Working Paper Series no. 566: Explaining and forecasting bank loans. Good times and crisis

This paper aims to develop a parsimonious model to explain and forecast bank loans to non-financial companies during calm periods as well as in situations of financial turmoil. In doing so, we are led to gauge the marginal informational content of simple leading indicators, and to investigate potential non-linearity in credit dynamics. This framework is applied to the French context, over a period including financial, banking and sovereign debt crises. In accordance with firms and banks’ balance sheets effects, the growth rate of equity prices appears to be one of the most interesting leading indicator as well as a significant threshold variable for explaining regime switching. However, our results highlight the difficulties to accurately predict the right credit dynamics regimes. A simple VAR model finally performs better.

The successive financial, banking and sovereign debt crises had huge effects on bank credit, especially in the bank-based European economies. Such an unexpected credit collapse had, in turn, a significant negative impact on economic activity. This required updating the empirical methods and the key determinants to be considered for explaining and forecasting bank loans.

Explaining then forecasting credit is crucial for policymakers

First, it is generally crucial for policymakers to anticipate business cycles, as it conditions the timeliness of their policies. In this respect, a relevant model for credit is required to improve investment and consumption forecasts. Moreover, it would make it possible to anticipate the severity of a forthcoming recession. Indeed, credit-intensive expansions tend to be followed by deeper recessions and slower recoveries. Second, understanding and anticipating credit dynamics is key to gauging the risk of financial crises. Numerous studies have already highlighted the link between credit market developments and financial turmoil. Thus, a better understanding of credit would make it possible to assess the potential occurrence of credit crunch and credit rationing. This may imply a model that is different from those prevailing in ‘normal conditions’. Finally, research on credit can be justified by the current unprecedented context of the new regulatory framework, and the implementation of both macroprudential and unconventional monetary policies, whose objectives are, at least in part, related to credit developments.

A parsimonious model for explaining and forecasting bank loans in France

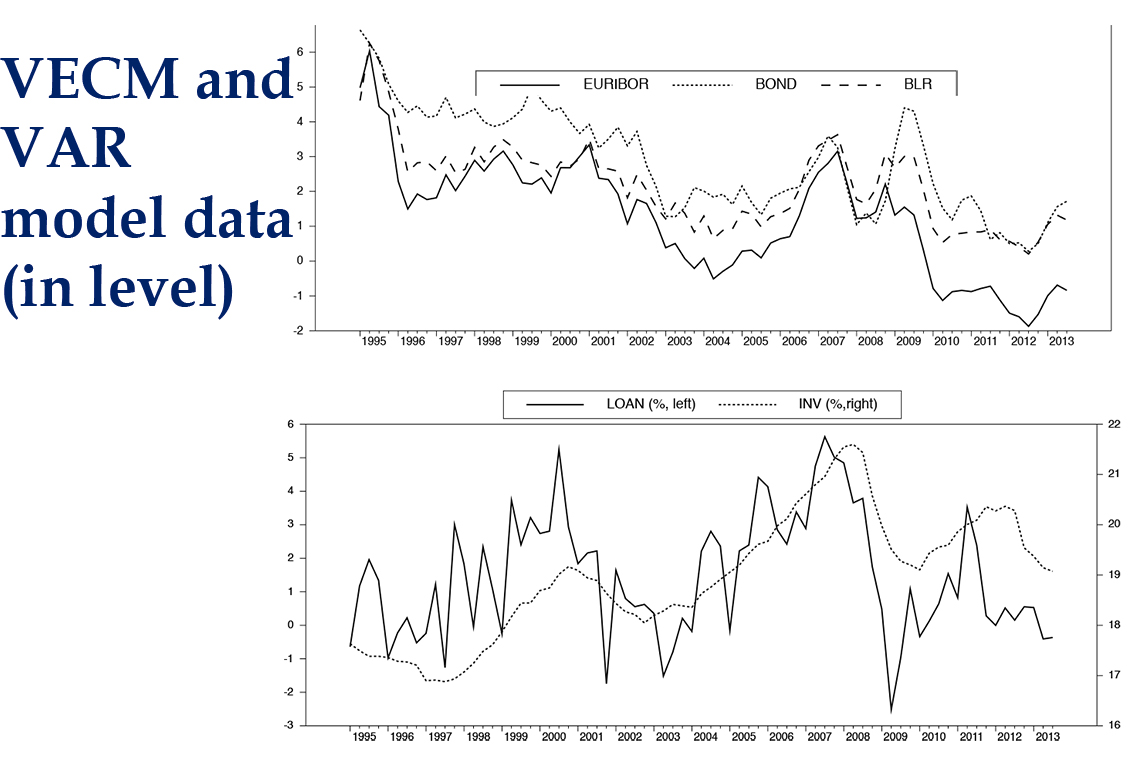

The objective of Grégory Levieuge consists in developing a parsimonious model for explaining and forecasting credit and gauging the marginal informational content of many potential leading indicators. Additionally, he investigates non-linearity in credit dynamics, bearing in mind that bank lending activity can change depending on the financial context. His analysis therefore covers a period that combines both good times and - financial, banking and sovereign - crises. Lastly, his contribution is original in that it concerns the French context, which has so far been neglected in the literature.

Grégory Levieuge finds that a simple Vectorial Auto-Regressive (VAR) model is acceptable for explaining and forecasting credit dynamics in France for horizons spanning 1 to 4 quarters. In addition, he looks at the marginal predictive power of a large set of more than 40 indicators, such as bank lending survey indicators, asset prices, interest rate spreads, risk indicators, bank balance sheet ratios, policy variables, etc. In this regard, he gauges whether these variables make it possible to improve the loan forecasting accuracy of the baseline VAR model.

The growth rate of the CAC40 index is a significant leading indicator of bank loans

Gregory Levieuge finds that the growth rate of the CAC40 index is one of the fairest leading indicators of bank loans. This can be theoretically justified. According to the literature on the financial accelerator, stock prices represent for future cash flows an appropriate proxy for the quality of borrowers’ balance sheets. The lower the equity prices, the higher the external financial premium that firms must bear and hence the lower their borrowing capacity. Moreover, changes in equity prices affect both the liability and asset sides of banks’ balance sheets. According to the bank capital channel theory, any decline in asset prices depreciates the value of banks’ securities portfolios and decreases their retained earnings. The resulting fall in their own equity capital leads banks to tighten credit conditions and/or to cut credit supply.

These theories describe non-linear mechanisms. Grégory Levieuge has built and estimated a switching regime model in credit dynamics, depending on changes in equity prices. The empirical results confirm that the growth rate of the CAC40 constitutes a significant threshold variable for explaining shifts in credit dynamics. However, as regards forecasting accuracy, such non-linear models are not significantly better than linear models. Indeed, the former fail to accurately predict the right regime (i.e. to forecast the threshold variable). In addition, when the regime is incorrectly predicted, forecasting errors are substantial.

Further investigations should look deeper into the promising non-linear hypothesis by identifying other threshold variables and/or another model specifically designed for forecasting regime switching.

G. Levieuge (2017). “Explaining and forecasting bank loans. Good times and crisis”, Applied Economics, Vol. 49, Issue 8 Pages 823-843

Download the PDF version of this document

- Published on 08/01/2015

- EN

- PDF (704.44 KB)

Updated on: 06/12/2018 10:56