▪ The war in Ukraine and the strong tensions in commodity markets and global value chains are creating a difficult environment. These shocks have led us to revise inflation upwards and activity downwards, to a greater extent than in March.

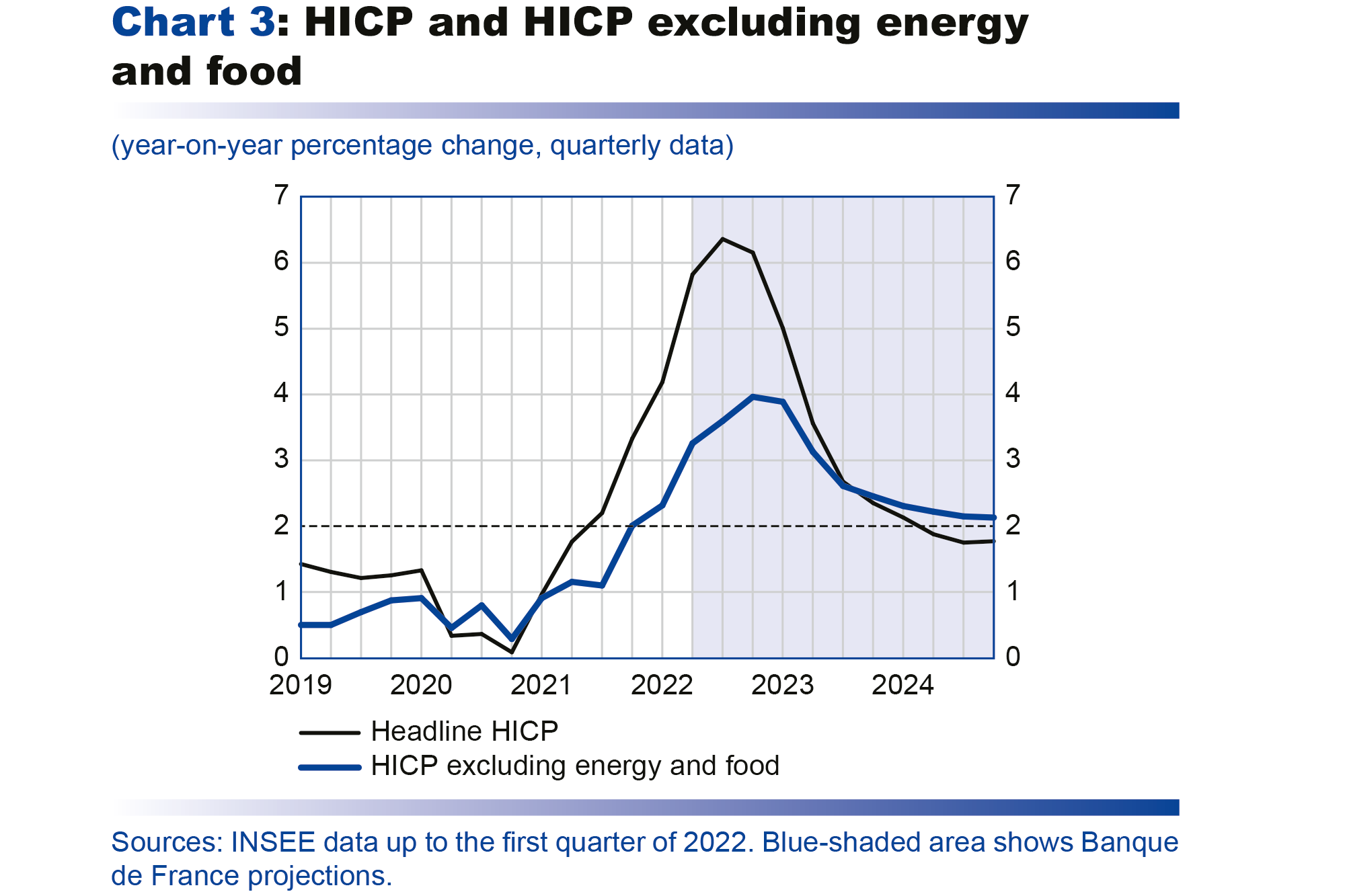

▪ As a result, French inflation is expected to be elevated in 2022 and 2023. The main driver should be soaring energy prices, especially as we are conventionally assuming that the price shield will not be extended beyond the end of this year. Inflation should also be fuelled by food and manufactured goods over the coming quarters. Under our baseline scenario, headline inflation and inflation excluding energy and food are then seen coming back to around 2% over 2024, which is the Eurosystem target and similar to the rates seen in 2002-07.

