Working Paper Series no. 645: Common Factors of Commodity Prices

In this paper we extract latent factors from a large cross-section of commodity prices, including fuel and non-fuel commodities. We decompose each commodity price series into a global (or common) component, block-specific components and a purely idiosyncratic shock. We find that the bulk of the fluctuations in commodity prices is well summarised by a single global factor. This global factor is closely related to fluctuations in global economic activity and its importance in explaining commodity price variations has increased since the 2000s, especially for oil prices

In this paper we analyse the degree of co-movement in international commodity returns by studying a broad range of commodities that are representative of the global market. In doing so, we estimate a dynamic factor model with a block structure to decompose each commodity price series into a global (or common) component, block-specific components related to specific commodity markets and a purely idiosyncratic shock. The distinction between global, block-specific and idiosyncratic components allows for the presence of shocks of different nature, having distinct consequences on the cross-correlation between commodity prices.

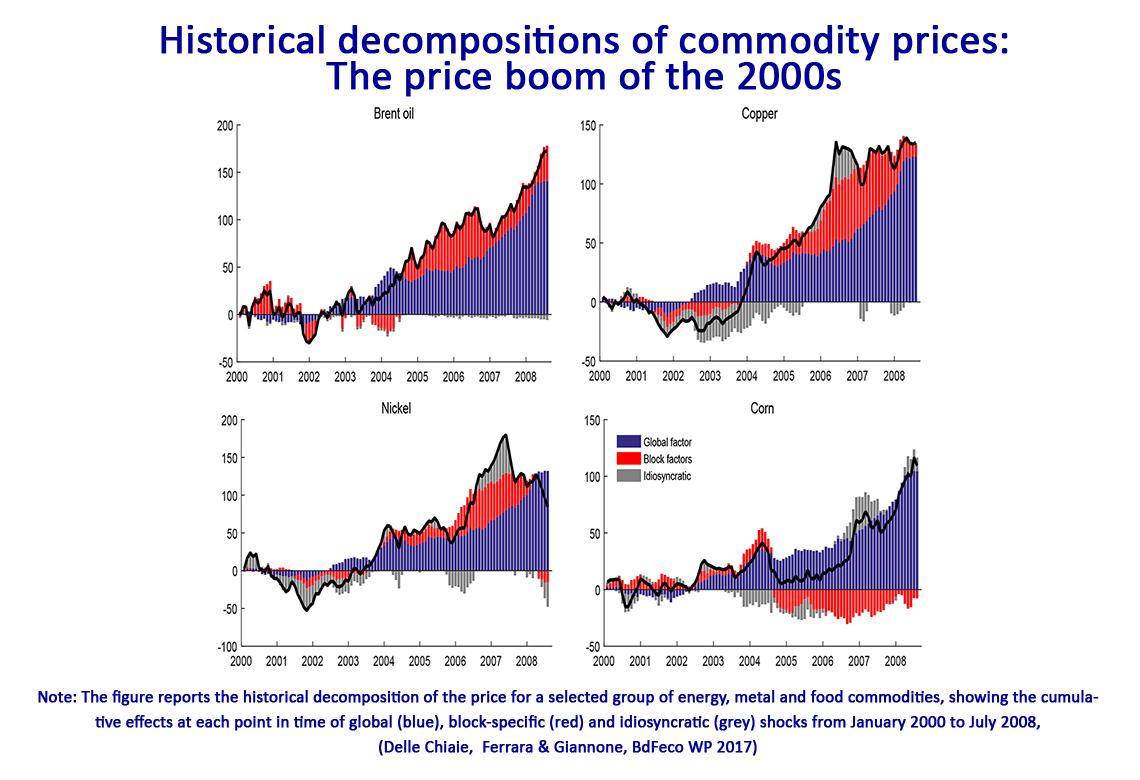

We find that there is a single global factor driving the bulk of commodity price fluctuations. The global factor is persistent and follows the major expansion and contraction phases in the international business cycle with the largest declines following recession periods. It is also strongly related to measures of economic activity, suggesting a close link with demand factors. This is further corroborated by the fact that the global factor has homogenous effects on all markets and hence limited effects on relative prices. Since the start of the new millennium, the relevance of the global factor has increased, especially for oil. We compute model-based historical decompositions of commodity price changes and we find that the global factor explains a large fraction of commodity price fluctuations during episodes typically associated with changes in global demand conditions, such as the world economic expansion that started around 2003 and the steep contraction during the Great Recession. By contrast, block components explain most of the fluctuations in commodity prices during episodes conventionally associated with supply or other commodity-specific shocks. We perform an out-of-sample validation of the model. We find that the factor model performs well in forecasting commodity prices and indices of commodity prices, in particular at short horizons.

Download the PDF version of this document

- Published on 09/26/2017

- 40 pages

- EN

- PDF (2.46 MB)

Updated on: 10/18/2017 09:12