Working Paper Series no. 843: The Deflationary Bias of the ZLB and the FED’s Strategic Response

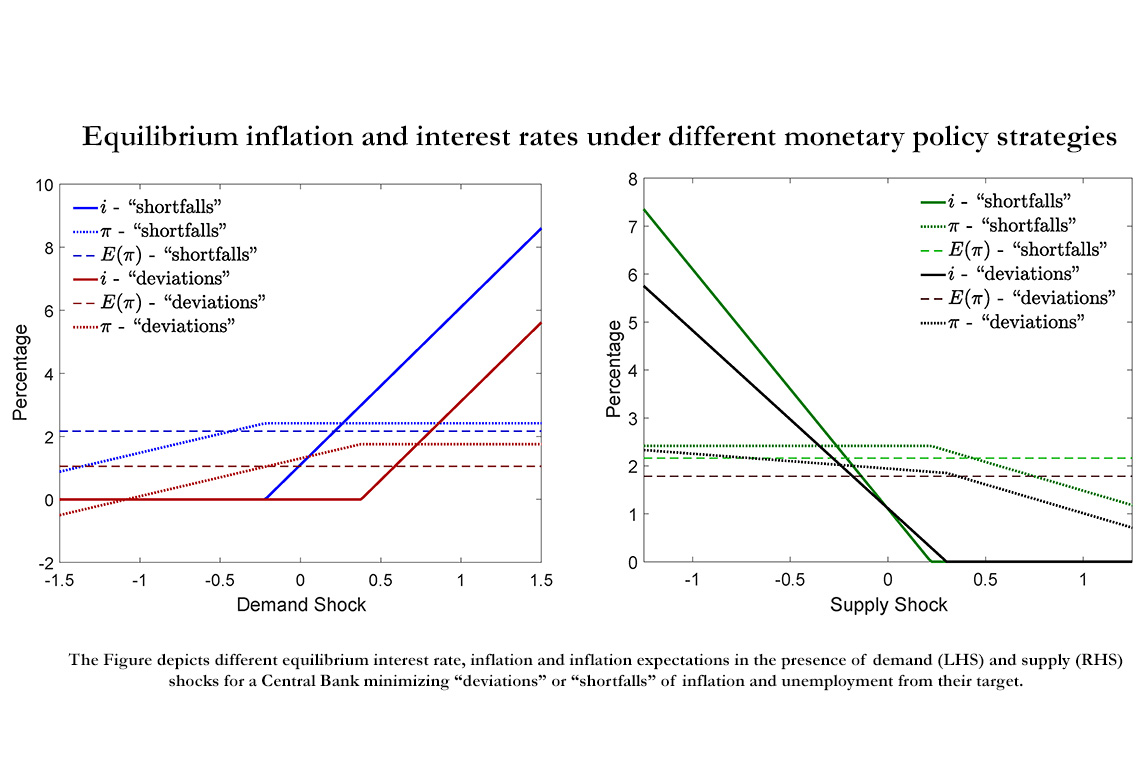

The paper shows, in a simple analytical framework, the existence of a deflationary bias in an economy with a low natural rate of interest, a Zero Lower Bound (ZLB) constraint on nominal interest rates and a discretionary Central Bank with an inflation mandate. The presence of the ZLB prevents the central bank from offsetting negative shocks to inflation whereas it can offset positive shocks. This asymmetry pushes average inflation below the target which in turn drags down inflation expectations and reinforces the likelihood of hitting the ZLB. We show that this deflationary bias is particularly relevant for a Central Bank with a symmetric dual mandate (i.e. minimizing deviations from inflation and employment), especially when facing demand shocks. But a strict inflation targeter cannot escape the sub-optimal deflationary equilibrium either. The deflationary bias can be mitigated by targeting “shortfalls” instead of “deviations” from maximum employment and/or using flexible average inflation targeting. However, changing monetary policy strategy risks inflation expectations becoming entrenched above the target if the natural interest rate increases.

The natural rate of interest (the real rate of interest which equilibrates the demand and supply of savings over the medium term) is estimated to have fallen persistently over the past decades in advanced economies. This fall in the natural rate has put severe limitations on the efficacy of conventional monetary policy. Given that nominal interest rates cannot go much below zero (the effective lower bound) and that a lower natural rate of interest implies lower nominal interest rate on average, this gives central banks less room to cut nominal interest rates to stimulate the economy. Additionally, if central banks cannot quickly reflate their economies, then inflation expectations will also fall. But nominal interest rates are composed of a real rate of return and expected inflation. Thereby, reducing inflation expectations hampers even further the room central banks have to deploy conventional monetary policy by lowering nominal interest rates. This constrains the central banks’ ability to reflate the economy and drives down expected inflation even further, creating a vicious spiral. This adverse interaction between a low natural rate of interest and the effective bound is referred as the “deflationary bias". In response to this risk, central banks have deployed many unconventional monetary instruments but inflation has remained stubbornly below target (until very recently), dragging down inflation expectations.

In August 2020, the United States Federal Reserve announced two important changes to its long run goals and monetary policy strategy. It decided to shift its concern from “deviations” of employment from maximum employment to a concern for “shortfalls from maximum employment”. Additionally, it has adopted a form of make-up strategy through the introduction of flexible average inflation targeting (FAIT).

In this paper, we first develop a simple model to explain the deflationary bias. To do this we extend the well-known Barro and Gordon (1983) model by adding a natural rate of interest and an effective lower bound at zero (ZLB). This modelling approach gives clear and intuitive analytical results and allows to compare the difference between a central bank with a dual mandate (on inflation and unemployment as for the Fed) or a pure inflation targeter (such as the ECB) and to study the effects of demand and supply shocks separately.

We demonstrate that in the presence of demand shocks, the deflationary bias is more severe for a central bank with a dual mandate than for an inflation targeting central bank. This is because the dual mandate central bank does not want to unduly overheat the labour market to increase inflation. We also show that a flatter Phillips curve (less sensitivity of inflation to unemployment) reduces the deflationary bias, while a steeper IS curve (less sensitivity of unemployment to changes in nominal interest rates) exacerbates the deflationary bias. In the presence of supply shocks, the deflationary bias is less severe for a dual mandate central bank than for an inflation targeter: supply shocks move inflation and unemployment in opposite directions and the dual mandate central bank will tolerate higher inflation to reduce unemployment. This boosts inflation expectations and mitigates the deflationary bias.

Then, we show how switching from a “deviations" to “shortfalls” interpretation of the unemployment component of the dual mandate can mitigate and, indeed, overturn the deflationary bias. Under the “shortfalls" strategy, the dual mandate central bank always prefers a lower rate of unemployment for any level of inflation. This leads to an upward bias in inflation and in the presence of the ZLB helps to combat the deflationary bias. Then we report simulations of the effect of switching to FAIT, a time varying temporary inflation target. We show that this strategy can mitigate the inflation bias but does not always eliminate it. This demonstrates the advantage of using both changes of strategy in tandem. In the final section of the paper we show that the welfare benefits of switching to “shortfalls" are positively correlated with the probability of hitting the ZLB

Download the PDF version of this document

- Published on 10/28/2021

- 41 pages

- EN

- PDF (1.33 MB)

Updated on: 10/28/2021 17:18