Working Paper Series no. 721: Informal Sector and Mobile Financial Services in Developing Countries: Does Financial Innovation Matter?

This paper investigates the impact of mobile financial services - MFS (mobile money, and mobile credit and savings) on the informal sector. Using both parametric and non-parametric methods on panel data from 101 emerging and developing countries over the period 2000-15, we find that MFS negatively affect the size of the informal sector. According to estimates derived from propensity score matching, MFS adoption decreases the informal sector size in a range of 2.4 – 4.3 percentage points of GDP. These formalization effects may stem from different possible transmission channels: improvement in credit access, increase in the productivity/profitability of informal firms attenuating subsistence constraints typical of entrepreneurship in the informal sector, as well as possible induced growth of firms already in the formal sector. The robustness of these results is supported by the use of an alternative estimation approach (instrumental variables). These findings lay the groundwork for the scarce literature on the macroeconomic impact of mobile financial services, a major dimension of the growing drive towards economic digitalization.

The informal sector (at around 35% of GDP) remains an important challenge for emerging and developing (EMDCs) insofar as it may introduce significant microeconomic distortions, (competition, sectoral capital allocation, etc.), and macroeconomic losses in efficiency (lower productivity of labor and capital, disincentive to innovate and to scale up, increase in income inequality and poverty). A larger share of the informal sector is also associated with insufficient domestic resource mobilization and public spending to finance access to basic services (health, education), which are essential to reach sustainable development goals, or investment, notably in infrastructure, to facilitate economic diversification and integration in global value chains.

The choice to conduct economic activities in the informal sector is driven by a wide set of economic, financial and institutional motives. The first one may be a desire to avoid tax and social contributions. Low financial development and in particular poor access to credit may also favor remaining in the informal sector. International opportunities, such as openness to political, social and economic globalization, as well as regulatory and institutional quality may also affect the appetite for informal vs formal activities. Finally, the relative attractiveness of the informal sector vs the formal sector may depend on the business cycle itself, as the informal sector provides alternative income during times of economic downturns and high unemployment.

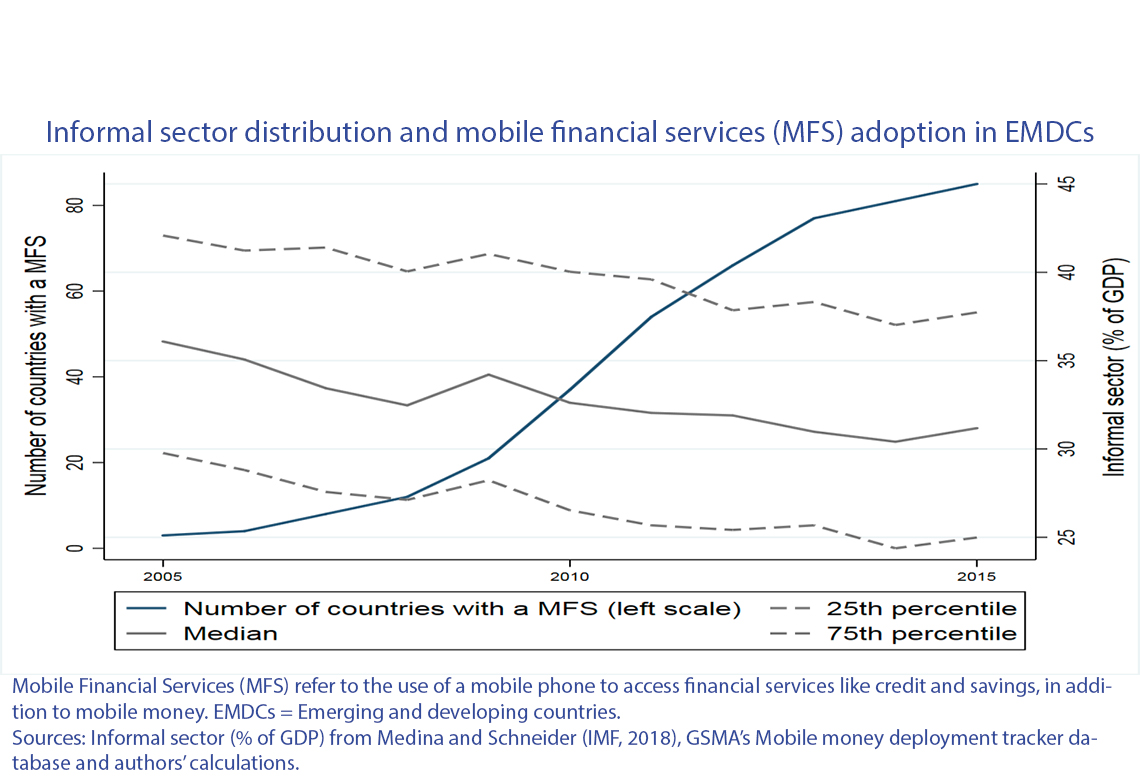

In parallel, mobile financial services (MFS) have been spreading rapidly in developing countries (see Figure above) with large informal financial sectors and low formal financial deepening and inclusion. As documented in the literature, these countries are characterized by a strong preference for cash transactions over other means of payment, low access to formal financial services for large segments of their populations and recourse to informal credit (and savings) to finance consumption and investment project instead of credit by formal banks and insurance. This very environment may have facilitated the rise of financial innovation in developing countries since the rise of Safaricom’s M-Pesa in Kenya in 2007, with significant associated leapfrogging effects. Another noteworthy development has been the trend towards diversification of financial services offered by a growing array of providers (telecom operators, Fintech startups, banks themselves). From its initial focus on transactions as a means of payment, i.e. mobile money, MFS are increasingly offering credit services, and more recently, insurance services.

In our view, assessing the impact of mobile financial services on the informal economy therefore represents a research question of growing and significant interest, one that has received little attention so far. Our research goal is to determine the net effect of MFS adoption on the overall size of the informal sector and analyze some of its transmission channels.

To assess the net impact of mobile financial services on the informal sector, we draw on a panel data from 101 developing countries over the period 2000-15. Previous studies on the shadow economy have been plagued by complex national accounting measurement issues. However, our study use the recent IMF estimates (based on the night lights approach), which has the advantage of providing new insights on the relative size of the informal sector. We find that mobile financial services negatively affect the share of the shadow economy in economic activities. Based on non-parametric approach (propensity score matching), we show that MFS adoption significantly decreases the informal sector relative size in range of 2.4 – 4.3 % percentage points of GDP over the period of our study. Formalization effects may stem from different possible transmission channels: improvement in credit access, increase in the productivity/profitability of informal firms attenuating subsistence constraints typical of entrepreneurship in the informal sector, as well as possible induced growth of firms already in the formal sector. The robustness of these results is also supported by the use of an alternative estimation approach (instrumental variables). On balance, our findings lay the groundwork for the scarce literature on the macroeconomic impact of mobile financial services, a major dimension of the growing drive towards digitalization.

Download the PDF version of this document

- Published on 05/28/2019

- EN

- PDF (2.23 MB)

Updated on: 05/28/2019 18:34