Working Paper Series no. 888: Different Motives for Holding Cash in France: an Analysis of the Net Cash Issues of the Banque de France

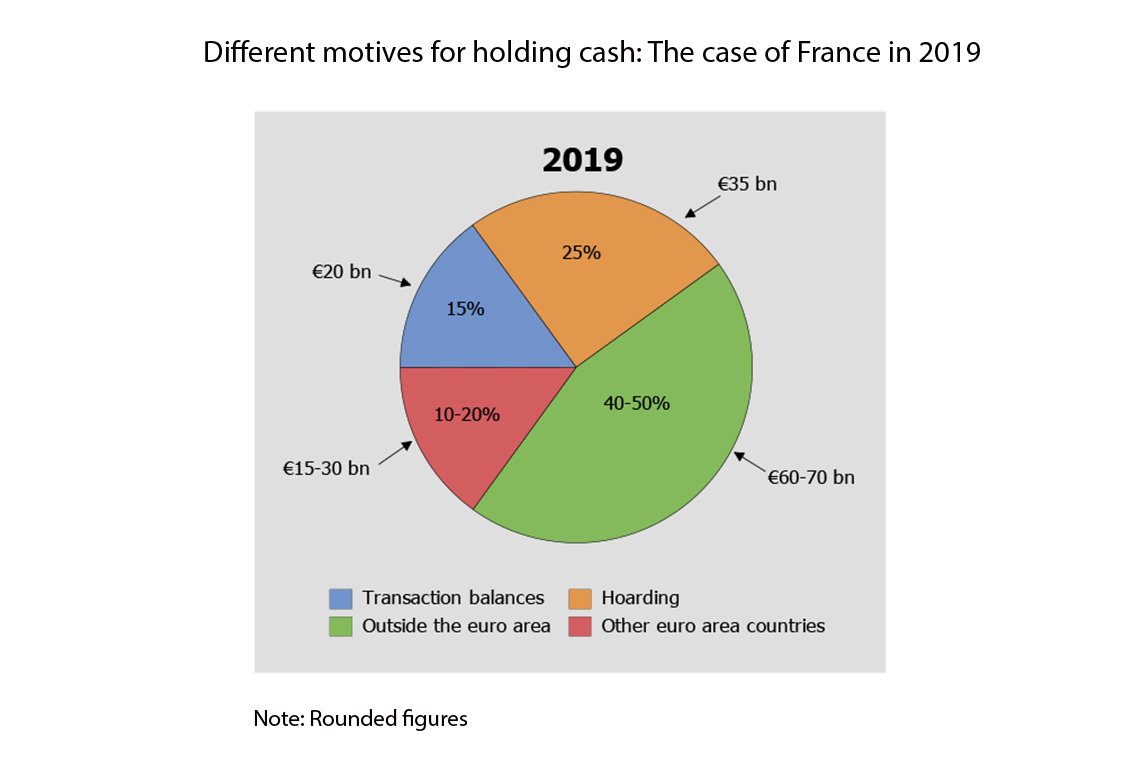

The present paper analyzes the net cash issues of the Banque de France. It is divided in two parts. The first estimates cash demand functions for different denominational groups (small, medium, large). We find that many of the different motives for holding cash are present in the French case. In a second step we try to estimate the amounts used for transaction and store of wealth purposes, internal hoardings and foreign demand with indirect methods with a special focus on different variants of the so-called seasonal method. Our results reveal that in 2019 only around 15 % of the cumulated net issues are used for domestic transactions. Around 60 % are held outside France, either in other euro area countries or outside the euro area.

The present paper analyzes the demand motives of the outstanding amount of euro banknotes issued by the Banque de France. Since the introduction of the euro, these cumulated net issues have steadily increased over time from €30 bn. in 2002 to nearly €185 bn. at the end of 2021. This is not only true in absolute terms, but also relative to GDP. Therefore, domestic demand for transaction balances cannot be the only driver. The demand for banknotes can be split into different shares: domestic transactions, store-of-value and foreign demand. Although the central bank knows exactly the amount of cash issued, there is lack of information on who holds it, for what motives and where it circulates. Moreover, within the euro area, the exercise is even more complicated as euro banknotes issued in France may migrate to other euro countries (and vice versa) without any obstacle. In our analysis, we concentrate on the situation from 2002 until the end of 2019 to not distort the results by the Corona pandemic which had huge repercussions on cash demand worldwide. As a first step we estimate cash demand equations for different denominational groups within a cointegration framework in order to get information on the prevalence of different motives for holding cash. The results confirm that non-transactional as well as transactional motives for holding cash are present in the case of France.

To estimate the corresponding shares, indirect methods are applied which make use of different characteristics of domestic transactions balances compared to cash balances held for other purposes (at home and abroad). We predominantly concentrate on the so-called seasonal method, which is applied to French cumulated net issues of banknotes. The aim of the seasonal methods used is to filter out information about banknotes in circulation not used for transaction balances within France from the "seasonal pattern of banknotes" characteristic.

In 2019, only around 15 % of the cumulated net issues (representing a total of €145 bn.) are used for domestic transactions (see Figure). More than half of the cumulated net issues are held outside France, either in other euro area countries (i.e., France is a net exporter of banknotes within the euro area) or, and mostly, outside the euro area. Finally, we estimate that around 25 % of the cumulated net issues are used for domestic hoarding purposes

Download the PDF version of this document

- Published on 10/14/2022

- 37 pages

- EN

- PDF (1.2 MB)

Updated on: 10/14/2022 11:58