Working Paper Series no. 842: Financial flows, macro-prudential policies, capital restrictions and institutions: what do gravity equations tell us?

This paper analyzes the impact on financial flows of institutional factors promoting financial integration such as European integration or trying to tame them such as capital control or macro-prudential policies. We use a detailed database of bilateral financial assets and construct gravity models, for foreign direct investment, portfolio flows and other investments. Capital control policies have limited and disparate effects, being particularly effective through restrictions on inward flows for destination countries. The impacts of macro-prudential measures are complex, with macro-prudential measures in the origin country financial sector having a positive impact on outward capital flows and macro-prudential measures in destination countries having a negative impact on inward capital flows. European integration has played a positive role on financial flows. We also emphasize the benefits of cooperation between the origin and destination countries, both for capital control and macro-prudential measures.

The development of financial integration has been one major feature of globalisation, leading to an increase over the long term of the volume of global gross capital flows in all their dimensions (foreign direct investment, portfolio flows, other investments). This development was accompanied by enhanced volatility, leading to major disruptions in emerging but also advanced countries. This raised many policy issues around the management of capital flows, which took a new turn following the global financial crisis and its aftermaths for the euro area, as well as the massive withdrawal of capital flows from emerging countries following the COVID-19 crisis.

Over the last decades, policy initiatives regarding capital flow management went both in the direction of promoting financial integration and of taming financial flows. Regarding financial integration, one of the most prominent projects was the European Union (EU) and the creation of the euro area, which led to a large liberalization of financial flows. On the other side, capital controls tended to increase since the global financial crisis across all income groups of countries and macro-prudential measures, which may impact capital flows directly or indirectly, were set up and implemented in emerging and advanced economies.

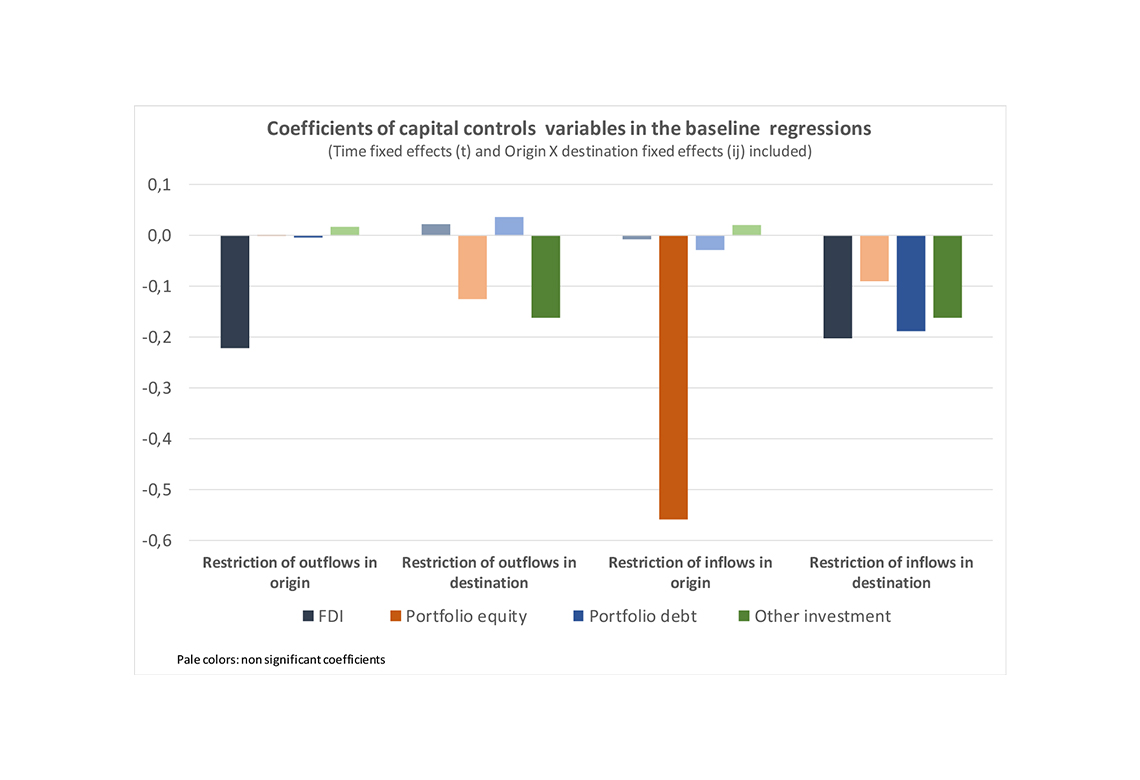

Using three different sets of regressions based on gravity equations with financial assets/flows, depending on sets of fixed effects used, it is found that standard determinants of gravity equations are significant and with expected signs. Capital control policies have limited and disparate effects, being particularly effective through restrictions on inward flows for destination countries for FDI, portfolio debt and other investments (see graph). The impacts of macro-prudential measures are complex, with macro-prudential measures in the origin country financial sector having a positive impact on outward capital flows and macro-prudential measures in destination countries having a negative impact on inward capital flows. European integration, whether in European Union or Euro Area, has played a positive role on financial assets. In the most complete set of fixed effects, we emphasize the benefits of cooperation between the origin and destination countries, both for capital control and macro-prudential measures. In particular, restriction of outflows in origin combined to restriction of inflows in destination have a negative impact on FDI and on other investments.

In a period when the IMF is reflecting on its views regarding the use of the tools available to different types of countries (Basu et al, 2020; Adrian et al. 2020), this paper offers both an assessment of the effectiveness of each policy tool and also of the benefits of international cooperation between origin and destination countries (Ghosh et al. 2014). In particular, the preemptive effectiveness of capital controls on inflows seems to be comforted.

Download the PDF version of this document

- Published on 10/25/2021

- 43 pages

- EN

- PDF (2.76 MB)

Updated on: 10/25/2021 12:16