Rue de la Banque no. 60: Eurosystem asset purchases and portfolio rebalancing in the euro area

Who holds and sells the assets purchased by the Eurosystem? And how do these counterparties rebalance their portfolio? This Rue de la Banque shows that the major end-counterparty of the Eurosystem’s purchases is the non-resident sector, followed by banks and mutual funds from euro area countries as a whole. Purchases by the Eurosystem have enabled the majority of investors to reduce their exposure to duration risk and sovereign risk.

By Ralph S.J. KOIJEN, François KOULISCHER, Benoît NGUYEN et Motohiro YOGO

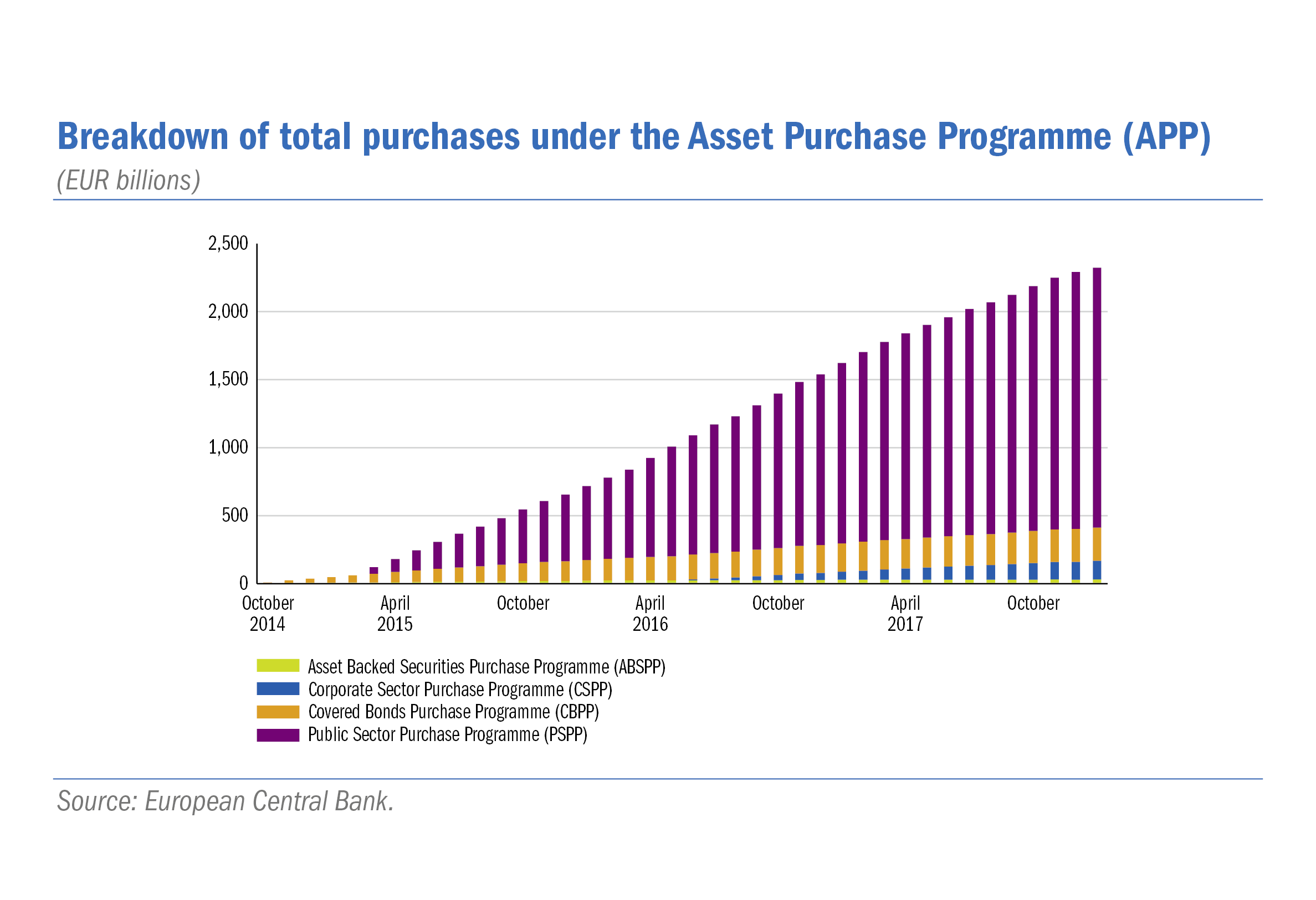

Asset purchase programmes are one of the most important non‑standard monetary policy instruments available to central banks. By the end of December 2017, the Eurosystem had purchased approximately 25% of the sovereign debt of euro area countries.

However, the underlying mechanisms of asset purchase transmission are still debated in the literature, and have rarely been quantified – including, for example, the oft‑mentioned “portfolio rebalancing” channel. Through this channel, central bank purchases exert upward pressure on the price of purchased assets.By rebalancing their portfolios towards other securities, investors bid up the price of assets that were not directly purchased by the central bank. Asset rebalancing should therefore play an important role in transmitting this type of non‑standard measure.

Download the PDF version of this document

- Published on 04/17/2018

- 6 pages

- EN

- PDF (620.5 KB)

Updated on: 04/17/2018 15:06