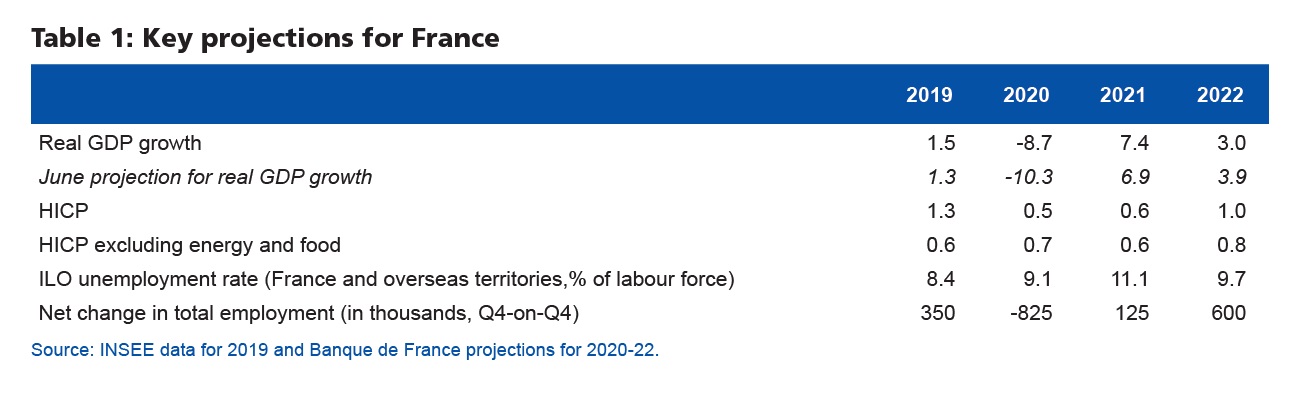

Economic projections Macroeconomic projections – September 2020

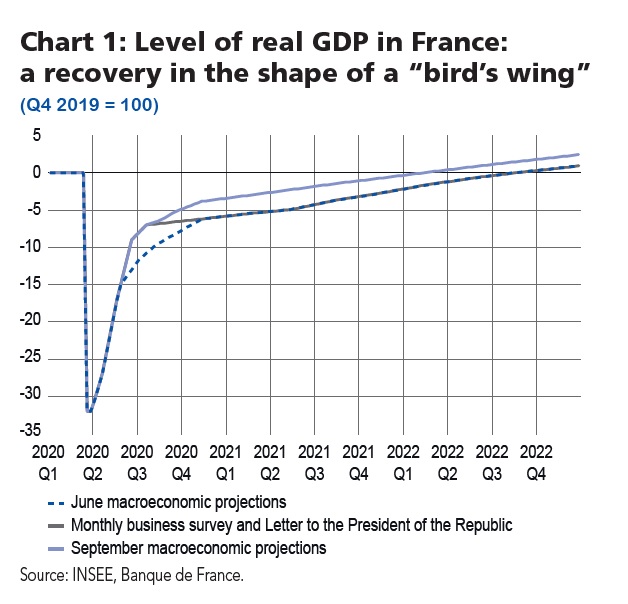

French GDP is projected to contract by 8.7% in 2020. After the steep drop in output in the second quarter and sharp rebound in the third quarter, the recovery is now expected to become more gradual, following a trajectory in the shape of a “bird’s wing” in 2020-22. Activity should return to its end-2019 level at the start of 2022, with GDP rising by 7.4% in 2021 and by 3.0% in 2022. This projection is slightly more favourable than in June, due both to a weaker than expected shock in the second quarter and to the fact that business surveys in recent months point to a stronger rebound. The deterioration in the labour market is thus projected to be slightly less severe, albeit still significant, with the total number of jobs expected to be down by some 800,000 at end-2020 compared with a year earlier. In contrast, in 2021 and 2022, over 700,000 net jobs are projected to be created. This new baseline scenario nonetheless remains subject to significant risks, especially given the continuing uncertainties over the evolution of the public health situation.

After a historic decline in 2020, activity should rebound sharply, reaching its end-2019 level at the start of 2022

The revision to activity in 2020 is driven by private domestic demand – consumption and investment – which proved more resilient than expected in the second quarter of the year. Short-term indicators also suggest that private consumption will continue to rebound in the second half, coming back to a level close to that seen at end-2019. The household saving ratio should therefore decline markedly in the second half of 2020 (after peaking at 27.4% in the second quarter), before normalising over the course of 2021. That said, the “forced” savings accumulated during the lockdown in the first half are not expected to be consumed. The amount of additional savings accumulated in 2020 could therefore be lower than the EUR 100 billion we estimated in June. In addition, the steep drop in government consumption in the second quarter means we now expect it to rebound sharply in the second half of the year. On the other hand, net trade is expected to make a marked negative contribution to growth in 2020 owing to the weakness in exports.

This upward revision to our projection should not disguise the fact that the virus is continuing to circulate and to weigh on economic activity. However, we have not factored any further deterioration in the situation into our baseline scenario, and are still including this eventuality among our downside risks (see below). Our projection assumes that the protective measures against the virus will remain targeted, and that businesses will continue to adapt.

