Working Paper Series no. 732: Central Bank Digital Currency: One, Two or None?

This paper considers the motives, modalities, and possible consequences of central bank digital currency (CBDC) issuance. It starts by drawing a distinction between a wholesale CBDC (WCBDC), accessible only to financial intermediaries, and a retail CBDC (RCBDC), accessible to the general public. The issuance of one could be dissociated from the other, implying the possibility of one, two, or no CBDC(s). The main motive for issuing a WCBDC could be to promote financial innovation and to lower transactions costs using a blockchain. The motives for issuing a RCBDC could be to supply the public with a digitalised monetary instrument without any liquidity or credit risks, easy to access and cheap to use. A CBDC would be created or destroyed only by the central bank and would be issued and exchanged at par with other forms of central bank money (banknotes and reserves). A WCBDC would have to be issued on a permissioned rather than a public blockchain. It would also have to be remunerated to keep reserves and the WCBDC at par. A RCBDC would not necessarily use the blockchain and would most likely involve intermediaries. The issuance of a CBDC would represent a supply shock, which would support economic growth in the medium to long run and could transitorily weigh on prices. One consequence of issuing a WCBDC could be the development of an intraday market, which could in turn lead to the adoption of a real-time monetary policy. Furthermore, the issuance of a RCBDC could put a floor to bank deposit rates and, if it is remunerated, raise them. If the RCBDC were not remunerated, the effective lower bound would be raised to zero and the effectiveness of asset purchases by the central bank could be diminished. If it were, the interest and exchange rate channels should be strengthened. The remuneration of the RCBDC would thus seem to create a trade-off between the effectiveness of monetary policy and the cost of bank intermediation.

This paper considers the motives, modalities, and possible consequences of central bank digital currency (CBDC) issuance. It draws a distinction between a wholesale CBDC (WCBDC) and a retail CBDC (RCBDC). A WCBDC would be accessible only to financial intermediaries, while a RCBDC would be accessible to the general public, including financial intermediaries. As the issuance of one sort of CBDC could be dissociated from the other, there could thus be one, two, or no CBDC(s).

