Working Paper Series no. 854: Committed to Flexible Fiscal Rules

We study the impact of fiscal rules on macroeconomic performance. To address the endogeneity of rule adoption, we use data on large, random natural disasters. We document empirically that countries with rules perform significantly better following such exogenous shocks than countries without rules. GDP and private consumption are persistently higher. This is associated with more expansionary fiscal policy and hinges on the existence of fiscal space and escape clauses. We rationalize the findings in a model of sovereign default, which replicates the empirical dynamics and shows that tight rules create fiscal space in good times for deficit-spending in bad times.

In response to the Covid-10 pandemic, many governments have suspended fiscal rules and implemented deficit spending at an unprecedented amount. This has revived a classical discussion about the benefits and costs of fiscal rules. Such rules are defined as persistent constraints on fiscal policy in the form of numerical targets for budgetary aggregates, such as debt or deficits.

The main goal of fiscal rules is to restrict the secular increase in government debt, which is viewed as reflecting political economy factors, but not optimal macroeconomic policy. There is a growing consensus in the empirical literature that fiscal rules are successful at achieving this objective. At the same time, a main contention is that the benefit of stabilizing debt involves a fundamental tradeoff with the flexibility to respond to economic shocks.

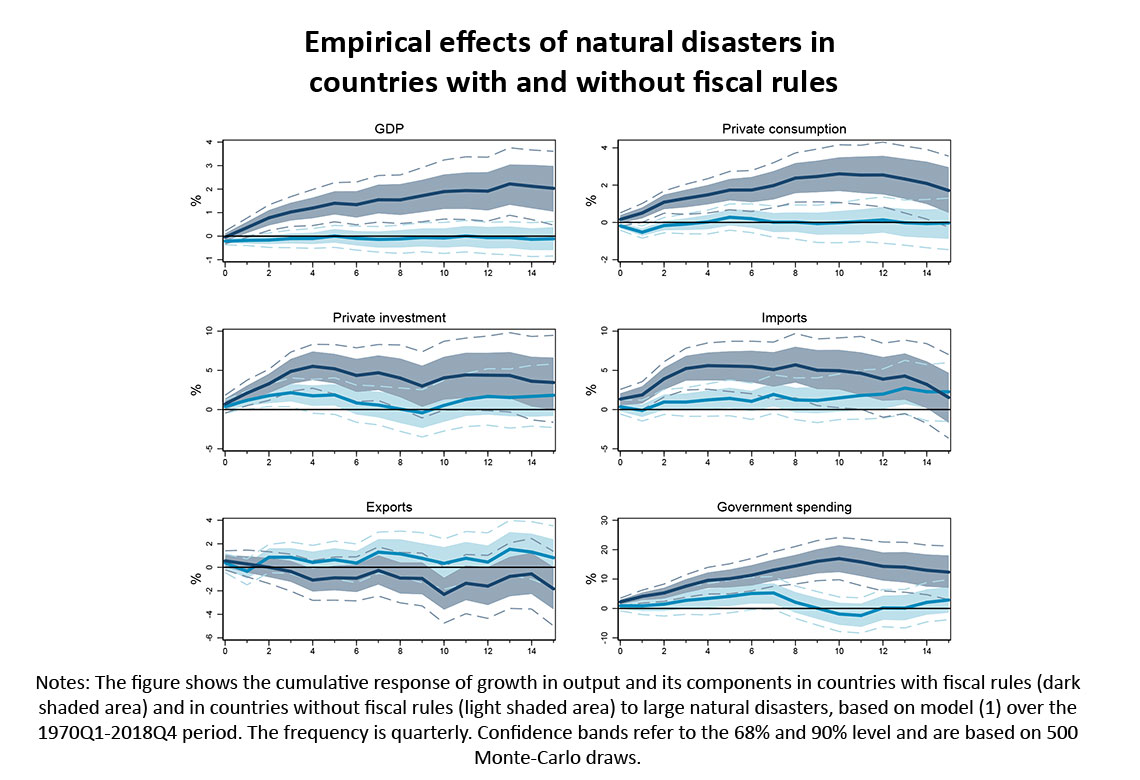

In this paper, we evaluate the tradeoff argument and provide a new stylized fact using natural disasters. We show empirically and theoretically that countries with fiscal rules buffer such adverse economic shocks better (not worse) than countries without fiscal rules. First, we document empirically that output and private consumption are significantly higher and fiscal policy significantly more expansionary, in the aftermath of disasters in fiscal rule countries (see Figure). Furthermore, we show that the superior performance depends on the existence of fiscal space before entering the crisis and on the presence of escape clauses. Then, we rationalize the findings through a model of sovereign default with endogenous fiscal space and tax plans, in which a numeric fiscal rule prevents a myopic government from accumulating excessive debt. The model predicts that, relative to a situation without a rule, sovereign spreads spike less and fiscal policy is more expansionary, with higher output and private consumption, when disasters strike.

Download the PDF version of this document

- Published on 12/14/2021

- 46 pages

- EN

- PDF (1.7 MB)

Updated on: 12/14/2021 18:06