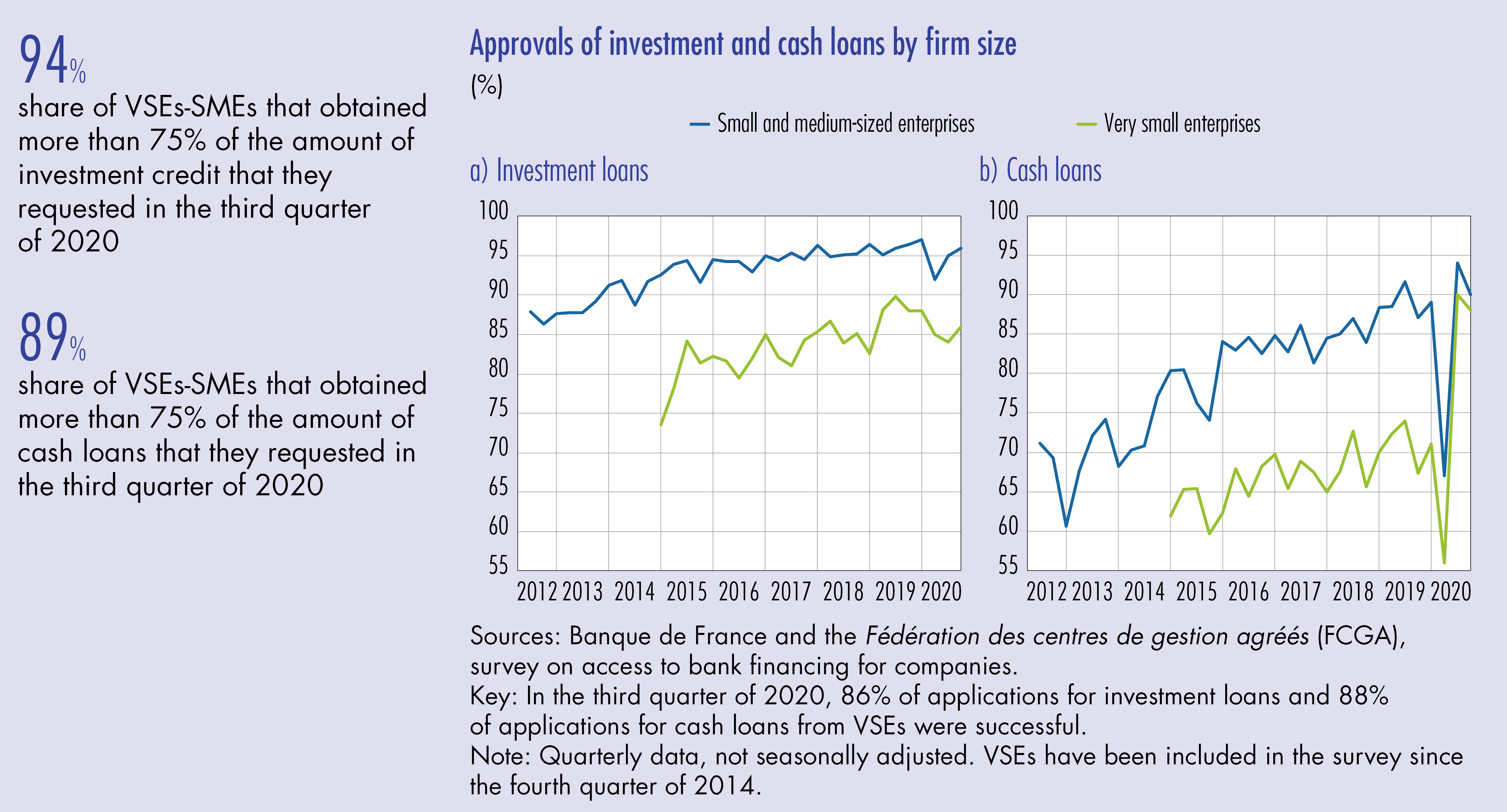

Since 2012, the Banque de France has carried out a quarterly survey of very small enterprises (VSEs) and small and medium-sized enterprises (SMEs) to assess their access to bank credit. The vast majority of demand for investment loans is met, with an average of 91% of VSEs and SMEs having their loan application approved in the period 2012-20. For cash loans excluding lines of credit, the success rate for loan applications is lower at 76% over the same period, but has followed an upward trajectory since 2012. In addition, the introduction of the state-guaranteed loan (SGL) scheme led to a marked rise in the success rate for applications in 2020, especially for VSEs. The main criteria used to determine access to credit are financial (solvency, self-financing and liquidity ratios). These factors outweigh all non-financial considerations (size, sector and age of the firm).

1 Since 2012, VSEs-SMEs have found it easier to access credit

France’s 3.81 million VSEs and SMEs account for nearly half the jobs and wealth produced by all the nation’s businesses. They are a genuine driving force behind the economy, but they have limited access to financial markets and instead have to rely on credit in order to expand. To assess these financial constraints, since the second quarter of 2012 the Banque de France has conducted a quarterly survey of over 8,500 enterprises to collect data on their access to bank financing (see Box 1). The size of the survey panel, and the fact that it remains relatively constant from one quarter to the next, makes it possible to monitor applications for and approvals of financing over time.

The vast majority of demand for investment loans is met

Investment loans are mainly used to finance equipment (means of transport, premises, office equipment, etc.) or real estate. On average, 18% of VSEs-SMEs apply to their banks for this type of financing in any given quarter. This proportion remained stable from 2012 to 2019, but then declined in 2020 (11% on average over the first three quarters) as firms chose to defer their investment decisions on account of the crisis. These loan applications are mostly accepted and the success rate has followed an upward trajectory: on average over the period, 91% of applications for investment loans were successful (a loan is deemed to have been granted if the firm obtains at least 75% of the amount requested).

Some firms request more investment loans than others to finance their activities. Firm size appears to be a significant factor in determining the need for investment loans: 15% of SMEs applied for an investment loan in the third quarter of 2020 compared with 6% of VSEs. For firms in manufacturing, construction and market services, the sector of activity also appears to play a role: over the entire period, 24% of VSEs-SMEs in the manufacturing industry applied for investment loans, compared with 16% of construction firms and 15% of services firms. Firms with the highest Banque de France ratings also tend to ask for more investment loans – the proportion applying is on average 6 percentage points higher than for firms with the lowest ratings.

With regard to bank loan approvals, the sector of activity of the applicant firm does not appear to play a significant…

Download the PDF version of this document

- Published on 03/17/2021

- 11 pages

- EN

- PDF (445.63 KB)

Bulletin Banque de France 233

Updated on: 03/17/2021 16:58