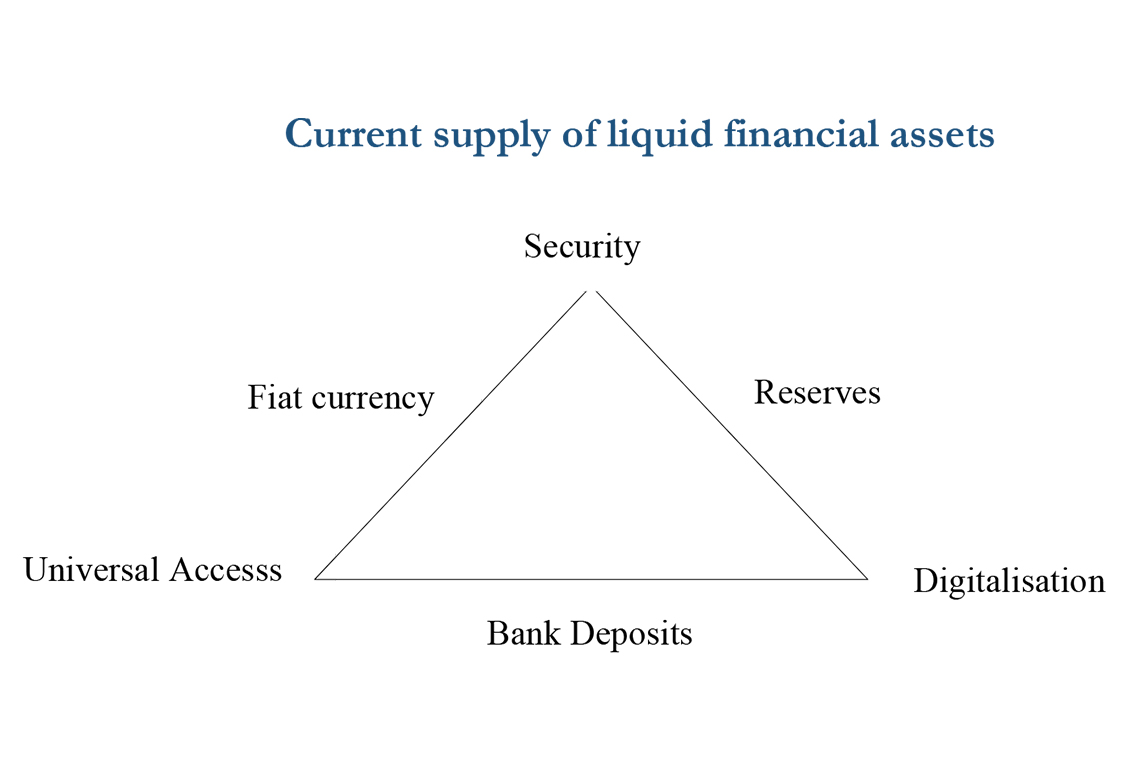

One motive for issuing a WCBDC could be to promote financial innovation and to lower transactions costs using a blockchain. As the underlying technology (the Distributed Ledger Technology – DLT) does not involve high costs, the issuance of a WCBDC could also improve the contestability of the financial services industry by supporting competition through the entry of new providers. The motives for issuing a RCBDC may vary from one economy to the other, even though the general objective would be to supply the public with a digitalised monetary instrument without any liquidity or credit risks, easy to access and cheap to use. A step towards more complete markets would thus be taken, leading to an improvement in social welfare, and breaking the current incompatibility triangle between universal access, security and digitalisation of liquid financial assets (see Chart).

A CBDC, be it a wholesale or a retail one, should feature a number of characteristics. The first characteristic of a CBDC would be that it could be created or destroyed only by the central bank. Furthermore, in order not to break the uniformity of the payment system, it would be issued and exchanged at par with the other forms of central bank money (banknotes and reserves), thus making it possible to keep the fungibility of the monetary base. This implies that its supply should be perfectly elastic. In order to maintain the WCBDC and the RCBDC separate and to keep some information confidential, the WCBDC would have to be issued on a permissioned blockchain, not a public one. As reserves are remunerated, it seems unavoidable to also remunerate the WCBDC, in order to keep reserves and the WCBDC at par. Most central banks lack a direct experience in managing individuals’ accounts, and would not take the reputational risk of a RCBDC being used in fraudulent transactions. Moreover, there would a priori be little interest in having the users validate transactions. A RCBDC would thus not necessarily be issued on a blockchain, while its circulation would most likely involve intermediaries. Whether non-residents should be allowed to hold a CBDC is an open question, although it would seem difficult to prevent them from doing so in the case of a RCBDC.

By increasing competition and allowing productivity gains, both in payment services and beyond (financial services, retail industry, etc.), the issuance of a CBDC would represent a supply shock, which would support economic growth in the medium to long run and would transitorily weigh on prices. As a WCBDC would be accessible universally and 24x7x365, its users would make transactions when financial markets and central banks are usually closed; one consequence could be the development of an intraday market for the WCBDC, which could in turn lead to the adoption of a real-time monetary policy. Also, the issuance of a RCBDC could put a floor to bank deposit rates and, if it is remunerated, raise them.

The interest rate on required reserves could be used for the remuneration of the WCBDC, for reasons of simplicity and efficiency. As regards the RCBDC, a rate below or equal to the rate of remuneration of excess reserves could be applied to it, in order to dissuade institutions from holding the RCBDC and thus keep it for the public. If the RCBDC were not remunerated, the effective lower bound would be raised to zero and the effectiveness of asset purchases by the central bank could be diminished. If it were, the interest and exchange rate channels should be strengthened and the cost of banks’ resources should increase. The remuneration of the RCBDC would thus create a trade-off between the effectiveness of monetary policy and the cost of bank intermediation.

Concerns have been voiced that the issuance of a RCBDC may facilitate bank runs and exacerbate liquidity strains. However, even if runs became more frequent, their negative consequences for economic activity would likely be lessened, since the main motivation for supplying a CBDC is to allow all economic agents to have a perfectly safe digitalised means of payment at their disposal, and thus to preserve economic activity in all circumstances. This motive would particularly be at play in times of crisis.

Download the PDF version of this document

- Published on 10/15/2019

- 15 pages

- EN

- PDF (1.77 MB)

Updated on: 10/15/2019 09:06