Working Paper Series no. 767: Bank Equity Value and Loan Supply

We study how bank equity values affect loan supply. We exploit granular balance sheet information on euro area banks matched with financial market data. We address endogeneity concerns by instrumenting bank stock prices with a shifter derived from each bank stock price's sensitivity to non-financial corporations' equity values. Our results indicate that, other things equal, rises in bank stock prices cause increases in corporate and household lending, and in bank capitalization. We interpret these results as due to bank managers reading the rises in their bank's stock price as reductions in their bank's cost of equity.

The ability for banks to lend to households and firms depends on the conditions at which they borrow. Banks’ funding mix is typically composed of deposits, bonds, and equity. The extent to which shocks on deposit and bond funding transmit to loan supply is one of the most studied topics in the banking literature. Conversely, far less attention has been devoted to how shocks on equity funding reverberate on loan supply. One reason lies in the fact that the cost of equity -- i.e. the remuneration required by stock investors to hold the equity of a firm -- is not directly observable.

In this paper, we proxy for each bank’s cost of equity by building on stock valuation techniques. These techniques imply that while controlling for bank fundamentals such as the dividends per share, the stock price of a bank relates negatively to the cost of equity required by the bank’s investors. This provides us with a way to assess the effect of the bank cost of equity on loan supply. Specifically, in our analysis, we examine the impact of bank stock prices on loan supply, while controlling for bank fundamentals through variables such as each bank’s dividends per share, earnings per share, CDS price, balance sheet ratios, together with country-time and bank fixed effects.

We implement this analysis on a sample of 68 banks from 12 euro area countries. The period on which we focus is from 2010Q2 to 2019Q2. The data we exploit includes granular information on bank balance sheets and comes from the ECB. These data are merged with bank-specific financial market information from Datastream and Bloomberg.

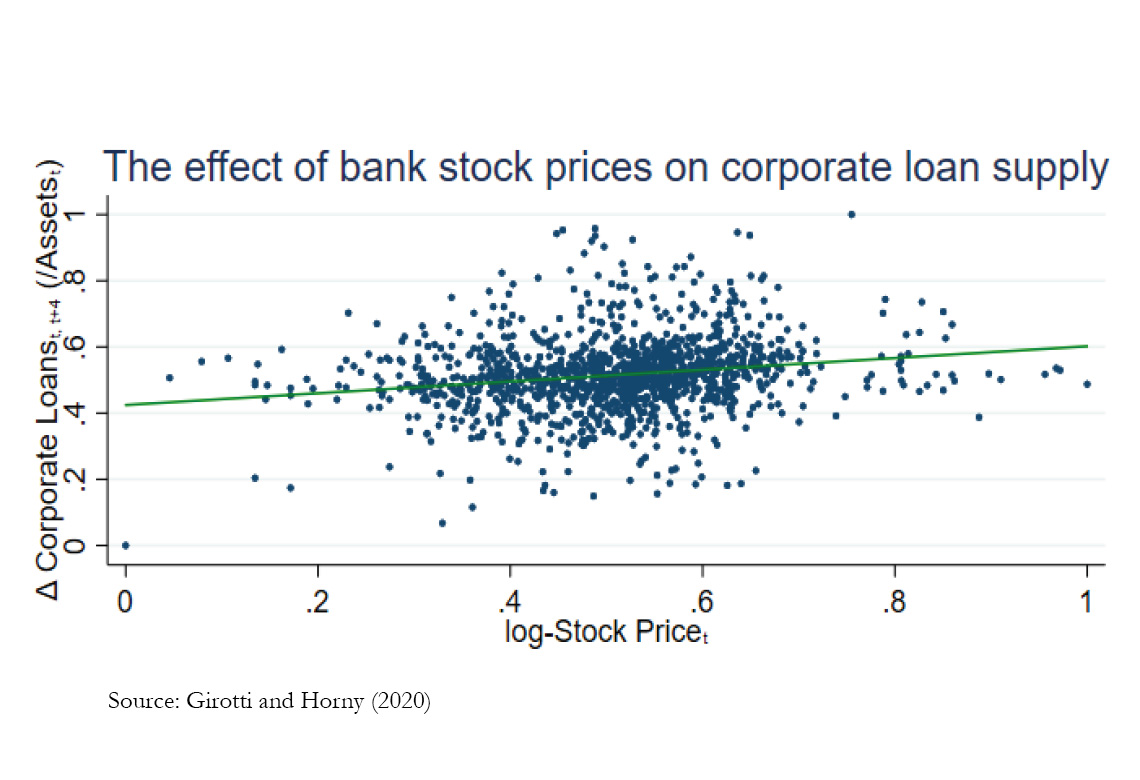

We first conduct a graphical analysis. We relate the sampled banks' (log-) stock price to the banks' corporate loan growth in the following year (preliminarily, we rescale the two variables to lie within 0 and 1, for each bank). The resulting scatter plot appears below. It shows that the (log-) stock price associates positively with loan growth, indicating that a lower cost of equity is related to greater loan supply.

When we bring the equation sketched above to the data, we find confirmation of a positive association of bank (log-) stock prices with loan supply to households and firms. However, it is possible that these results are due to some unobservable elements, which simultaneously affect both bank stock prices and bank loan supply. We cope with this endogeneity issue by using an instrumental variable.

We construct a bank-quarter specific instrument based on the idea that a bank's net worth, and thus its stock price, depend on the bank's portfolio of investments and on how this reacts to macroeconomic conditions. We first measure the sensitivity of each bank's stock price daily returns to the daily returns of an index representing euro area non-financial corporations, over one-year long rolling windows. We predict the trajectory that each bank's stock price should have taken given the realization of that index and the bank’s historical relationship with it. We then use the quarterly returns in these fictional trajectories as an instrument for banks’ stock prices.

Armed with this instrument, we assess the effect of bank stock prices on loan supply. We find confirmation of the OLS estimates. The effects are quantitatively important, especially considering that they are net of changes in bank fundamentals, and of macroeconomic conditions: every 10% increase in a bank's stock price corresponds to a rise in corporate and household lending of 0.32% of the bank's total assets. For a median bank, this means more loans to corporations and households for an amount equal to € 260 million.

Our reading of these results is that bank managers interpret an increase in their bank’s stock market value as a reduction in the cost of equity requested to the bank by market investors. They thus react by lending more. However, if this mechanism underpins our results, we should also find that in parallel to greater lending, bank managers exploit the relaxed equity funding conditions by increasing their stock of equity. We test this by using our identification strategy. We find confirmation of the mechanism: banks do react to an increase in their stock price by increasing their stock of equity.

Download the PDF version of this document

- Published on 05/12/2020

- 36 pages

- EN

- PDF (2.9 MB)

Updated on: 05/12/2020 14:04