On this basis, 2021 and 2022 should see a marked yet gradual recovery, with activity now expected to return to its end-2019 level in the first quarter of 2022, and not in mid-2022 as initially projected in June. As a result of the sharper than expected rebound at end-2020, annual growth for 2021 has been revised slightly upwards to 7.4% from 6.9%. For 2022 the figure has been revised slightly downwards to 3.0% from 3.9%, as the stronger rebound in 2020 and 2021 reduces the catch-up effect in 2022, although growth is still expected to remain above potential.

After experiencing a sharper economic contraction than the euro area as a whole in the first half of 2020, due to its decision to implement one of the tightest lockdowns in the region, France should now see a stronger rebound in the next few quarters. Based on our projections and those of the ECB, French GDP should return to near its end-2019 level earlier than the euro area average (see Chart 2).

This projection remains subject to major risks, both to the upside and downside. First, there are still significant uncertainties over how the health situation will evolve, both in France and the rest of the world. There are also numerous risks to the international environment, in particular the threat of a no-deal Brexit. On a domestic level, the stimulus plan announced by the government on 3 September is expected to support activity, but we still need to evaluate by how much and over which period. Indeed, this projection only takes into account a small part of the package announced on 3 September, as the full terms and timing of the measures need to be set out in the forthcoming budget law. Some measures that positively affect growth have already been taken into account in our forecasts (such as the extension of the short-time work scheme, some of the measures to boost youth employment, and some of those included in the Ségur healthcare spending plan). On the downside, the plunge in exports in certain sectors (e.g. tourism, aeronautics) could place a more lasting drag on economic activity. The drop in business investment in the first half was much smaller than expected, albeit still significant (–8.9% in the first quarter followed by –13.6% in the second quarter), and this projection assumes that the corporate investment ratio will decline slightly, while still remaining high over the coming quarters. However, we still cannot rule out the possibility of an even bigger slump in investment spending as businesses encounter financial difficulties and higher capital requirements.

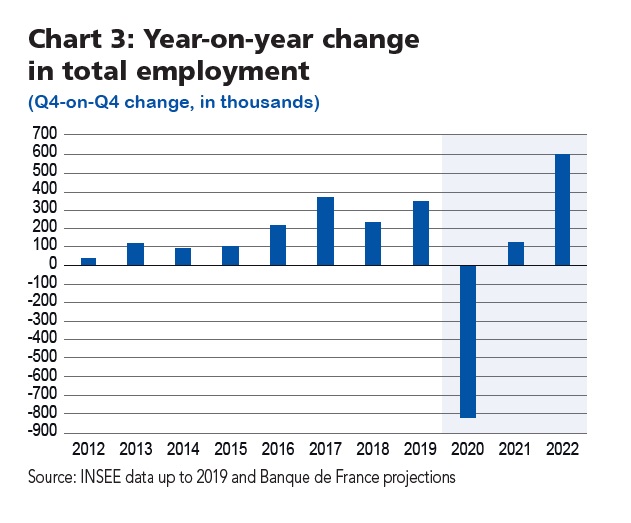

Total employment is expected to bottom out in the first half of 2021

With businesses making significant use of the short-time work scheme, the adjustment of employment to the activity shock remained relatively contained in the first half, and the majority of job destructions stemmed from adjustments in temporary labour and the non-renewal of short-term contracts. At the end of 2020/start of 2021, however, employment should continue to decline, lagging behind activity, as struggling businesses start to make more permanent job cuts. Net job losses are expected to total more than 800,000 across the entire economy at end-2020 compared with end-2019 (see Chart 3). This projection is slightly less unfavourable than in June, reflecting the smaller than expected contraction in activity, especially in the market sector. Total employment should begin to improve over 2021, and is projected to rise by a little over 700,000 in 2021 and 2022.

After the decline (described as “deceptive” by INSEE) in the ILO measure of unemployment during the lockdown, the jobless rate could rebound to a peak of around 11% in the first half of 2021, assuming the labour force returns to its usual levels. It is then expected to fall back below 10% in 2022. This unemployment forecast nonetheless remains highly uncertain, owing to measurement difficulties in the current context and to difficulties in forecasting how the labour force will adjust. However, unemployment should return to a trajectory more in line with employment.

