Working Paper Series no. 903: Macroeconomic Forecasting Using Filtered Signals from a Stock Market Cross Section

Stock prices declined abruptly in the wake of the Covid-19, reflecting both the deterioration of investors’ expectations of economic activity as well as the surge in risk aversion. In the following months, however, economic activity remained sluggish while equity markets bounced back. This disconnect between equity values and macro-variables can be partially explained by other factors, namely the decline in risk-free interest rates, and -for the US- the strong profitability of the IT sector. As a result, an econometrician forecasting economic activity with aggregate stock market variables during the Covid-crisis is likely to get poor results. Our main contribution is thus to rely on sectorally disaggregated equity variables within a factor model in order to predict US economic activity. We find, first, that the factor model better predicts future economic activity compared to aggregate equity variables, or to conventional benchmarks used in the literature, both in-sample and out-of-sample. Second, we show that the strong performance of the factor model comes from the fact that it filters out the “expected returns” component of the sectoral equity variables as well as the foreign component of aggregate future cash flows. The constructed factor overweights upstream and “value” sectors that are found to be closely linked to the future state of the business cycle.

After the Covid shock in March 2020, aggregate stock prices declined abruptly, reflecting both the deterioration of expectations of future economic activity as well as the surge in risk aversion. In the following months, however, and to the surprise of many, whereas economic activity remained sluggish, equity markets bounced back sharply. As a result, an econometrician forecasting economic activity with aggregate stock variables during the Covid-crisis would likely have obtained poor results.

The idea of this paper is to rely, within a factor model, on sectoral stock variables to predict future Industrial Production (IP) growth in the US. Surprisingly enough, whereas disaggregated equity data is easily available without lags, to our knowledge the literature on factor models rarely relies on sectoral stock data, and never estimated specifically a factor out of sectoral equity variables only. This paper constitutes thus the first application of a factor model to extract the predictive content from these sectoral equity variables.

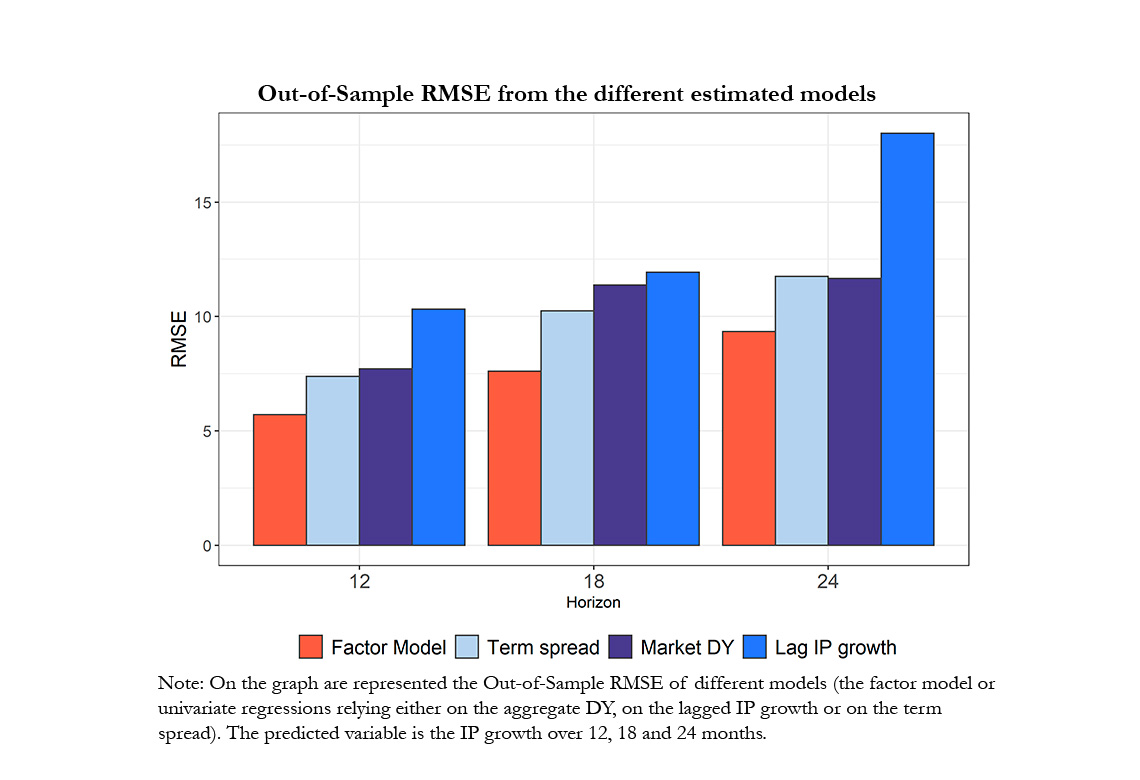

On the result side, we find first that our factor based on sectoral dividend yields (DYs) better predicts IP growth, as compared to the same variable measured as an aggregate and to other conventional benchmark models (both in-sample and out-of-sample, and at various horizons, see Graph below).

Second, we show that our model improves forecasting accuracy because it filters out the noisy components of equity variables, namely the expected returns/discount rate component, as well as the foreign component of aggregate future cash flows.

Third, we are able to identify the sectors that provide additional forecasting power. Specifically, we find that our factor model overweights upstream sectors (primary industry and other industrial inputs) and “value” sectors, as the latter are found to be closely linked to the US business cycle.

To conclude, we find that the factor model is better able to forecast IP, and particularly so during periods of negative growth. As a consequence, our model has greater precision exactly at times of economic stress. For practioners (policymakers or central bankers for example) this attribute is of particular importance given that these periods are often characterized by elevated macro-uncertainty and the need for reliable business cycle predictions.

Download the PDF version of this document

- Published on 12/29/2022

- 32 pages

- EN

- PDF (1.98 MB)

Updated on: 12/29/2022 10:27