Banque de France Bulletin no. 227: Article 1 France’s national wealth in 2018: Weaker growth in household wealth due to the fall in equity prices

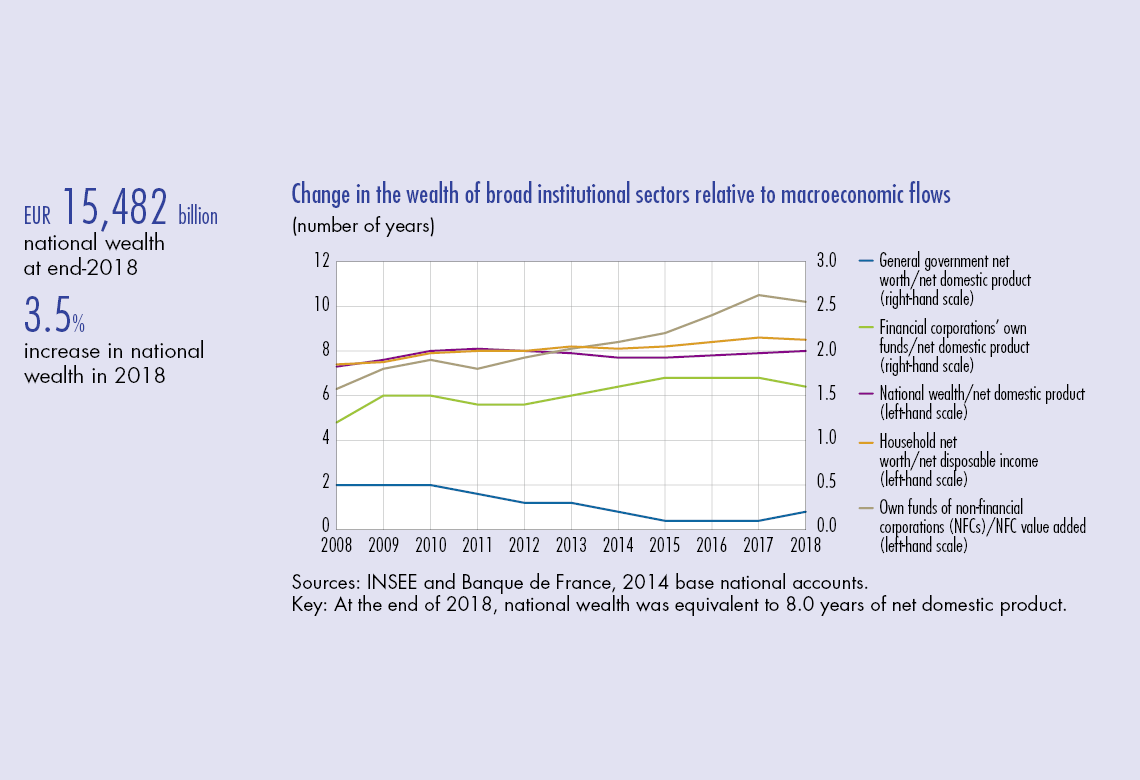

France’s national wealth continued to expand in 2018, reaching EUR 15,482 billion at the end of the year or 8.0 times its net domestic product. The rise was driven by non-financial wealth and especially land underlying buildings and structures. However, the rate of growth was more subdued than in the previous year, at 3.5% compared with 4.6%.

Household net worth rose to EUR 11,735 billion. The increase was markedly smaller than in the previous year (at 1.6% versus 4.7% in 2017), due to the temporary downturn in equity prices at the end of 2018. For the same reason, non-financial corporations’ own funds were little-changed at end-2018, showing an increase of just 0.3% at EUR 9,945 billion. Financial corporations’ net worth recovered to EUR 722 billion, with the rise stemming essentially from a rebound in financial net worth. General government net worth rose by 7.6% to EUR 303 billion at end-2018, from EUR 282 billion a year earlier.

At the end of 2018, France’s national wealth (or net worth; see definition in Box 3) amounted to EUR 15,482 billion, the highest level seen since 2012 and equivalent to 8.0 times France’s net domestic product for the year (see Chart 1 and Box 1). National wealth increased again in 2018, but at a more subdued rate than in 2017 (3.5% versus 4.6% previously – see Table 1). The rise was essentially fuelled by non-financial wealth (growth of 4.2%), and in particular by land underlying buildings and structures (growth of 5.5%).

Growth in financial assets and liabilities (see definition in Box 3) decelerated markedly in 2018 (1.2% and 1.6% growth respectively after rises of 7.7% for both assets and liabilities in 2017). With financial assets growing to a lesser extent than liabilities, France’s financial net worth declined sharply to EUR 7 billion, down from EUR 96 billion in 2017.

1. Household wealth suffered from the steep fall in equity prices

At the end of 2018, household net worth (see definition in Box 3) was little-changed, showing growth of just 1.6% compared with 4.7% in 2017 (see Table 2). At EUR 11,735 billion, the figure was 8.5 times the level of household net disposable income (see Chart 1). Household financial net worth fell for the first time since 2008 (decline of 2.7% in 2018 after growth of 4.9% a year earlier). On the financial assets side, households continued to favour bank savings products. Currency and deposit holdings grew at almost the same pace as in 2017 (4.5% rise after 4.6% previously), buoyed by stronger inflows into passbook savings and overnight deposits in a low interest rate environment. Holdings of equities and investment fund shares fell by 5.4% after 9.4% growth in 2017. Equity holdings in particular fell by 9.3% over the year, due to the sharp drop in stock market prices: between 31 December 2017 and 31 December 2018, when the stock market hit a low, the SBF 120 index shed 11.7% (compared with growth of 10.8% in 2017). In addition, households were net sellers of equities and investment fund shares over the year. Household life insurance holdings (which make up 35% of their total financial assets) also declined by 1.3% (after 1.4% growth in 2017) due to negative valuation effects. In total, household financial assets fell by 1.0% in 2018 after rising by 5.3% the previous year.

On the liabilities side, …

Download the PDF version of this document

- Published on 02/18/2020

- EN

- PDF (296.28 KB)

Bulletin Banque de France 227

Updated on: 02/18/2020 09:38