Working Paper Series no. 784: Economic Adjustment during the Great Recession: The Role of Managerial Quality

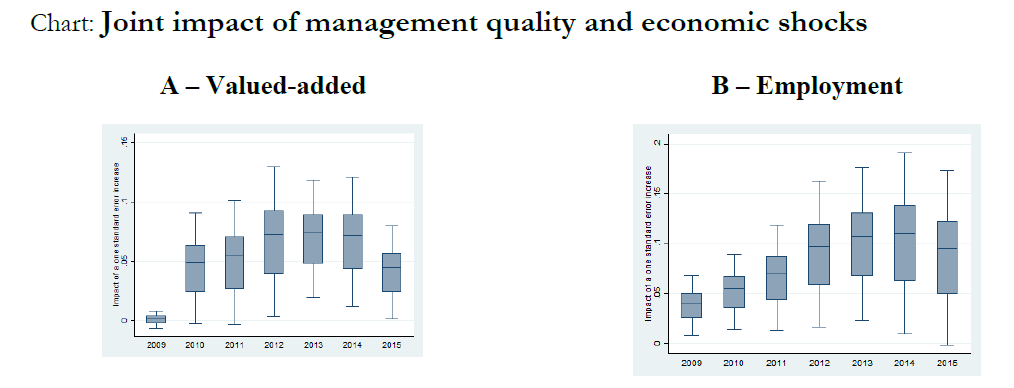

This study investigates empirically how managerial practices have affected macroeconomic adjustment during the Great Recession after the 2008 economic crisis. We start by constructing a country*industry balanced panel data over the 2007-2015 period for eighteen industries in ten OECD countries, and complementing it by two indicators: an indicator of management quality at the country level based on the managerial practices categorical scores at firm level from Bloom et al. (2012); and an indicator at the industry level for the shocks stemming from the 2008 economic crisis. We then rely on the local projection method pioneered by Jordà (2005) to estimate the direct impacts of country management quality indicators and industry economic shocks as well as their joint impacts, on five variables of interest: value-added, employment, labor productivity, wage per employee and labor share during the Great Recession. We find that, in countries where management quality is higher, production and employment are more resilient during the Great Recession, with less production losses and employment damages, no effects on productivity, wage moderation and a slight increase in the labor shares. It appears, moreover, that this resilience is increasing with the size of industry shocks.

While it is too early to study the effects of managerial talent on resilience to the Covid-19 crisis, useful insights can be drawn from the experience of the Great Recession. In this paper we study the way in which average managerial quality has shaped the response of OECD economies to the financial crisis focusing on its effects on employment and related economic outcomes at sectoral level.

Research has shown that managerial practices vary a lot not only across firms in an economy but also across countries. Bloom and Van Reenen (2007), Bloom et al. (2009, 2012, 2016) and Bender et al. (2018) have collected, via firm-level surveys, data on the quality of management for 35 countries which show that the dispersion of managerial quality across countries and across firms within countries is wide.

Several studies have shown the effect that managers can have on firm-level and sectoral productivity outcomes in the medium to long-run. Another strand of research has highlighted the role of managers in efficiently allocating tasks in a firm in ways that preserve, develop and use efficiently human capital and workers' skills, including by maintaining workers' incentives and satisfaction. However, there has been relatively little research to date on the effects of managerial practices on macroeconomic outcomes during a crisis. Are countries that have on average better managers able to preserve employment levels and the associated human capital in the wake of a temporary demand shock? If so, what are the trade-offs managers can leverage upon, such as wages or productivity, in weathering the shock and ensuring a rebound during the recovery period?

In this paper we focus on these issues using the Great Recession (GR) as an exemplary case study. We rely on a country-industry panel covering 18 industries in 10 OECD countries over the 2007-2015 period and adapt the local projection approach developed by Jorda (2005) and Teulings and Zubanov (2014) to study the covariation of average managerial quality, measured by the World Management Survey indicators, with the response of employment, value-added, wages, productivity and the labor share. In other words, we estimate the extent to which country-industry differences in managerial quality are correlated with differential responses of employment and other variables to the intensity of the demand shocks induced by the 2008 Great Recession.

We find that the quality of management practices was significantly associated with employment dynamics during the Great Recession. On average, countries that had better management levels suffered less employment losses. The difference in cumulated job losses between countries at the top and bottom management quality quartiles has been significant. In better managed countries, employment losses have been contained by limiting declines in production, implementing wage cuts and maintaining productivity levels. As a result, in these countries labor shares have not declined. Moreover, these positive cushioning effects of good management on employment appear to increase with the depth of the shock suffered at sectoral level.

Our paper contributes to three main strands of literature. First, it adds a dimension to the macroeconomic research looking at the interactions between institutions and shocks. Second, it explores the macroeconomic implications of evidence found at the microeconomic level concerning the link between management styles and labor reallocation within firms experiencing exogenous shocks. Third, it extends research on the way managerial quality affects the response of economic outcomes to shocks by looking beyond the productivity dimension into the mechanisms that underlie these outcomes.

The finding that good management may contribute to smooth out the effect of deep crises on employment is potentially relevant for understanding differences in employment responses to the Covid crisis during lockdowns across countries, beyond influences exerted by other institutional arrangements such as reliance on job retention vs unemployment insurance schemes. It could also be relevant looking forward to gauge the persisting effects of the Covid-19 crisis on employment upon exiting confinement periods via the emergence of new work arrangements reflecting the need for social distancing. While there are obvious differences between the causes and mechanisms underlying the Great Recession and the Covid-19 crises and the policy responses to these crises, our results suggest that good management could have positive effects in the recovery process of both crises through comparable channels.

Download the PDF version of this document

- Published on 10/23/2020

- 20 pages

- EN

- PDF (2.14 MB)

Updated on: 10/23/2020 09:48