Working Paper Series no. 718: Estimating US Consumer Gains from Chinese Imports

We estimate the size of US consumer gains from Chinese imports during 2004-2015. Using barcode-level price and expenditure data, we construct inflation rates under CES preferences, and use Chinese exports to Europe as an instrument. We find significant negative effects of Chinese imports on US prices. This effect is driven by both changes in the prices of existing goods and the entry of new goods and it is similar across consumer groups by income or region. A simple benchmarking exercise suggests that Chinese imports led to a 0.19 ppt annual reduction in the price index for consumer tradables.

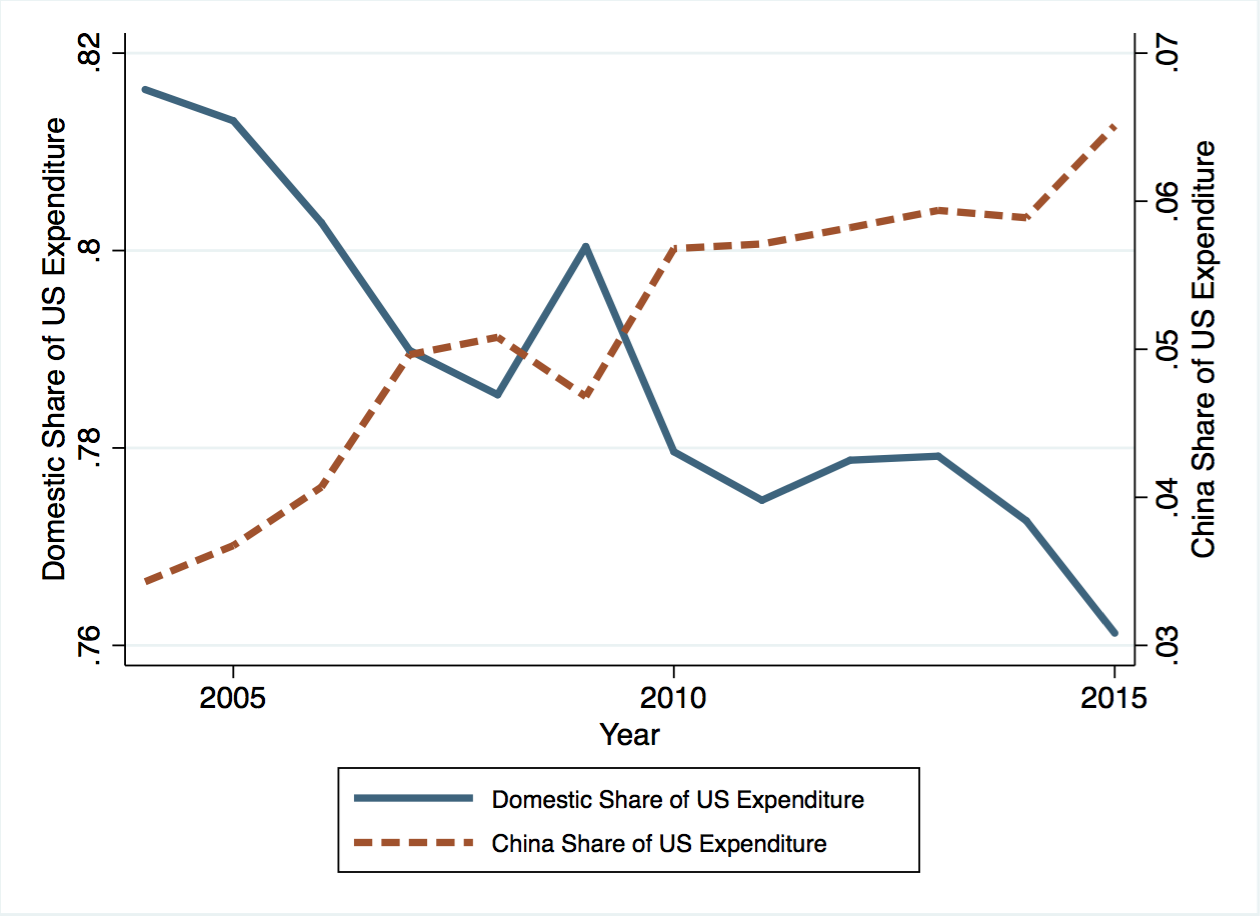

Recent years have witnessed a significant shift in US expenditure towards imports from China. For consumer tradable goods, the share of US expenditure on domestically produced goods has fallen by more than 5ppt over 2004-15, while the share of expenditure on Chinese goods has increased by roughly 3ppt. What are the welfare effects of Chinese import penetration for the US?

While previous research has focused mostly on the effect of Chinese import penetration on US manufacturing employment (Autor et al. 2013), this paper estimates the consequences for US consumer prices. In particular, we provide the first micro-estimates of this effect using barcode-level price and expenditure data, decompose the effect into various margins of adjustment, and investigate heterogeneous effects across consumer groups by income and region.

Our consumption data come from AC Nielsen and cover purchases made by a nationally-representative sample of 60,000 households during 2004-15. The data are highly detailed, giving us information about prices paid by households and their expenditure for over 1.5 million barcoded goods. We use these data to compute inflation rates for individual product categories and build a concordance to link this information with data on HS 6-digit international trade flows.

To estimate the effect on inflation, we make use of variation in Chinese import penetration across categories of consumer goods. The main threat to identification is that both prices and imports from China may be driven by demand or supply shocks in the US instead. To deal with this, we use a strategy similar to Autor et al. (2013) and instrument for the change in the domestic share of US expenditure using Chinese import penetration in Europe.

Our results show that Chinese import penetration significantly reduced inflation. Comparing a product category with median China trade shock to one with no change, prices in the median category grew by 0.17 percentage points less per year. A simple benchmarking exercise implies that the ideal price index for the set of tradable goods we analyze declined by 0.19 percentage points per year.

This effect is driven by both lower inflation among existing goods (intensive margin) and the entry/exit of goods (extensive margin), suggesting the presence of pro-competitive effects and variety gains. Product categories with high Chinese import penetration are characterized by high rates of entry and exit of products. While higher product entry takes place at all quintiles of the price distribution, higher exit is concentrated among low-price goods. Finally, we also investigate potential effects on consumer prices through the import of intermediate goods from China, but these results are inconclusive.

To investigate potential heterogeneous gains across different consumer groups, we make use of demographic information in the Nielsen data. Specifically, we divide households into different groups by income and region of residence, and then re-compute inflation rates for these subgroups. In the empirical analysis we do not find evidence for any heterogeneous effects through differential inflation of consumer tradable goods. However, household may still be differentially affected through the price channel to the extent that they have different expenditure shares on tradable goods, as, e.g., in Fajgelbaum and Khandelwal 2016.

Download the PDF version of this document

- Published on 05/06/2019

- 36 pages

- EN

- PDF (2.2 MB)

Updated on: 05/06/2019 15:37