Rue de la Banque no. 59: The effects of monetary policy on the composition of bank deposits and on loan supply

Using US bank level data, this Rue de la Banque shows that when monetary policy tightens, banks with a larger proportion of zero-interest deposits on their balance sheet experience larger increases in their interest-bearing deposit rate. A larger increase in the interest-bearing deposit rate then corresponds to a larger decrease in their loan supply.

Therefore, the funding composition of the banking system plays a role in the transmission of monetary policy: the bank lending channel is still at play.

By Mattia GIROTTI

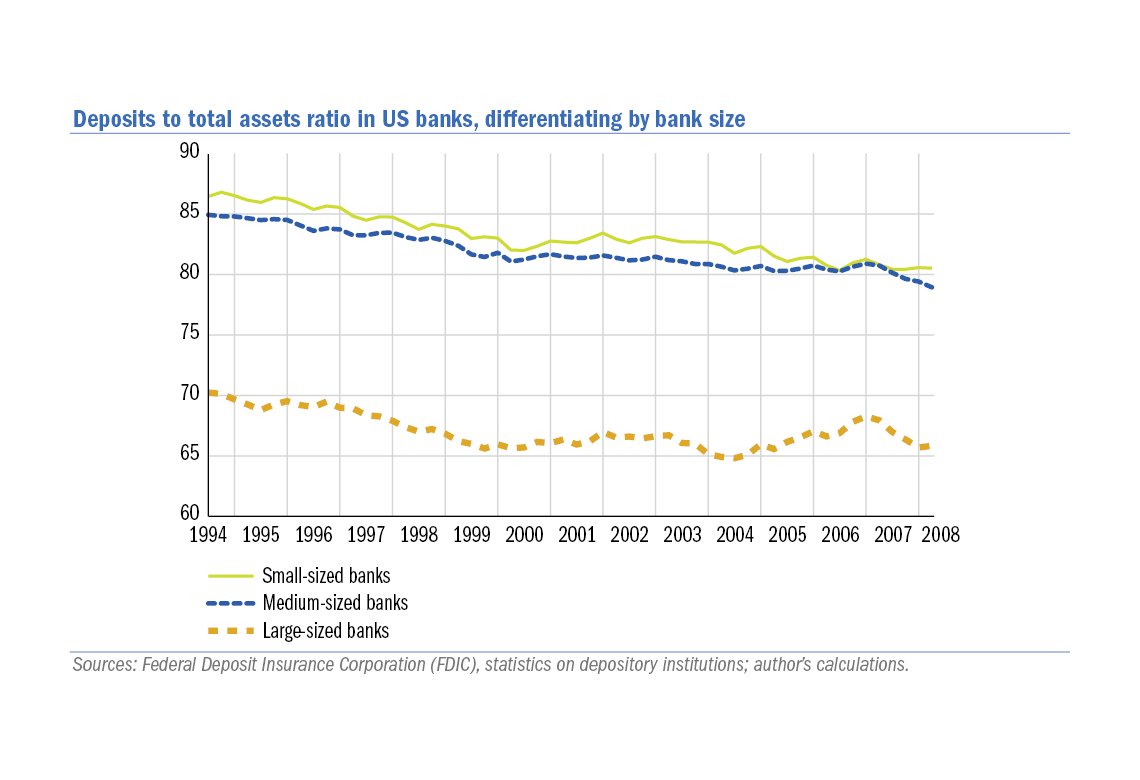

After a prolonged period of decreasing interest rates, major economies are now confronted with discussions on when central banks will progressively increase interest rates. Building on Girotti (2016), this Rue de la Banque describes a mechanism through which monetary policy affects the composition of banks’ liabilities and their funding costs. According to this mechanism, when the central bank increases interest rates, commercial banks need to substitute cheap liabilities with increasingly expensive liabilities. As a result, the more banks obtain funding through such cheap liabilities, the more their funding cost increases, and the more they cut back lending.

The existence of this mechanism indicates that bank liability composition determines how banks respond to monetary policy. This, in turn, suggests that the bank lending channel of monetary policy transmission is currently still at play. Central banks should then pay particular attention to how the banking system obtains funding when they aim to modify the monetary policy stance.

Download the PDF version of this document

- Published on 03/30/2018

- 4 pages

- EN

- PDF (548.86 KB)

Updated on: 03/30/2018 14:12