Banque de France Bulletin no. 232: Article 7 Outstanding loans to enterprises increased sharply in France in the first half of 2020

Since the outbreak of the Covid-19 crisis in March 2020, outstanding bank loans to enterprises have surged: between end-February and end-June 2020, they rose by EUR 101 billion. This upswing can be attributed first and foremost to substantial drawing on existing credit lines as of March 2020 by mid-tier enterprises and large corporations. The second largest contributing factor has been the use of the state-guaranteed loan (SGL) scheme, primarily by small and medium-sized enterprises (SMEs). Since July 2020, the volume of SGLs appears to have stabilised: between June and July 2020, it increased by “just” EUR 10 billion, after rising by EUR 19 billion between May and June, and by EUR 45 billion between April and May. The introduction of the SGL scheme has prompted a decline in interest rates on loans to enterprises.

As a result of the epidemic linked to the novel coronavirus, French GDP slumped by 13.8% in the second quarter of 2020 following a 5.9% decline in the first quarter. The contraction in activity led to a steep drop in corporate revenues, leaving firms in urgent need of liquidity, notably to cover charges that could not be deferred. One of the main sources of liquidity for firms is bank credit. This article analyses the dynamics in firms’ bank borrowing in the first half of 2020 in the context of the crisis.

1 A sharp rise in outstanding loans from the start of the first lockdown

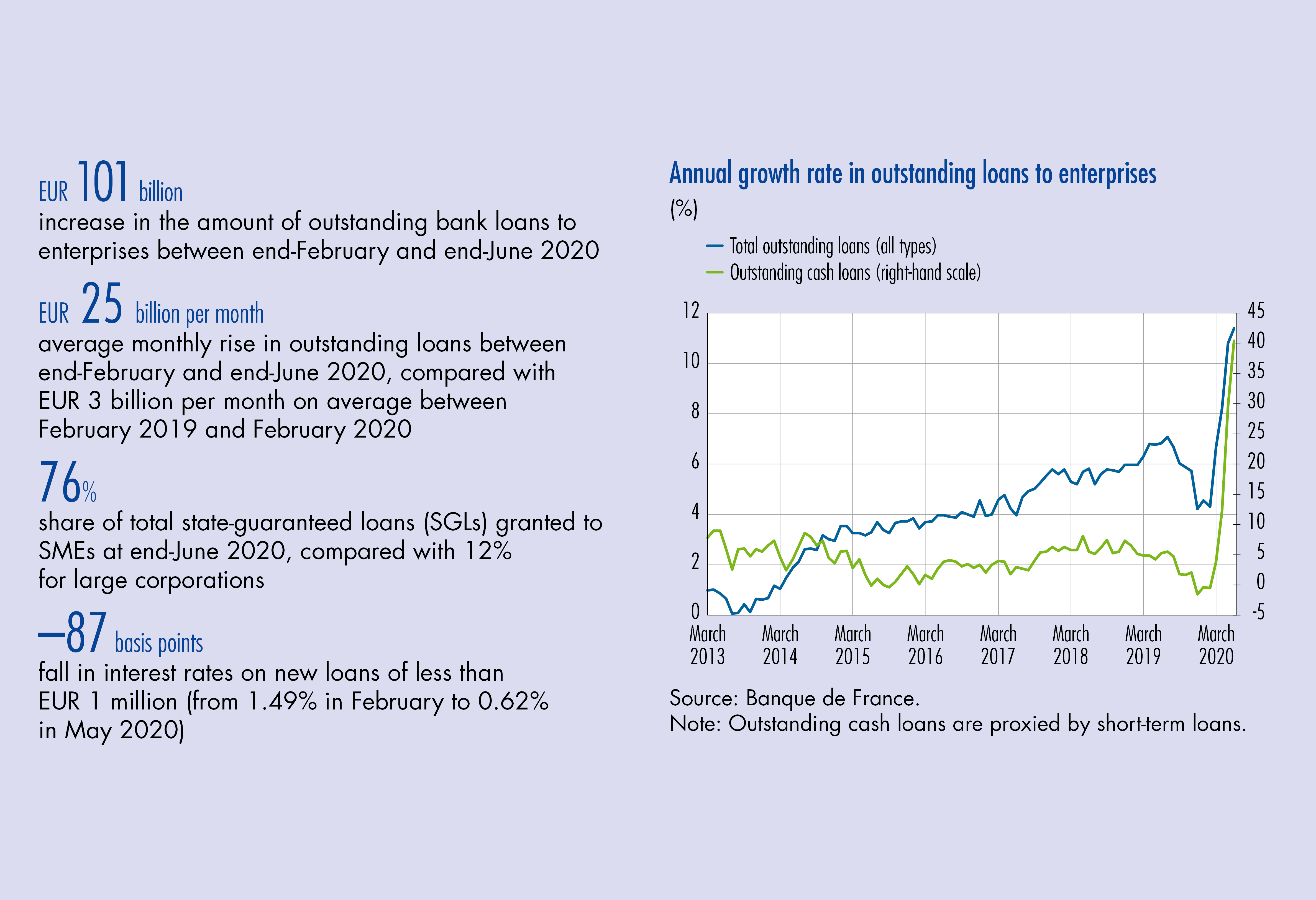

The recovery in activity from the low of 2012 fuelled a steady acceleration in the annual rate of growth in outstanding loans to firms, from 0.1% in mid-2013 to 7.1% by mid-2019. The growth rate subsequently eased, and in February 2020, just before the start of the Covid-19 crisis, it stood at 4.3% (see Chart 1).

The effects of the shock to activity were immediately visible in France, with bank lending to enterprises surging from as early as March 2020 (especially cash loans, on account of the state-guaranteed loan scheme; see below). Total outstanding loans to firms jumped by EUR 101 billion in the space of just four months (from end-February to end-June 2020). This very rapid rise – of around EUR 25 billion per month on average from February to June 2020 – compares with average monthly growth of EUR 3 billion in outstanding loans between February 2019 and February 2020.

The surge in bank credit came in response to the rapid deterioration in firms’ cash positions (see Chart 2). Deprived of income by the lockdown, firms still had to pay the charges accumulated before the crisis. Bank credit was therefore used (i) to help pay these charges; and (ii) to rebuild cash reserves. Firms have also showed a tendency to hoard cash since the start of the crisis, with the gross debt and deposits of non-financial corporations both following very similar trajectories since March 2020 (increasing by EUR 151.4 billion and EUR 149.6 billion respectively; see Table 1).

Firms have accessed this liquidity via different mechanisms, but principally by drawing on existing lines of credit and by taking out state-guaranteed loans.

2 Growth in outstanding loans by firm size

The rise in lending as of March 2020 was initially driven by large corporations (LCs) and mid-tier enterprises (MTEs). …

Download the PDF version of this document

- Published on 02/24/2021

- 7 pages

- EN

- PDF (343.75 KB)

Bulletin Banque de France 232

Updated on: 02/24/2021 16:09