Working Paper Series no. 892: Is Capital Account Convertibility Required for the Renminbi to Acquire Reserve Currency Status?

It is widely assumed that the renminbi (RMB) cannot acquire a meaningful place in central bank reserve portfolios without full liberalization of China’s capital account. We argue that the RMB can in fact develop into a consequential reserve currency in the absence of capital account convertibility. Trade and investment links can drive official use and accumulation despite limited access to Chinese financial markets. But this route to currency internationalization requires policy support. China must allow access to RMB through loans and People’s Bank of China (PBoC) currency swaps. It must ensure convertibility of RMB into US dollars on offshore markets. It must provide these RMB services at a stable and predictable price. Currency internationalization without full capital account liberalization thus requires the RMB to be backed by dollar reserves, which the PBoC consequently will continue to hold and use. Hence we do not foresee RMB internationalization as supplanting dollar dominance.

Why doesn’t the currency of the second largest economy in the world play a consequential reserve-currency role? The share of China’s renminbi (RMB) in global reserve portfolios, at 2%, pales in comparison with those of the dollar (60%) and the euro (20%). What explains the difference?

A common response is that the RMB cannot develop as an international reserve currency without full liberalization of China’s capital-account (Frankel 2011; Prasad 2021). This view is based on the assumption that countries will not hold RMB reserves if they cannot easily purchase and sell them on international markets. It is supported by the history of the rise of the pound sterling and then the dollar as leading international currencies in the 20th century, both of which were traded on deep and liquid markets.

It cannot be excluded that internationalisation of the RMB may unfold in a very different way. Unlimited access to deep and liquid Chinese capital markets may not necessarily be essential, in fact, for RMB internationalization.

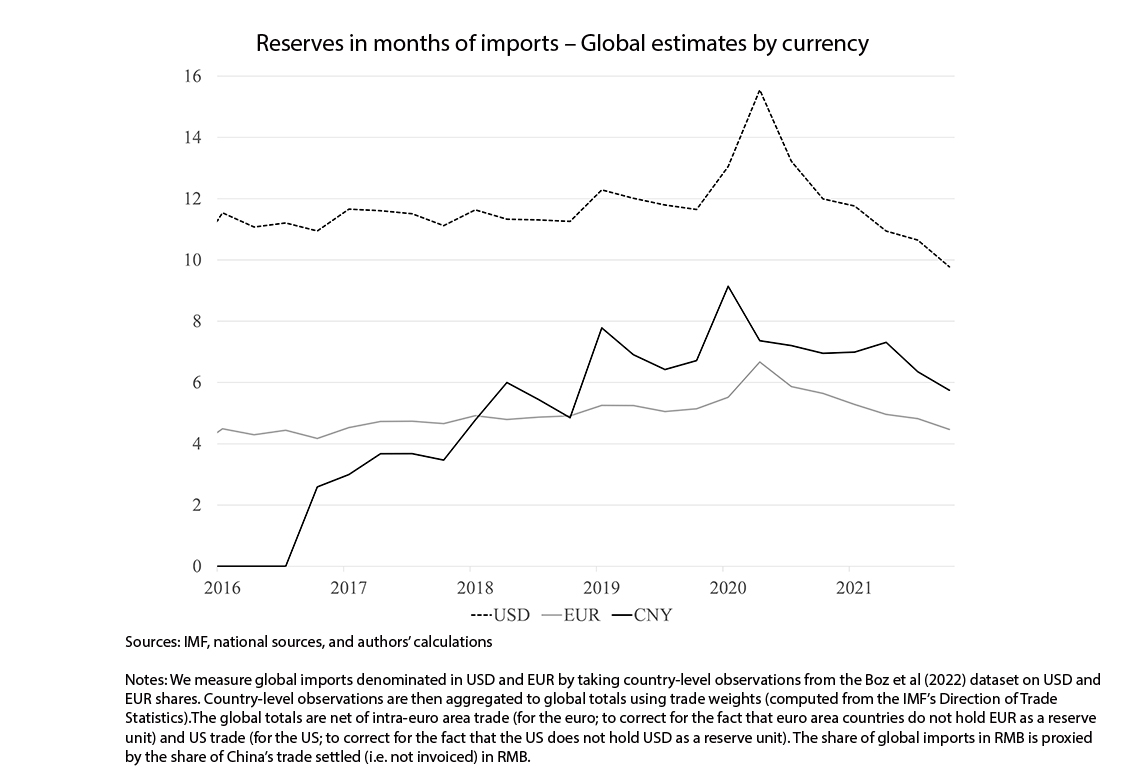

Historically, currencies first acquired a role in trade invoicing and settlement before also assuming reserve currency status. The RMB can similarly acquire a more important international reserve currency role via China’s trade links. China has established a global network of clearing and payments, such that it is now possible to undertake cross-border transactions in RMB in a wide variety of different jurisdictions. Using data on reserves in RMB by country, we document a significant correlation between a country’s trade with China and its holdings of RMB as reserves, notwithstanding China’s limited capital account openness. Invoicing transactions and accepting payment in RMB, the currency that is the natural habitat of Chinese banks and firms, is a way of encouraging Chinese entities to do business with a country’s domestic counterparts. Indeed, the ratio of total RMB reserves to trade invoiced in RMB (at the world level) is close to the ratio of total euro reserves to total trade invoiced in euro (see Figure 1). This observation is striking, given China’s low degree of capital account openness.

But ability to accumulate RMB-denominated reserves is not the same as willingness to hold them. For the latter, offshore RMB markets and central bank swap lines are key. The PBoC has negotiated bilateral currency swap agreements with at least 39 central banks, totalling some RMB 3.7 trillion ($550 bn). Although they are not permanent lines available in unlimited amounts, swap lines engender confidence that RMB can be obtained from the Chinese central bank. The offshore market reassures central bank reserve managers and other investors that they can convert RMB into dollars at reasonably stable and predictable prices. Just as the London gold market was a safety valve for dollar holders in the 1960s, the offshore RMB market in Hong Kong is a safety valve for RMB holders today.

Stability and predictability further require the Chinese authorities to regulate the RMB/USD exchange rate. And regulating the exchange rate in turn requires those authorities to hold dollar reserves. This observation suggests that an enhanced role for the RMB as a reserve currency will not automatically eliminate that of the dollar. Rather, China will have to hold dollar reserves in order for other countries to willingly hold RMB reserves. The two reserve currencies will be complements, not substitutes.

Holding dollars may have disadvantages for China, insofar as this creates mutual dependence with the US. But this peculiar relationship between the world’s two largest economies is the only way for China to make the RMB a significant reserve currency without embarking on full capital account liberalisation. That said, the question of how many dollars China needs to hold in order to support its economic expansion and encourage its economic partners to hold RMB remains open.

Download the PDF version of this document

- Published on 11/18/2022

- 37 pages

- EN

- PDF (2.1 MB)

Updated on: 11/21/2022 08:57