Working Paper Series no. 896: Fiscal policy orientation in the euro area in real-time

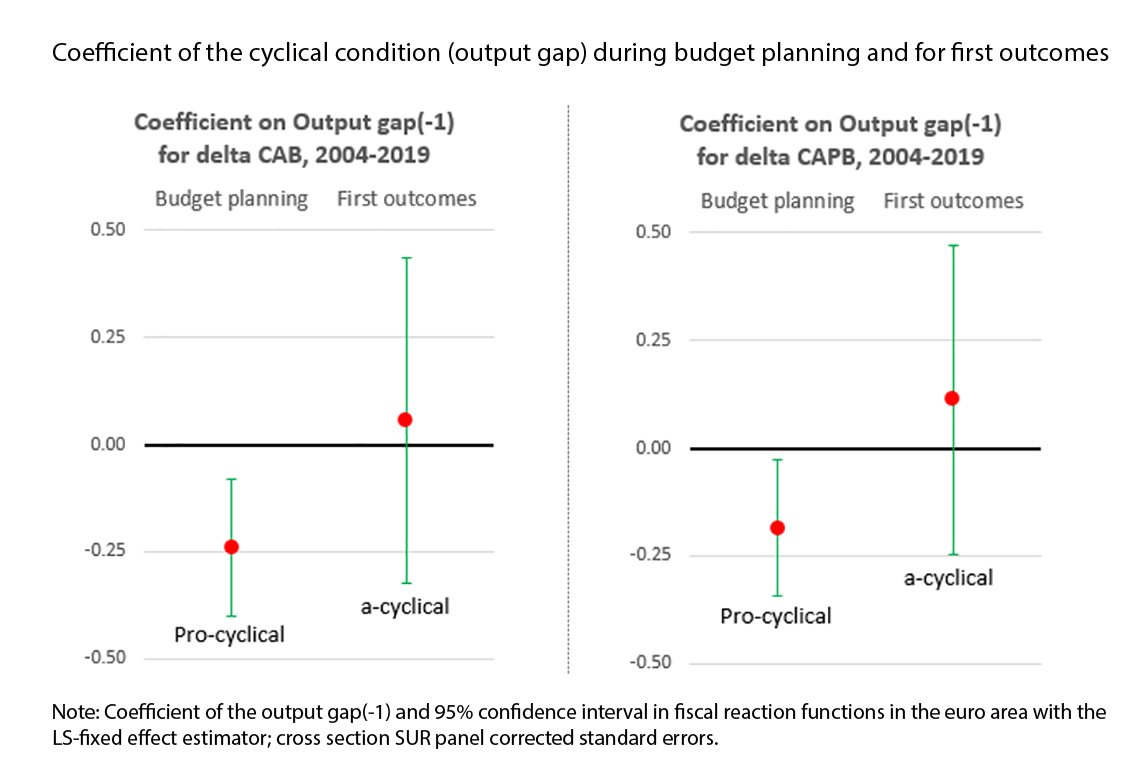

This paper analyses the orientation of fiscal policy in the euro area in real-time, using a new real-time dataset including 11 euro area countries for the 1999-2019 period. We compare the cyclicality of the fiscal stance, measured as the change in the cyclically-adjusted total and primary budget balance, established during budgetary planning with their ex-post outturns. We find empirical evidence for pro-cyclical fiscal plans and a more a-cyclical behaviour of fiscal outcomes on average for euro area countries. We show hence that the tendency to run a pro-cyclical policy is already anchored in fiscal plans and not just an outcome of surprises on cyclical conditions. This result is robust to different specifications and estimation methods. We observe pro-cyclicality at budget planning especially during tightening episodes and a more a-cyclical fiscal stance during fiscal loosening. We also find that fiscal plans are pro-cyclical outside of crisis years of the Global Financial crisis and the European Debt crisis. We detect strong country heterogeneity in the orientation of fiscal policy ex-ante and ex-post in the euro area.

This paper analyses the fiscal stance in euro area countries in real-time. The fiscal stance reflects the discretionary, i.e. non-automatic, reaction of the budget balance to cyclical conditions. The fiscal stance is said to be counter-cyclical if the non-automatic part of the budget balance goes in the same direction as the change in the output gap (e.g. deteriorating the balance to face economic downturns), pro-cyclical if both evolve in opposite directions and a-cyclical if the non-automatic part of the budget balance does not respond to the output gap.

One of the objectives of fiscal policy is to stabilize the economy along its potential, i.e. to conduct a counter-cyclical policy rather than a pro-cyclical one. However, assessing in real time the position in the economic cycle is a difficult exercise. It depends on the forecasts of GDP (which can be revised later) and potential GDP (also subject to large measurement uncertainties and revisions). Fiscal stance measures, based on estimates of cyclical conditions, underlie the same uncertainties and revisions. Hence, the fiscal stance at the time of budgetary decisions may be different from the fiscal stance observed in outcome data. It is therefore interesting to examine the fiscal stance separately at the moment of budget planning, showing the intentions of fiscal policy makers, compared to final outcomes.

This paper evaluates the fiscal stance in a panel of 11 euro area countries between 1999 and 2019 (before the Covid crisis) at the time of the budget forecasts and compares it with the fiscal stance according to outcome data. To do this, we use a new real-time dataset for the 1999-2019 period based on European Commission data. We regress the change in the cyclically-adjusted budget balance on the output gap, controlling for different other variables affecting the budget balance, first using budgetary planning data, then using the same variables observed after the completion of the year. We find that, on average for these 11 euro area countries, the fiscal stance is pro-cyclical during budget planning and a-cyclical in fiscal outcomes. Hence, the tendency to run a pro-cyclical policy is already anchored in fiscal plans and not just an outcome of surprises on cyclical conditions.

We use both a fixed effect estimator and an instrumental variable approach as an empirical strategy. Our results are robust to different econometric approaches and model specifications. They are also robust when controlling for the two crisis periods, the Global Financial crisis and the European Debt crisis, that hit the euro area during the examined period. Fiscal plans were also pro-cyclical outside of the crisis years, and, according to our empirical results, counter-cyclical (but not significant) during the Great Financial crisis and significantly pro-cyclical during the European Debt crisis.

A possible explanation for the pro-cyclicality of fiscal plans could be for governments to signal a tighter policy stance than is implemented in the end. We show that pro-cyclicality at the budget planning phase is more frequent and more significant during tightening episodes, whereas the fiscal stance tends to be more a-cyclical during fiscal loosening episodes on average for these 11 euro areas countries. This supports the claim that forced consolidation due to market stress or the intention of the governments to signal a tighter fiscal policy in difficult economic times may explain this pro-cyclical behaviour.

We also show that the fiscal orientation is not uniform in the euro area and that the average result is driven by some countries with a strong pro-cyclical ex ante fiscal policy orientation. We observe a more pro-cyclical behaviour of fiscal plans for countries such as Greece, France, Italy, Spain, and Finland and a more counter-cyclical behaviour in fiscal plans for a group of countries covering Ireland, Germany, Austria, and to a lesser extent the Netherlands and Belgium. The heterogeneity of the cyclicality of fiscal policy is important in the euro area.

Download the PDF version of this document

- Published on 12/19/2022

- 35 pages

- FR

- PDF (1.34 MB)

Updated on: 12/19/2022 10:42