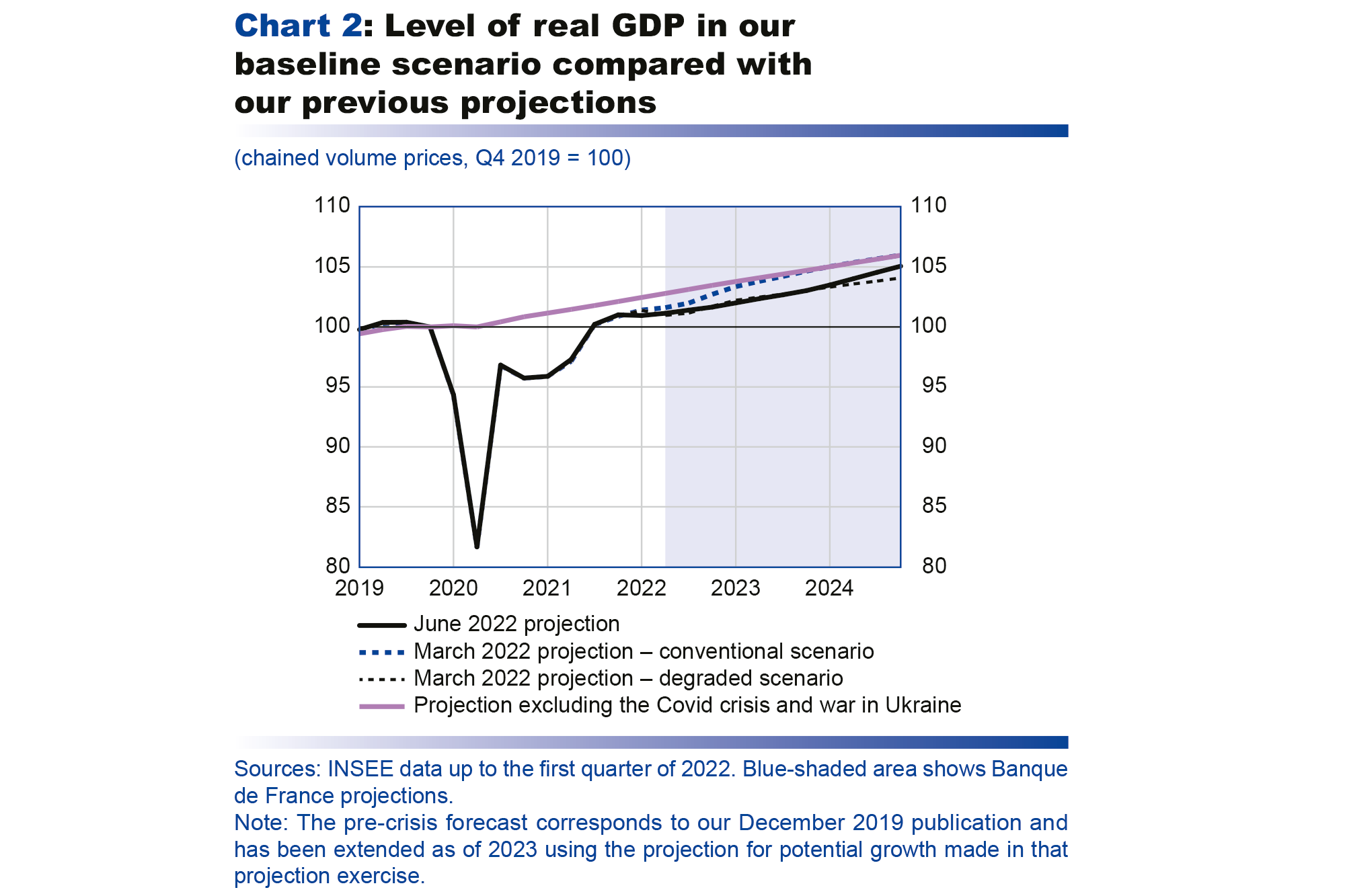

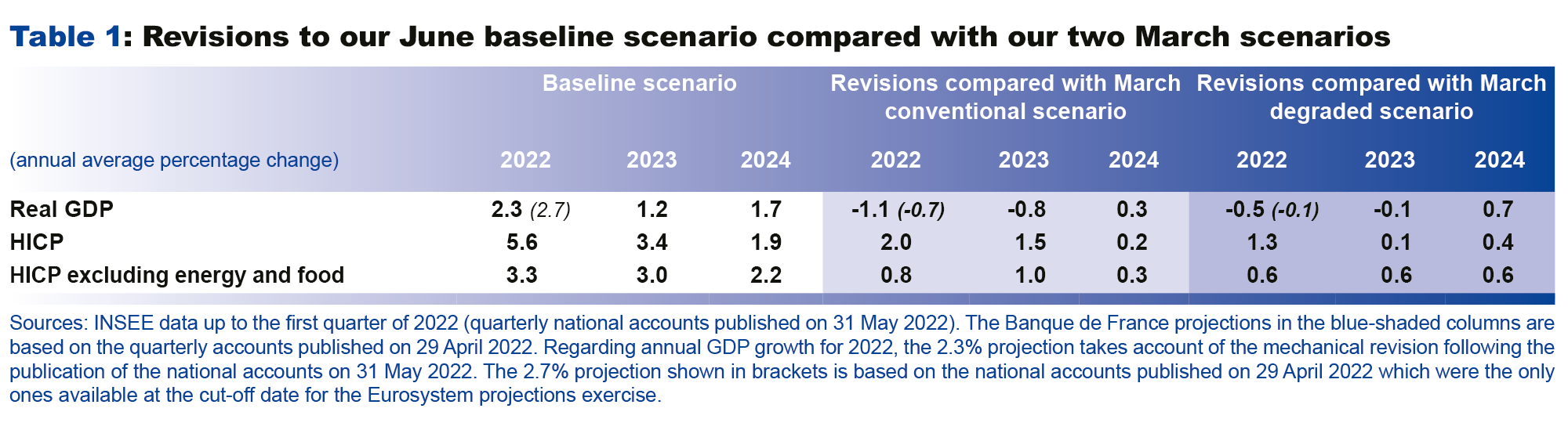

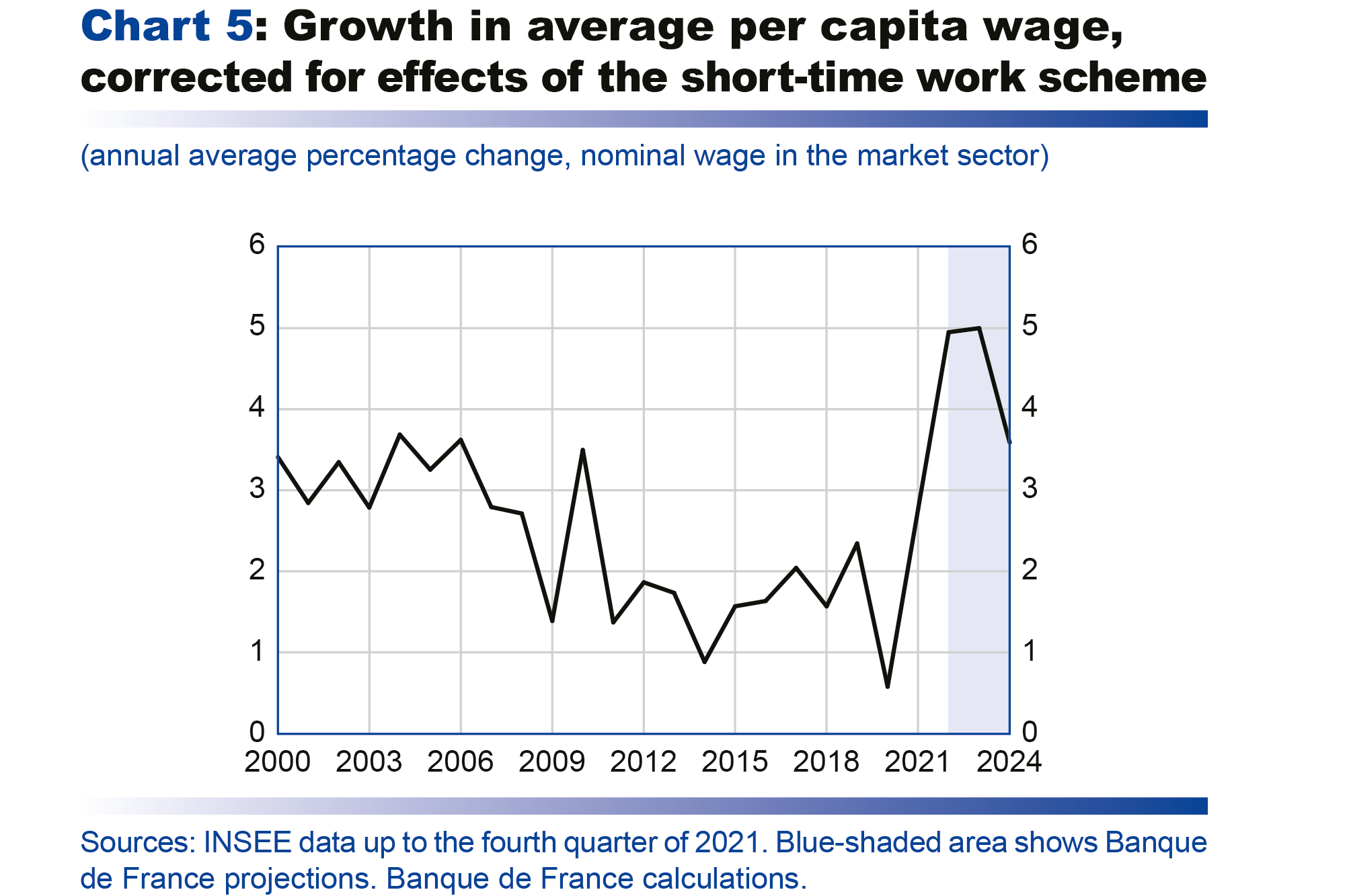

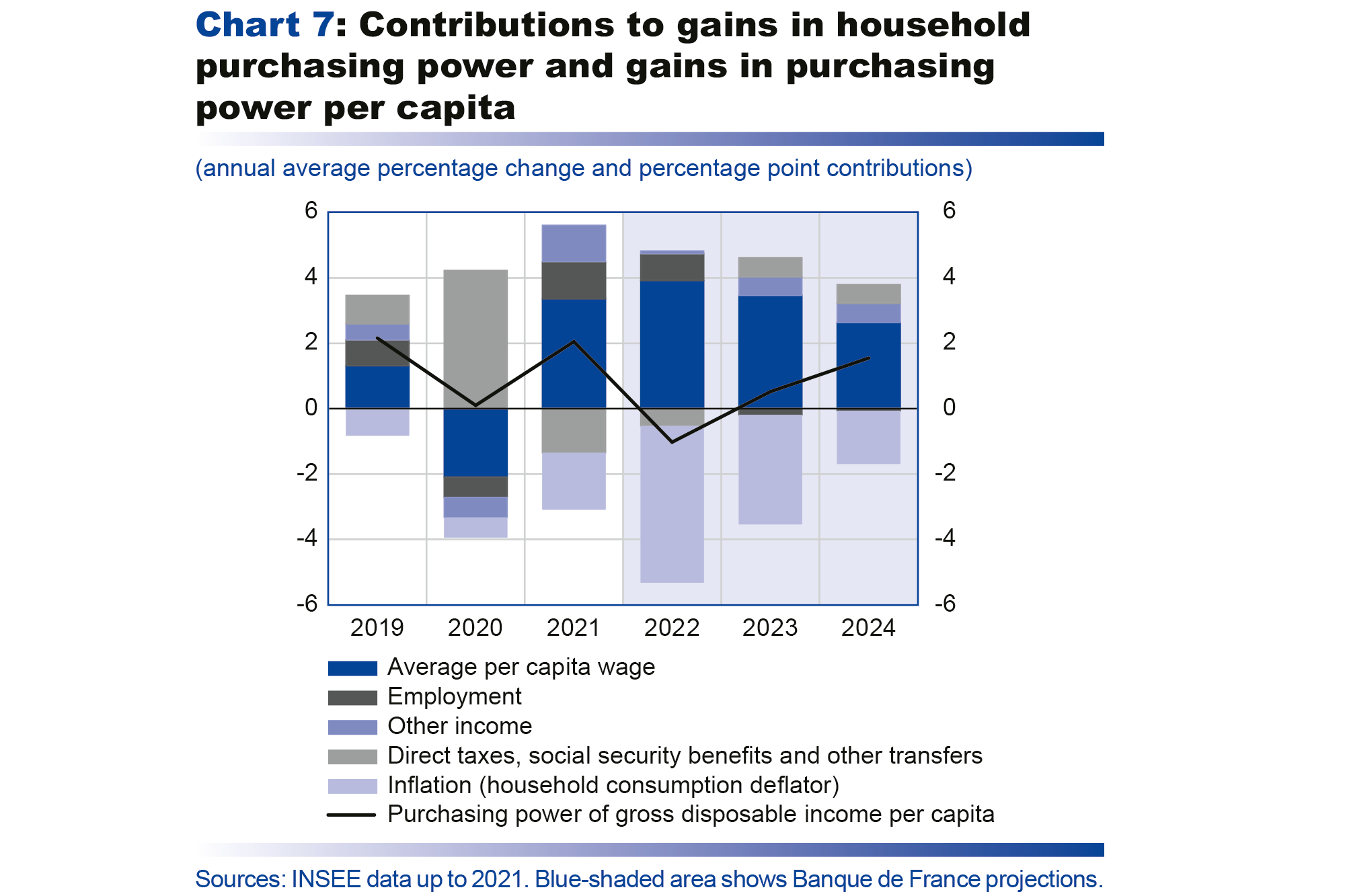

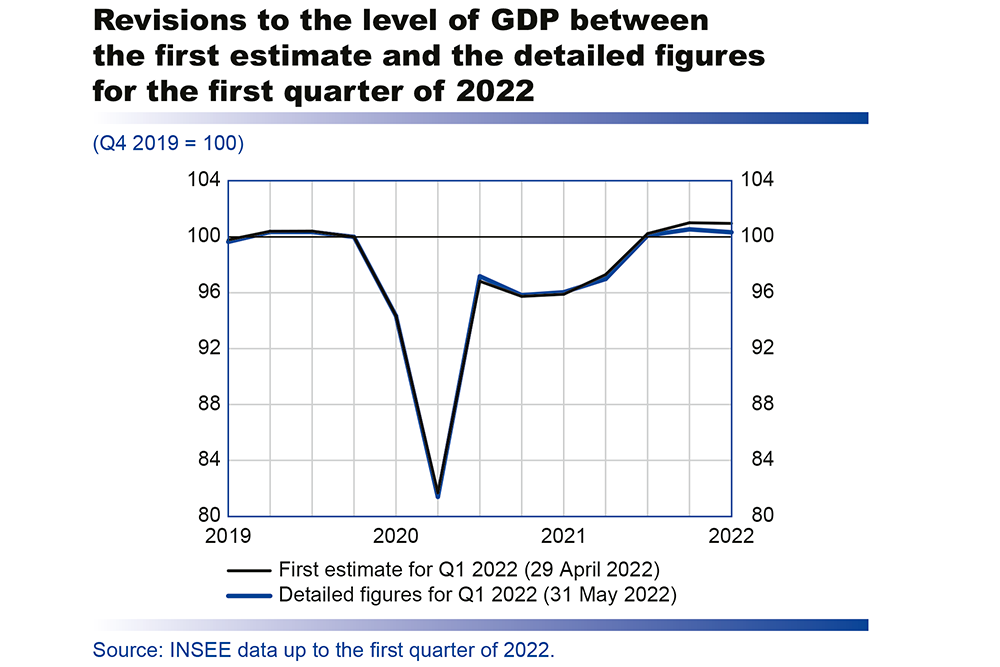

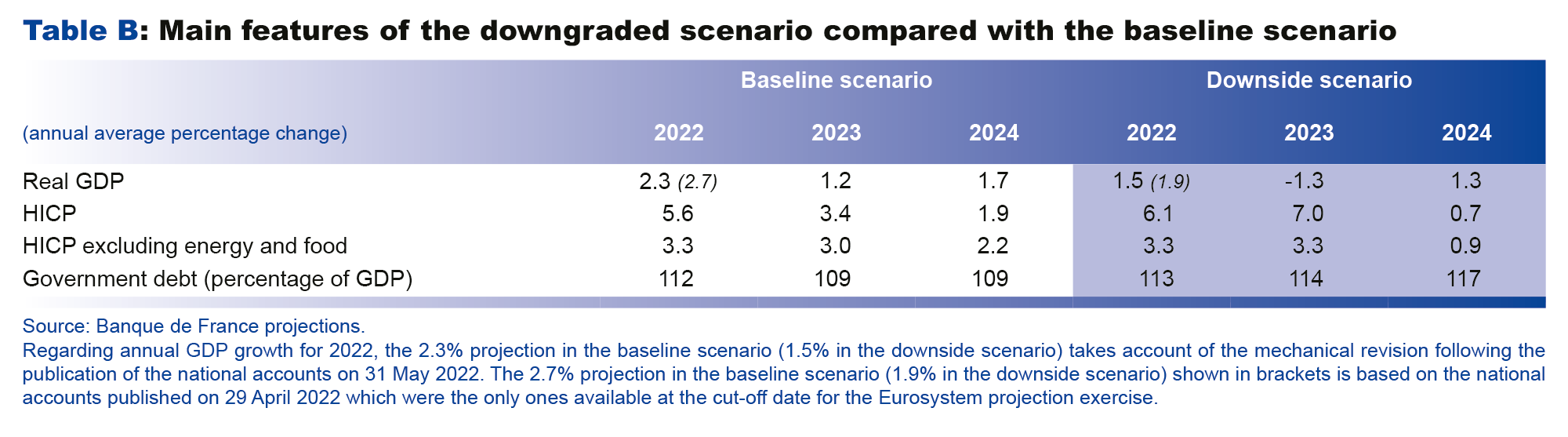

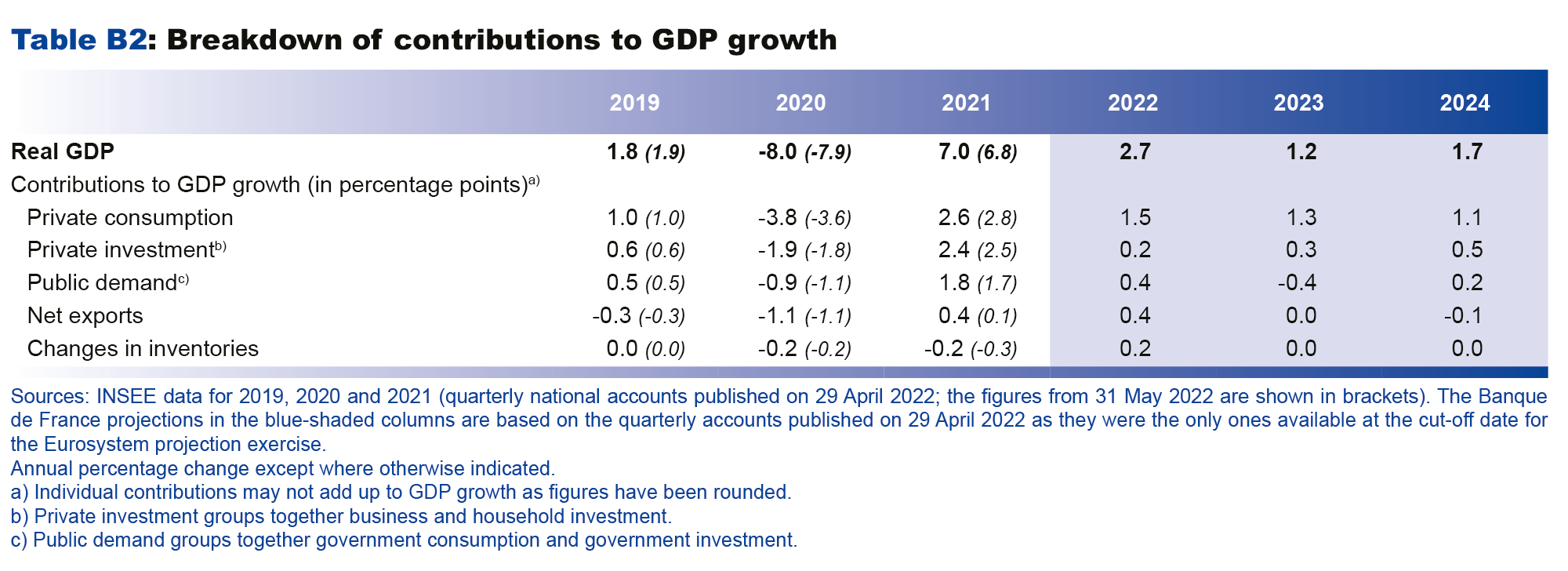

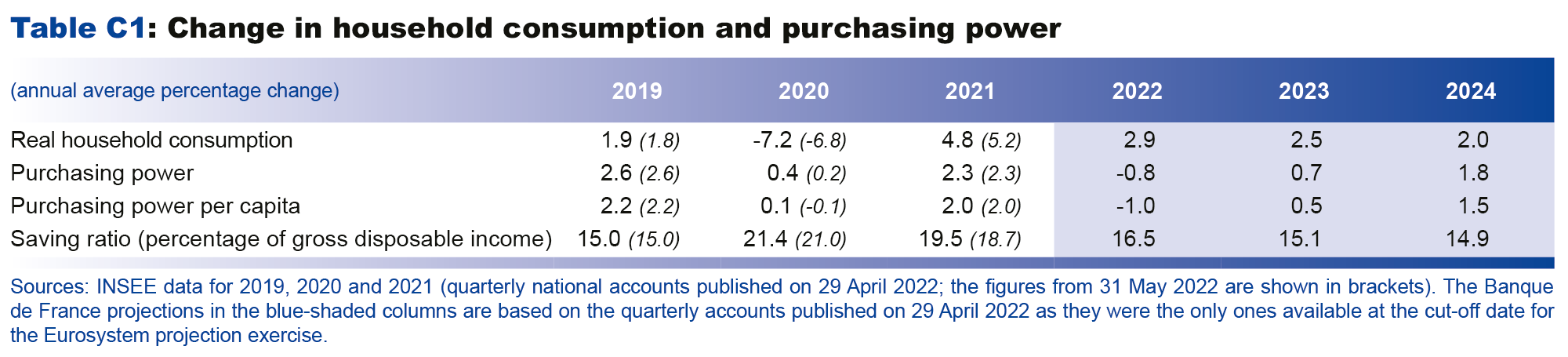

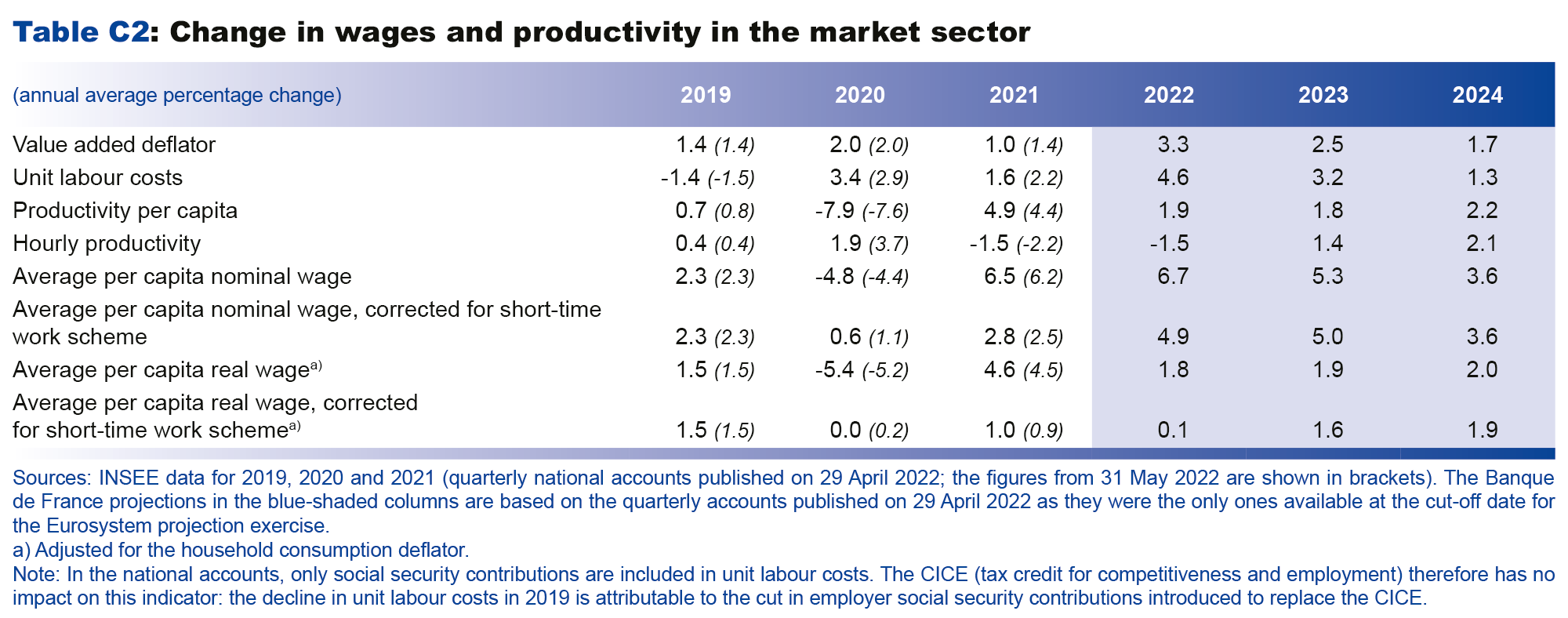

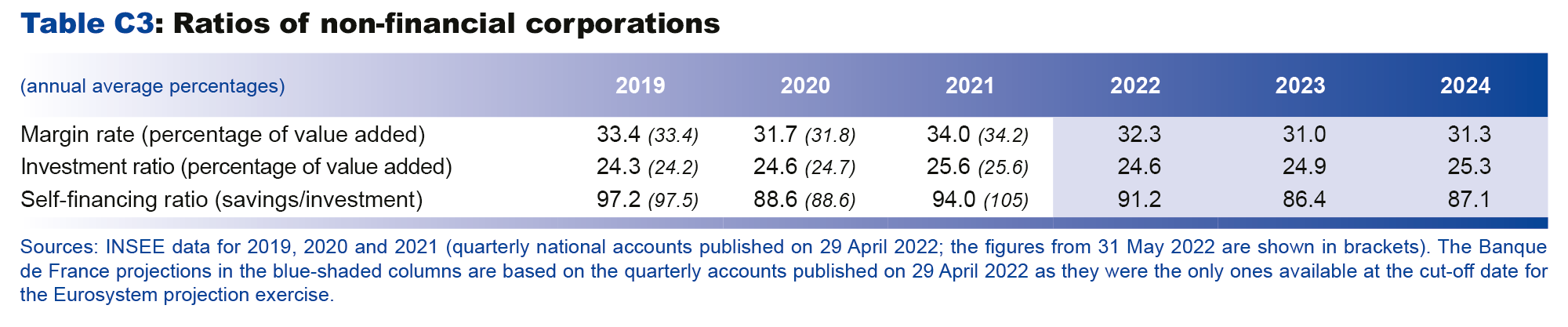

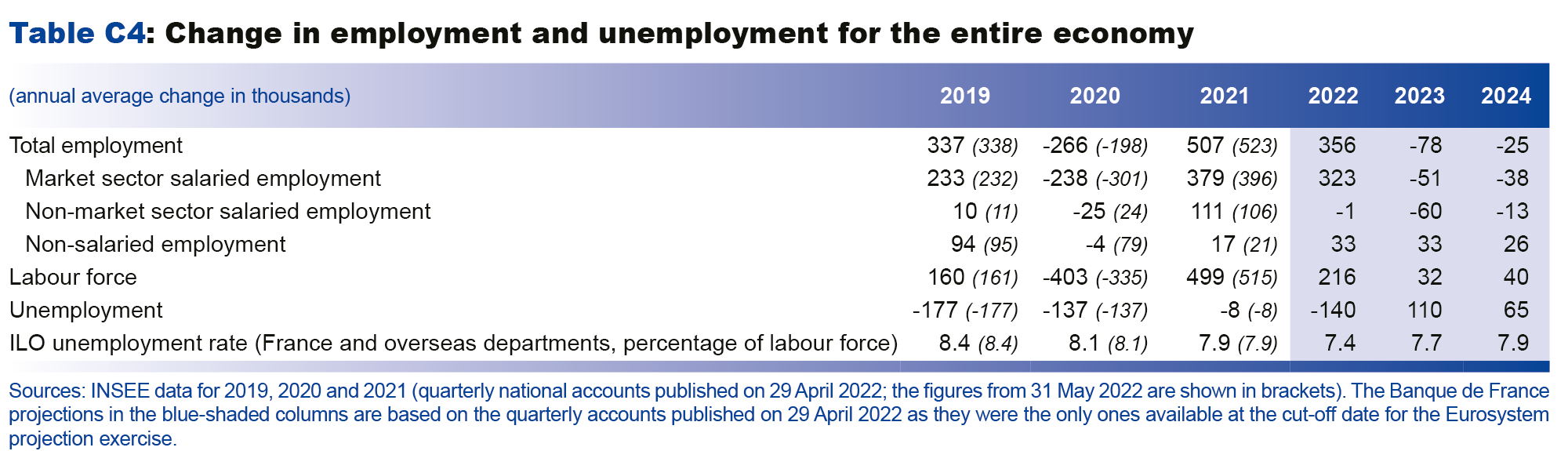

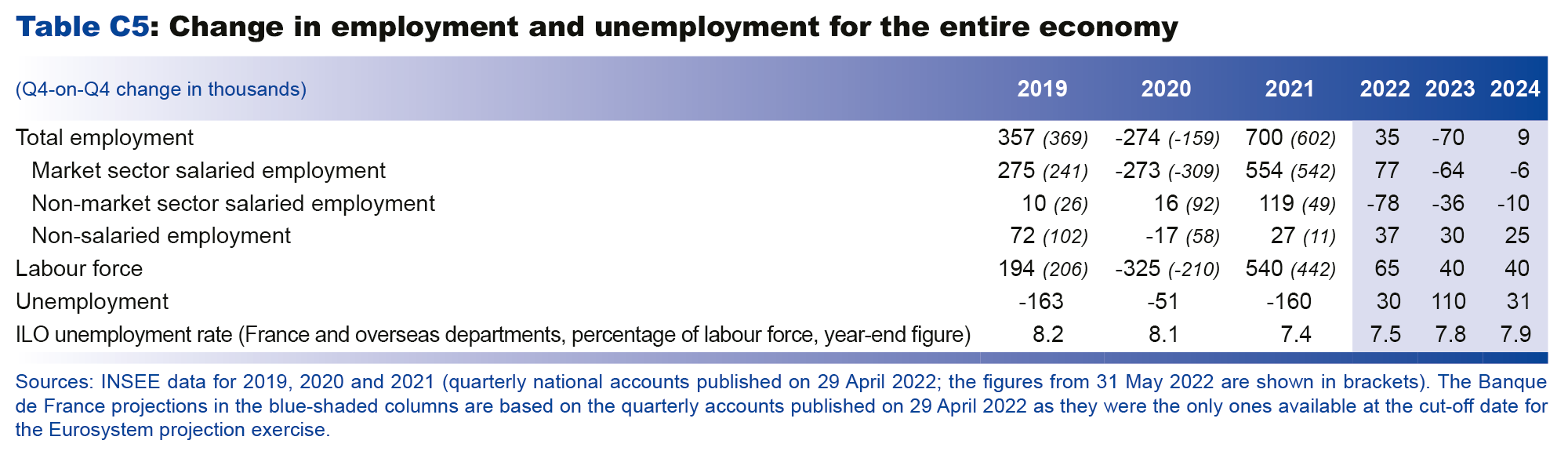

▪ In 2022, growth in French activity is expected to slow to 2.3% if we mechanically incorporate the revision to the past quarterly