Working Paper Series no. 654: SMEs’ financing: Divergence across Euro area countries?

This paper studies the divergence/convergence process of European countries as regard the financing behavior of small and medium sized enterprises. Using a firm level and country representative survey, we construct country-time indicators of SMEs’ use of three external financing sources: bank loans, credit line/overdraft and trade credit. These indicators account for composition effects and demand effects. We find substantial differences between countries in the SMEs’ use of the three financing sources. In particular, the cross-country differences related to SMEs’ use of bank loans have significantly increased over the period 2010-2014. This divergence is not related to a global increase in the volatility of this use between countries. Instead, it has been driven by a sharper increase (resp decrease) in the countries where SMEs’ use was initially higher (resp. lower). Finally, we investigate whether SMEs’ uses of financing sources are correlated at the country level with various macroeconomic and banking structure indicators. The results suggest that indicators about banking concentration are good candidates to explain the cross-country divergence of SMEs’ use of bank loans.

We address the following questions: How does the use of external financing sources, banking ones (bank loans, credit lines/overdraft) and trade credit, by SMEs vary across Euro area countries? Are there country specific factors that explain cross-country differences in addition to the demand for external finances and to firms’ characteristics? How do these country specific factors vary over time? We propose an original empirical approach, taking advantage from the firm level and country representative Survey on Access to Finance by Enterprises (SAFE) conducted by the European Central Bank. We construct comparable country-time indicators of SMEs’ propensities to use external financing sources and analyze the evolution of the variance of these indicators over time. We focus on bank loans, credit lines and bank overdraft and trade credit.

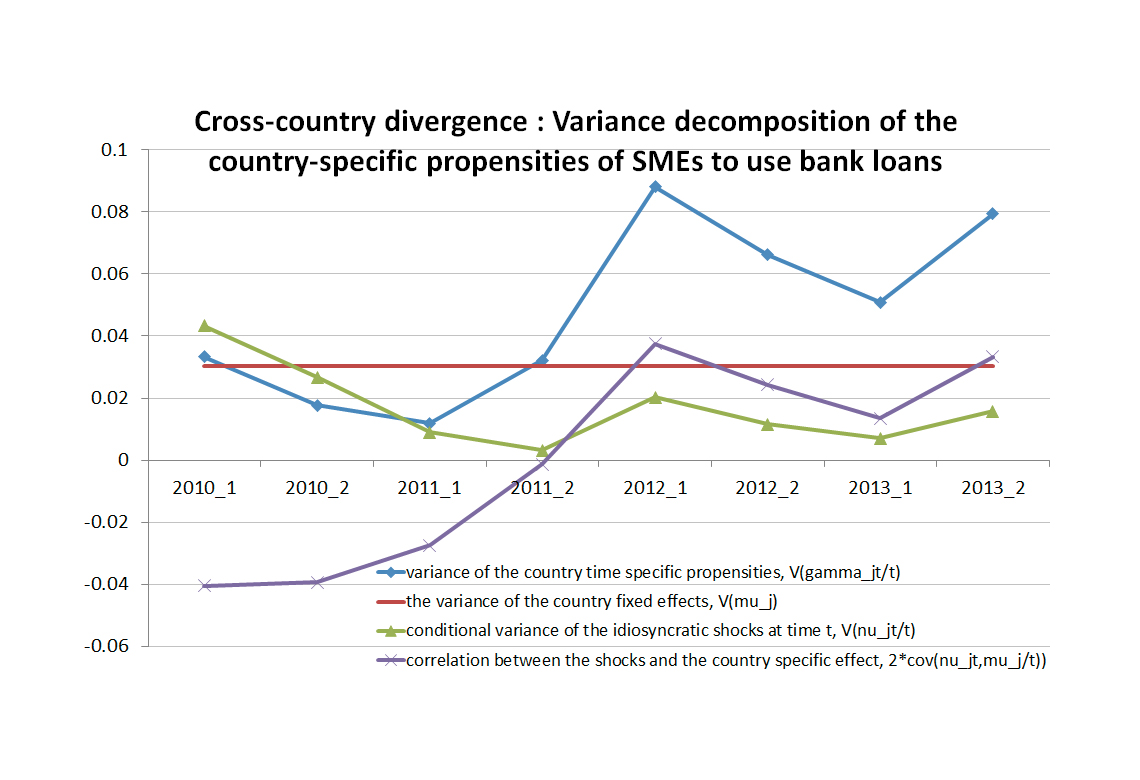

First we build country-time specific propensities to use each source of external finances that control for firm-level characteristics and also for firms’ financing needs. Second, we turn on the assessment of the divergence of SME’s financing conditions across the Euro area countries. To do that, we decompose the estimated country-time propensity into a country fixed effect, a time cross-country effect and idiosyncratic shocks and examine the evolution over time of the variance of the country-time propensities. The conditional variance of the country-time propensity at time t is then the sum of three components: i) the variance of the differences between countries that are constant over time, assessed by the variance of the country fixed effects ii) a measure of the uncertainty faced by countries, assessed by the conditional variance of the idiosyncratic shocks at time t iii) the country-specific dynamics of the idiosyncratic shocks, measured by twice the covariance, conditional on time, between the country fixed effects and the idiosyncratic shocks. Regarding the convergence/divergence across Euro area countries, we find cross-country divergence as regards the use of bank loans by SMEs. The increase in the variance over time is due to the increase in the covariance between idiosyncratic shocks and the time-invariant country specific effect. These results show that country specific factors play a crucial role in explaining the evolution of the euro area cross-country heterogeneity in firms’ financing behaviors. Third, we investigate what could be the underlying economic factors explaining the country-specific propensities of using bank loans. Our results suggest that indicators about banking concentration are good candidates to explain the cross-country divergence of SMEs’ use of bank loans. These results may then be related to the discussions in the literature about the effect of market structure, competition and regulation in the banking sector on SMEs’ access to finance.

Download the PDF version of this document

- Published on 12/12/2017

- 47 pages

- EN

- PDF (3.07 MB)

Updated on: 12/12/2017 17:07