Working Paper Series no. 884: DSGE Nash: Solving Nash Games in Macro Models with an application to optimal monetary policy under monopolistic commodity pricing

This paper presents DSGE Nash, a toolkit to solve for pure strategy Nash equilibria of global games in general equilibrium macroeconomic models. Although primarily designed to solve for Nash equilibria in DSGE models, the toolkit encompasses a broad range of options including solutions up to the third order, multiple players/strategies, the use of user-defined objective functions and the possibility of matching empirical moments and IRFs. When only one player is selected, the problem is re-framed as a standard optimal policy problem. We apply the algorithm to an open-economy model where a commodity importing country and a monopolistic commodity producer compete on the commodities market with barriers to entry. If the commodity price becomes relevant in production, the central bank in the commodity importing economy deviates from the first best policy to act strategically. In particular, the monetary authority tolerates relatively higher commodity price volatility to ease barriers to entry in commodity production and to limit the market power of the dominant exporter.

When individual agents choose strategically, they try to anticipate the actions of other players to maximise expected benefits. This behaviour might lead to outcomes that are inferior to what would be achieved via coordination, i.e. when agents maximise the global welfare of the economy. Studying strategic interactions allows to quantify these losses, detect the reasons why individual incentives might be inefficient and design policies that try to correct them. These mechanisms are relevant in macro models where some agents (e.g. countries) need to decide on the best policy to implement. However, modelling global games is significantly more complex in the context of macro and general equilibrium models. We present a new toolbox, DSGE Nash, that computes the solution of global games for a wide set of macroeconomic models. The toolkit envisages four main configurations that cover a wide range of problems. First, it can solve a Nash game between agents in general equilibrium models, with the model's remaining equations taken as constraints. Second, it can target a broad set of objective variables and it can be applied to different frameworks, including semi-structural and agent-based models. Third, when only one player is selected, DSGE Nash re-casts the problem into a standard optimal policy problem and solves it. Fourth, it can estimate models by moment or impulse response matching. All these functionalities are provided in an user-friendly environment that allows for the customization of both the model and the solution algorithm.

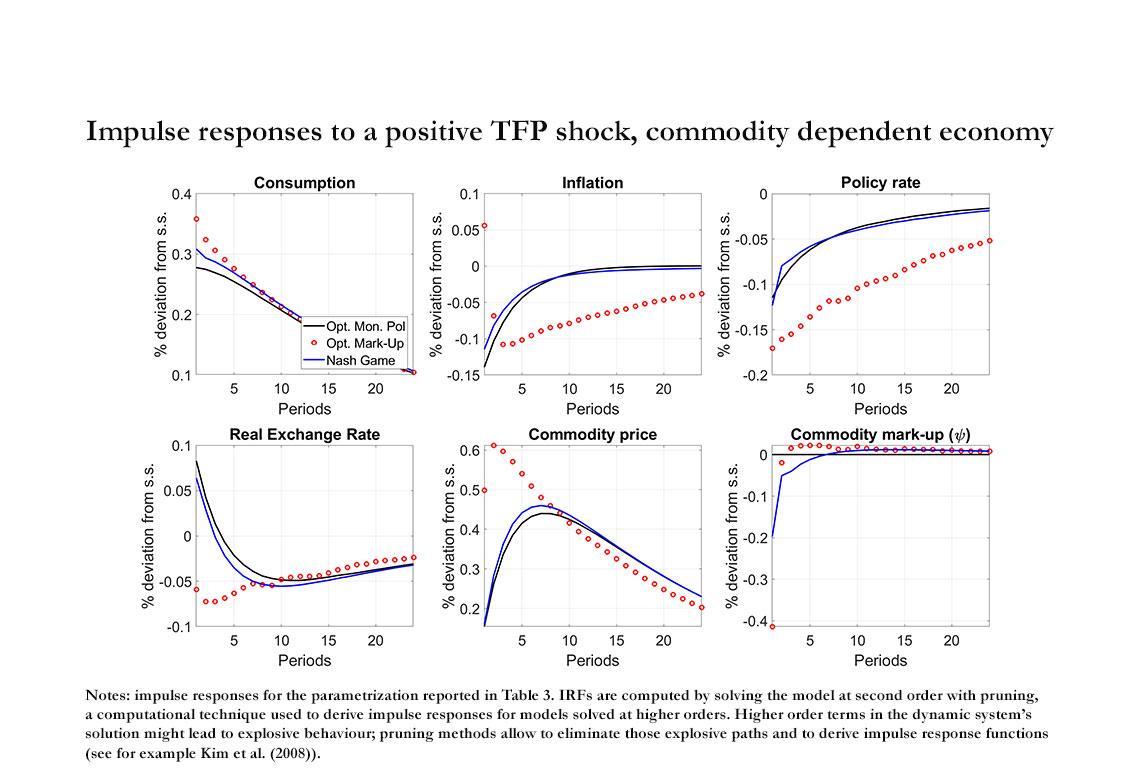

As an application example, we use DSGE Nash to study an open-economy model where a commodity importing country and a monopolistic commodity producer compete on a market characterized by barriers to entry. Rising commodity prices have been recently a main source of supply shocks, exacerbated by the monopolistic nature of commodity production. Against this background, the question of how policy makers should respond to commodity price swings has become prominent. We find that the degree of strategic competition between the producer and the importing country depends on the importance of the commodity in consumption and production. If the commodity share is low, both players have a dominant strategy requiring: i) strong core inflation targeting and no reaction to the commodity price by the commodity importer; ii) a somewhat lower mark-up setting for the monopolist. When the commodity is relevant for production, the central bank cannot follow the first-best policy because that would allow the exporter to extract higher rents, thus reducing domestic welfare in the importing economy. The central bank then knowingly chooses an alternative rule that tolerates higher volatility in commodity prices. Barriers to entry are hence lowered and the exporter faces more competition. To avoid the risk of new competitors entering the market, the exporter reduces its mark-up, which benefits the importing economy and ultimately increases welfare, despite a less efficient monetary policy rule.

Download the PDF version of this document

- Published on 09/20/2022

- 50 pages

- EN

- PDF (3.66 MB)

Updated on: 09/20/2022 11:38