national accounts published by INSEE on 31 May (and to 2.7% without this revision). Growth should be dampened by the current level of inflation which is weighing on purchasing power. It should also be affected by the deterioration in the global economic environment and by the strong geopolitical uncertainty that is denting confidence for all economic agents. In the near term, our baseline scenario is for a sharp slowdown in activity over the four quarters of 2022, even though the decline in GDP in the first quarter is not expected to continue. In 2023, GDP growth is expected to average 1.2% owing to some persistent effects of the shocks being felt today and, under our conventional assumptions, the withdrawal of the temporary part of the economic support introduced during the crisis. In 2024, however, once the shocks have dissipated, growth should return to a stronger average rate of 1.7%, buoyed by fairly robust domestic demand. Against this backdrop, employment should hold up well overall, with the unemployment rate remaining historically favourable and showing only a moderate rise.

▪ The government deficit is expected to be impacted by economic activity, but also in 2022 by the measures to support purchasing power. Under our current assumptions, the deficit should narrow but will still slightly exceed the threshold of 3% of GDP in 2024. As a result, the reduction in government debt that began in 2021 is expected to stall at the end of the projection horizon.

▪ Given the high degree of uncertainty, we have also provided a downside scenario where additional risks materialise, including much stronger inflationary pressures on energy and food prices. Whereas in March we made no comment on the respective probabilities of the conventional and degraded scenarios, this time our downside scenario should be seen as a risk to our baseline scenario, with the latter remaining more likely at this stage. Growth under the downside scenario would be sharply curtailed in 2022, and GDP would decline by 1.3% in 2023 before returning partially to growth in 2024 with an expansion of 1.3%. The shocks to commodity prices would also push inflation to over 6% in 2022 and 2023 but this would be followed by a sharper reduction in inflation in 2024 owing to the significantly impaired economic environment under this downside scenario. Government debt would undergo a sharp upward shock, even assuming fiscal policy remains unchanged.

After the marked rebound in activity in 2021, the economic consequences of the war in Ukraine are expected to weaken the post-Covid recovery

With the lifting of the public health restrictions that weighed on the economy in 2020, 2021 was marked by a robust pace of activity from spring onwards, resulting in strong annual growth. In the second half, however, with all economies experiencing a strong economic recovery after the end of the pandemic-related lockdowns, tensions gradually emerged in commodity prices, combined with increasing supply disruptions. These difficulties intensified significantly at the start of 2022 with the outbreak of the Ukraine conflict and the reintroduction of lockdown measures in some areas of China.

