Focus no. 16: The emergence of bitcoin and other crypto-assets: challenges, risks and outlook

The blockchain technology on which the circulation of certain crypto-assets is based should offer numerous potential uses to both financial and non-financial corporations. This technology,among others, contributes to the welcome dissemination of innovation in the financial sphere.

Crypto-assets, such as bitcoin or ether, were born at the start of the 2010s, following the global rise of “virtual” communities, where internet users interact through digital media, such as chat rooms, forums, etc. Often mistakenly termed “virtual currencies” or cryptocurrencies”, these assets are defined by the French Monetary and Financial Code as “any instrument containing non-monetary units of value in digital form that can be held or transferred for the purpose of acquiring a good or service, but do not represent a claim on the issuer”.

Initially designed to be instruments of exchange in the digital world, crypto-assets have gradually gained a foothold in the real economy through services whereby they can be bought or sold against fiat currencies, held, or used as a means of exchange, or even more recently as investment or financing instruments with the creation of Initial Coin Offerings (ICOs).

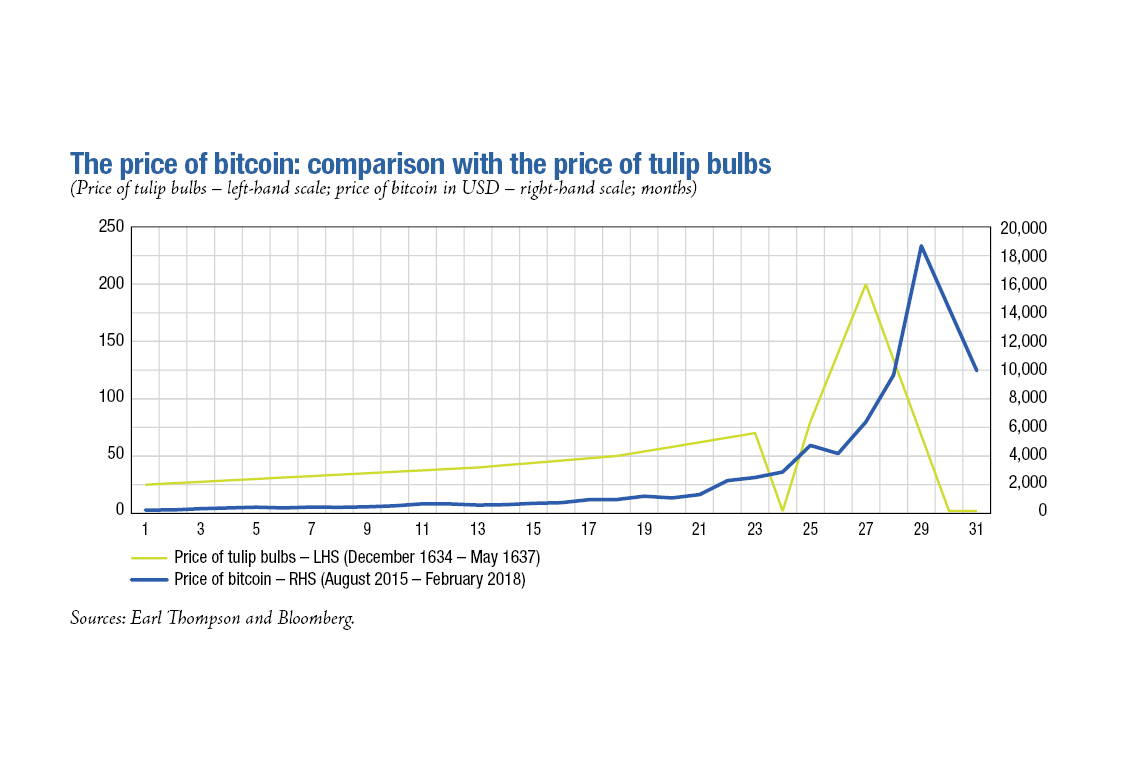

These recent developments, alongside the sudden emergence of a speculative bubble, have led financial supervisors and regulators to reflect on ways to change the regulatory framework in order to address the development of these assets, via a concerted approach at the European and international level.

This Focus explains why crypto-assets are not currencies, shows the risks to which crypto-assets expose their users and outlines the existing regulatory solutions identified to prevent such risks.