Working Paper Series no. 906: International Commodity Prices Transmission to Consumer Prices in Africa

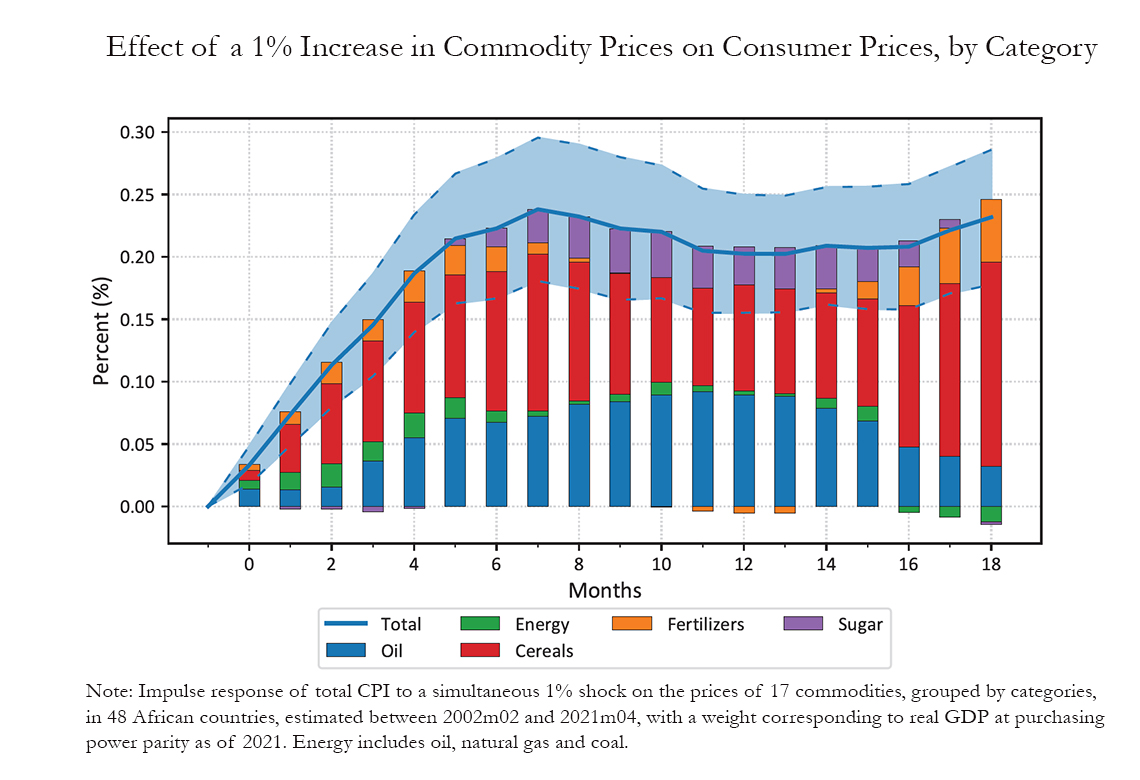

Global commodity prices spikes can have strong macroeconomic effects, particularly in developing countries. This paper estimates the global commodity prices pass-through to consumer price inflation in Africa. Our sample includes monthly data for 48 countries over the period 2002m02-2021m04. We consider 17 commodity prices separately to take into account both the heterogeneity in price variations and the cross-correlations between them, and to depart from aggregate indices that use weights unrepresentative of consumption in African countries. Using local projections in a panel dataset, we find a maximum pass-through of 24%, and a long-run (18 months) pass-through of about 20%, higher than usually found in the literature, which typically uses aggregate indices. We also consider country-specific regressions to test whether estimated pass-through are related to countries’ observable characteristics. We find evidence that the pass-through is negatively correlated with the GDP per capita and the quality of transport infrastructure, and positively correlated with the share of food and energy in the consumption basket and the share of taxes on goods and services in government revenue. Net oil exporters, countries with larger energy subsidies and with a more independent central bank tend to have a lower pass-through. We further show that commodity-specific pass-through are correlated with the share of corresponding goods in the consumer basket.

This paper presents a new estimation of global commodity prices pass-through to consumer prices in Africa, both at the continent and country level. While a large literature has been documenting the transmission of commodity prices to consumer prices, the existing results mostly rely on aggregate commodity price indices. Yet, such an approach falls short of taking into account the strong heterogeneities existing between commodity prices (as all of them are aggregated into a single index) and between the weights of commodities in local consumption (as aggregated indices are based on weights representative of global trade but not of local consumption). Estimating properly such a pass-through is particularly important for African countries, as they are highly dependent on imports for several commodities, have narrow financial margins to mitigate, for the consumer, the strong rise in commodity prices observed since 2020, and have a highly heterogeneous consumption structure.

We first show using survey data from the World Bank that African economies are characterized by a strong heterogeneity of consumption baskets, both in terms of share of food in total consumption (which ranges from 14% in South Africa to 71% in Burundi), and in terms of structure of food consumption between types of cereals and vegetable oils. We then document both a large heterogeneity and correlations of commodity prices, both within and across categories.

Our empirical strategy takes stock of these stylized facts. It builds upon a flexible framework, that takes into account each commodity separately, and that is agnostic about the weight of each of these commodities in consumption baskets. More specifically, we implement local projections (Jordà, 2005) on panel data, regressing the variations of consumer price indices from 0 to 18 months on the monthly price variations of 17 commodities among cereals (wheat, rice, maize, soybeans, groundnut), vegetable oils (palm oil, sunflower oil, rapeseed oil), energy (coal, crude oil, natural gas), fertilizers (DAP, TSP, urea, potash, phosphate), and sugar. We use data between 2002m02 and 2021m04, and control for intensities of natural disasters (using EM-DAT data) and conflicts (using ACLED data), local currency/USD exchange rates and monetary policy rates. Observations are weighted by the GDP at purchasing power parity in 2021. The maximum estimated pass-through reaches 24%, and the long-run pass-through at 18 months is about 20%. We show that, when we use aggregate commodity prices, thus reproducing the typical framework of existing estimates, we obtain a pass-through close to the latter, ranging between 10% and 15%. This suggests that using aggregate commodity prices entails downward biases in estimated effects.

We also document that the results are robust to alternative specifications, to using different sources of variables or types of controls, and that the pass-through are statistically significant both for positive and negative commodity price shocks (even though the shapes of the cumulated prices responses are slightly different, with higher maximum pass-through for positive shocks). Our baseline results are therefore not driven only by positive or negative shocks.

In a last exercise, we carry out regressions country by country, in order to correlate the pass-through with observed country characteristics. We find a large heterogeneity of pass-through between the 48 countries we study, with averages over 18 months ranging between about 0 and 100%. Lower pass-through are observed for net oil exporters, as well as for countries with higher GDP per capita, better transport infrastructure, higher energy subsidies and a more independent central bank (as measured by Romelli, 2022, and especially in flexible exchange rate regimes). On the contrary, higher pass-through are observed for countries with a higher share of food and energy in the consumption basket and with a higher share of taxes on goods and services in government revenue. Finally, commodity-wise pass-through are positively correlated with the share of respective goods in the consumption basket.

Download the PDF version of this document

- Published on 02/08/2023

- 47 pages

- EN

- PDF (1.42 MB)

Updated on: 02/08/2023 11:08