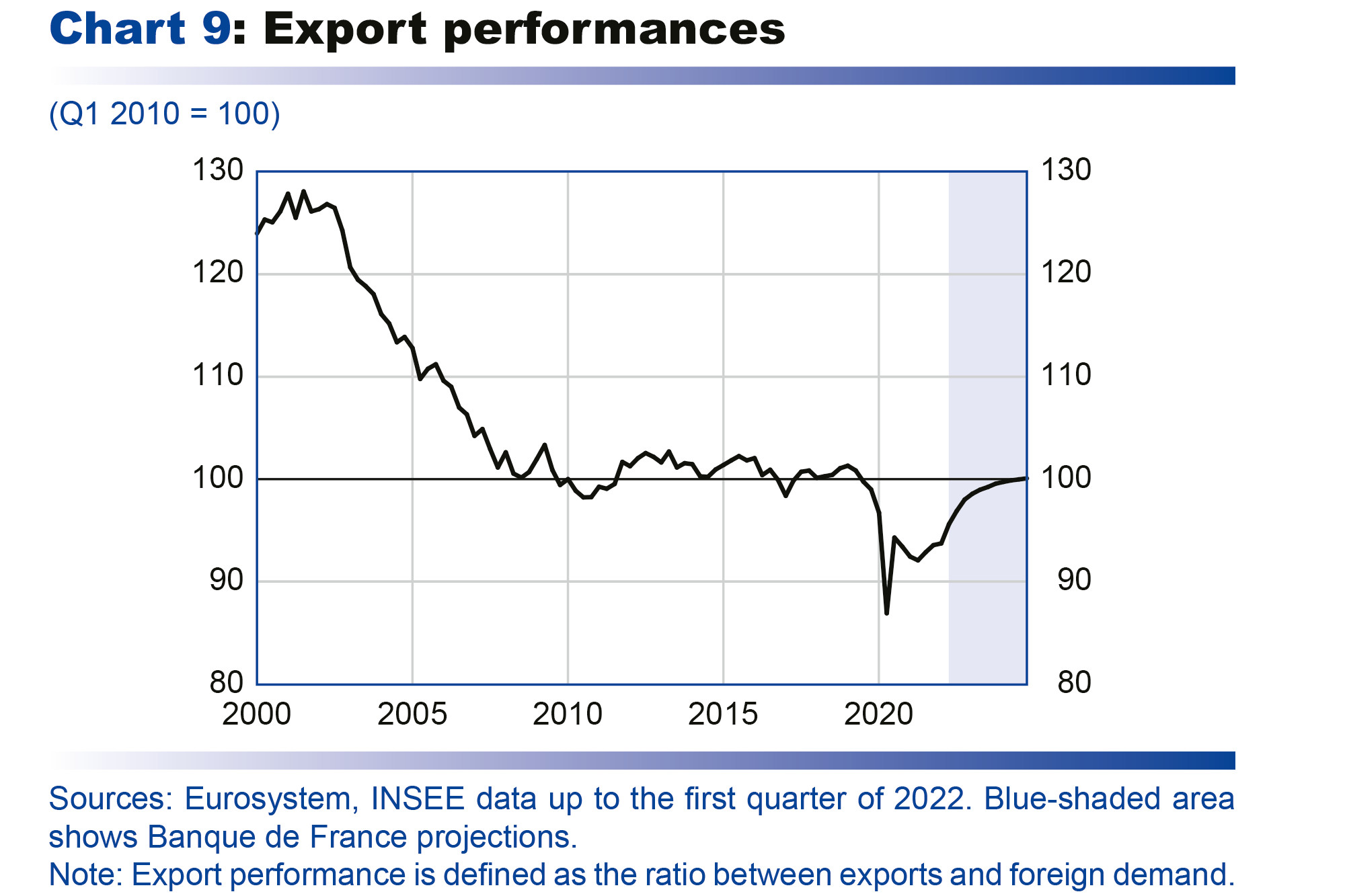

In the first quarter of 2022, according to the detailed quarterly national accounts published by INSEE on 31 May, GDP inched down by 0.2% (see Box 1), reflecting a marked 1.5% decline in household consumption and weaker than expected exports. In the second quarter, according to short-term data from the Banque de France business surveys, GDP is expected to grow by around a quarter of a percentage point: certain services sectors (especially accommodation and food services) are benefiting from the lifting of the last pandemic-related restrictions and the recovery of tourism, including foreign tourism; in contrast, industrial activity and construction are being adversely affected by supply disruptions and rising production costs.

Activity is expected to remain moderate over the second half of 2022, reflecting the adverse effects of higher energy and food commodity prices and developments in the global economy. The Eurosystem assumptions regarding commodity prices and the international environment, for which the cut-off date is 17 May 2022, are for Brent crude oil to average USD 105.8 per barrel over 2022, which represents a sharp upward revision compared with the price of USD 93 underlying our conventional scenario for March (see Chart 1). This assumption of a rise in the price of Brent takes into account market expectations that the European Union will impose a gradual embargo on Russian oil; however, our baseline scenario does not see this causing any significant increase in energy supply disruptions given the alternative sources available for oil. In addition to higher crude prices, we have also taken into account the recent rise in margins on refining and distribution, especially on diesel which is primarily imported from Russia. Demand from France’s trading partners is also expected to deteriorate sharply: growth in foreign demand for French goods and services has been revised down by between 1 and 1½ percentage points for 2022 and 2023 compared with our conventional scenario in March.