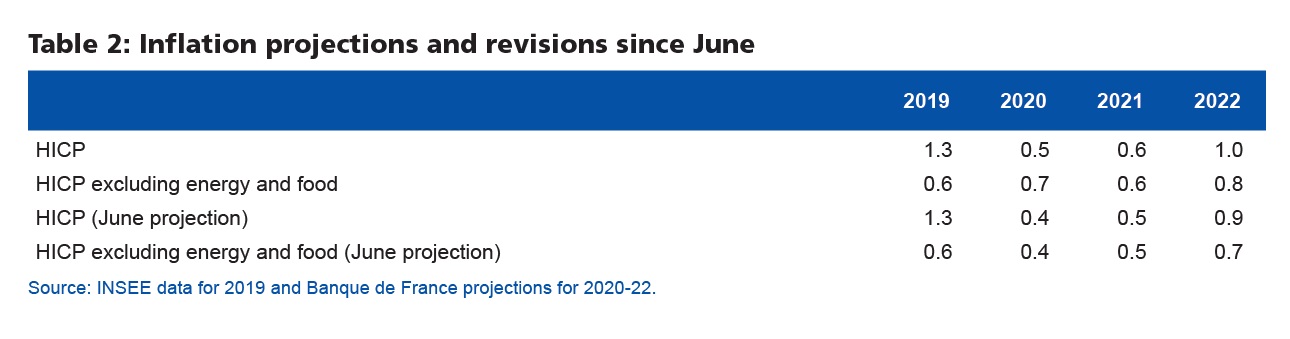

Inflation should remain weak over the entire projection horizon

The price of oil has recovered markedly since our June projections, and is now expected to average USD 43 per barrel in 2020 (based on futures prices for the end of the year), which is nearly USD 19 higher than our June assumption. Nonetheless, it is still more than USD 20 lower than in 2019, which is a significant decline. As a result, the year-on-year change in energy prices (–9.6% in the second quarter of 2020) is anticipated to remain firmly negative up until the end of 2020, before turning slightly positive (with an oil price of around USD 49 per barrel in 2022). In addition, the euro effective exchange rate appreciated again in the third quarter of 2020 and is now more than 5% higher than a year ago, which also has a downward impact on future inflation (as exchange rates are set at their last known level in our assumptions). These changes, especially the sharp drop in the oil price in 2020, should impact the path of headline inflation.

Annual HICP inflation is expected to bottom out at around 0.1% at the end of 2020, reflecting the fall in energy prices. It should then pick up again over the projection horizon, while still remaining weak, reaching an average of just 1% in 2022 (see Chart 4). Inflation has nonetheless been revised up slightly compared with our June 2020 publication (see Table 2), reflecting, on the one hand, the slightly smaller than expected fall in inflation in the second quarter of 2020, and, on the other, our forecast of a less severe deterioration in the domestic macroeconomic environment.

Services inflation indeed proved less sluggish than expected in the second quarter due to one-off rises in certain sectors, notably hairdressers, vehicle repair and food services. However, these appear to reflect firms passing on additional costs linked to the health crisis, rather than any new and lasting price trend. As a result, HICP excluding energy and food has been revised up slightly for 2020. But beyond this timeframe, underlying inflation is expected to remain weak and has only been revised up slightly due to a lower unemployment rate than predicted in June.

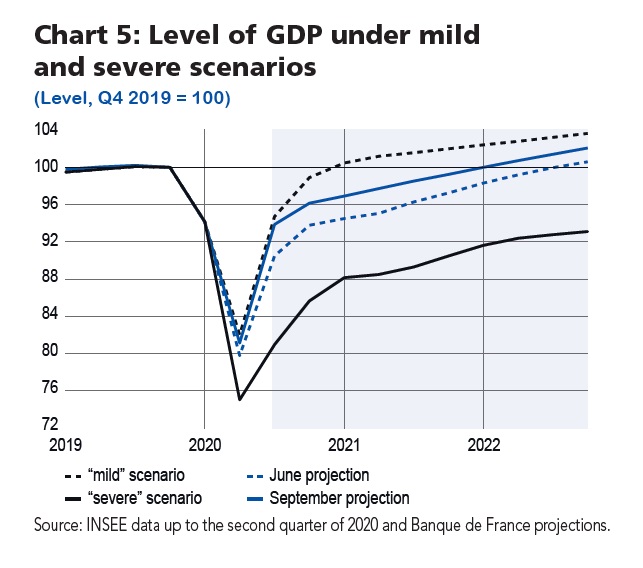

This baseline scenario is still framed by two alternative scenarios, one “mild” and the other “severe”

In our June macroeconomic projections for 2020-22, we presented two alternative scenarios to our baseline projection, illustrating the high degree of uncertainty surrounding projection exercises in the current exceptional circumstances. These scenarios still frame our September projection. Under the “mild” scenario where the epidemic is brought under control, activity is seen returning to pre-crisis levels by as early as end-2020, and the fall in GDP is limited to 7% in 2020, followed by a marked rebound in 2021 (+10%). Under the “severe” scenario, however, where the circulation of the virus intensifies, leading potentially to stricter health and economic restrictions, activity remains well below pre-crisis levels over the entire projection horizon, with GDP falling by 16% in 2020 and then rebounding by a fairly modest 6% in 2021 owing to the scale of the economic shock.

Compared with our June forecast, our September projection is now closer to the mild scenario in the short term, but remains well below it over the longer term (see Chart 5). This is because the catch-up in activity observed so far and anticipated for the near term is faster than we expected in June; however, in the longer term, the continuing circulation of Covid-19 will prevent GDP from reaching our mild scenario levels. In addition, we still cannot rule out the possibility that a stronger resurgence of the virus and an increase in health and economic uncertainties could push activity towards our severe scenario.

Download the PDF version of this document

- Published on 09/18/2020

- FR

- PDF (316.76 KB)

Updated on: 09/18/2020 15:43