Economic projections Macroeconomic projections – September 2021

- The strength of the recovery in economic activity in France is bearing out in 2021, after the historic fall in 2020. With the rapid expansion of the vaccination campaign, GDP and employment rebounded significantly in the second quarter. This momentum should continue in the third quarter according to our business surveys, and thereafter activity should remain buoyant in the fourth quarter, despite the new variants of the Covid-19 and certain sectoral supply or recruitment difficulties.

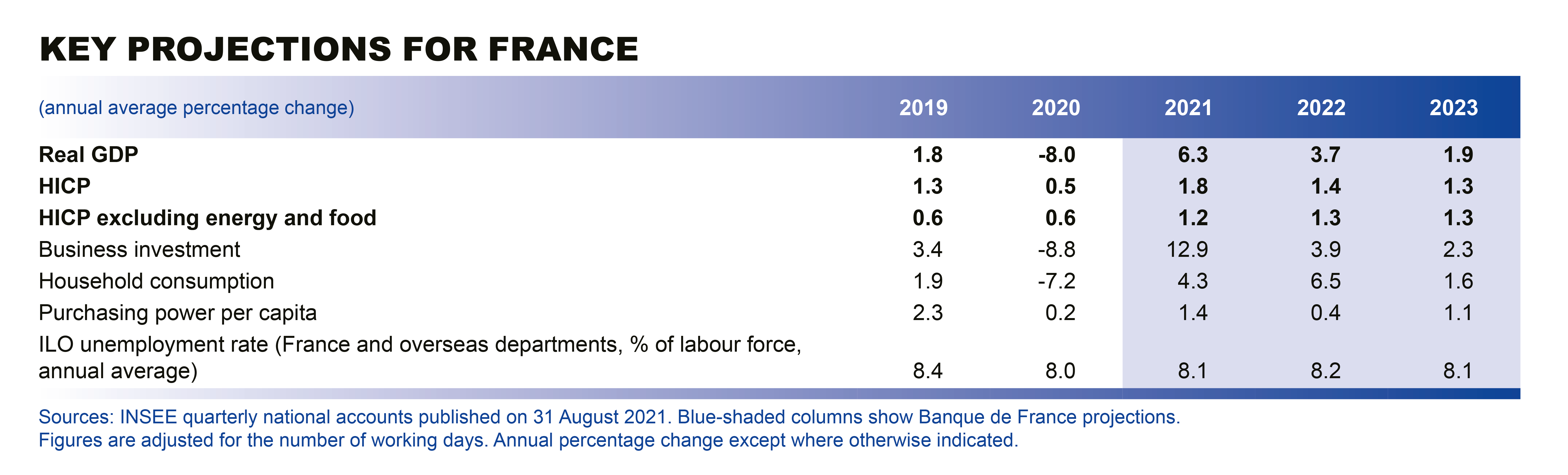

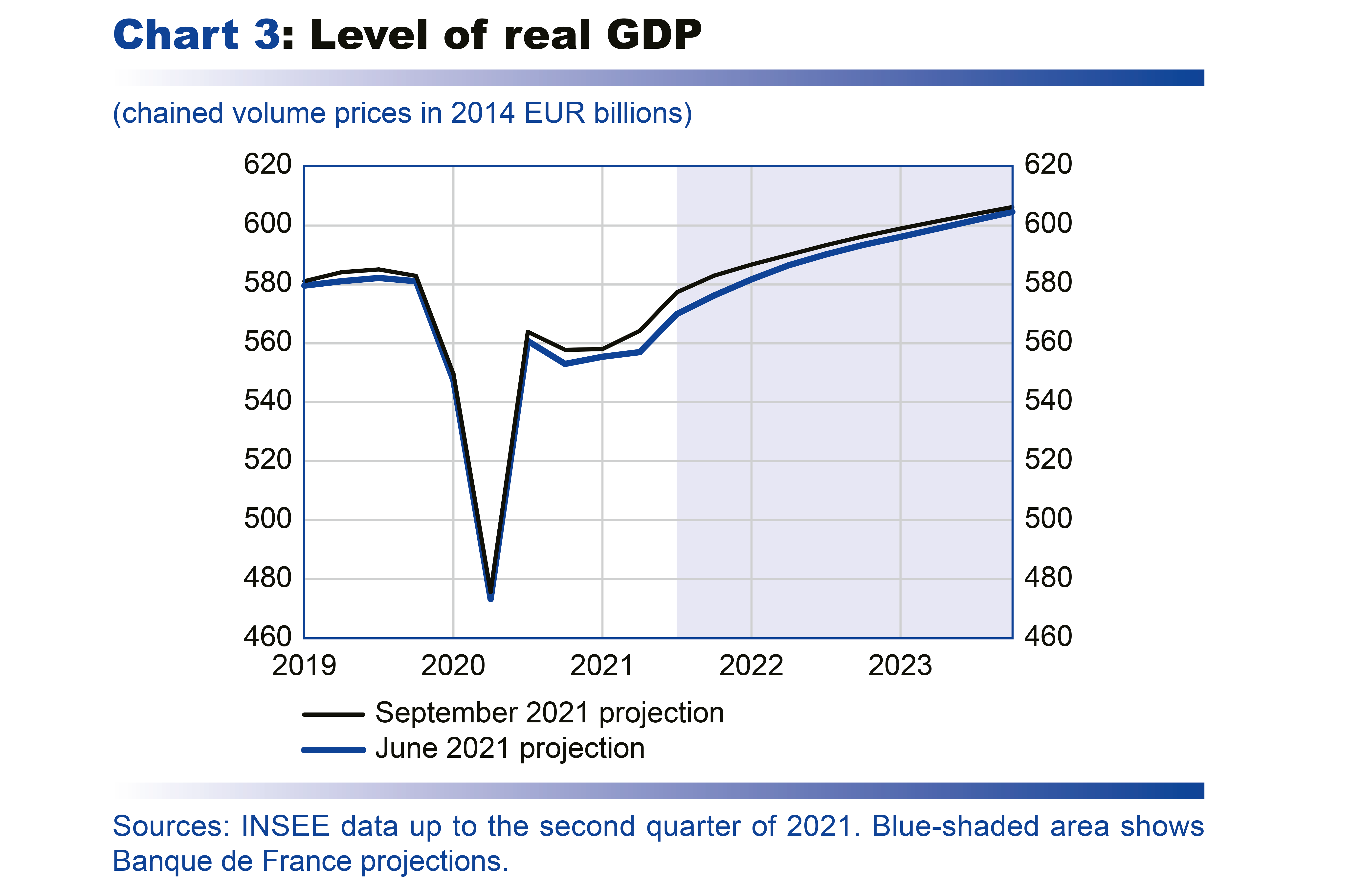

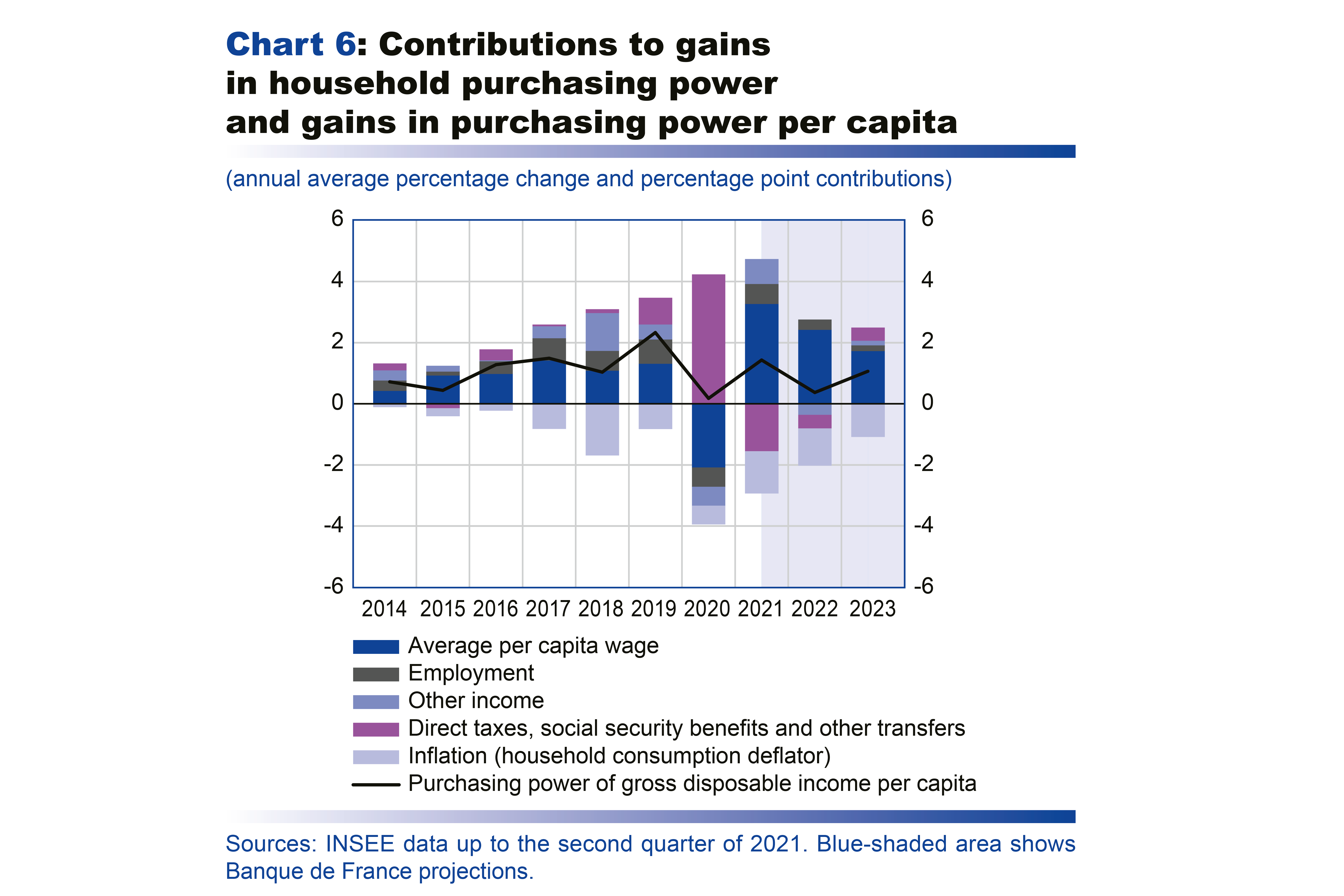

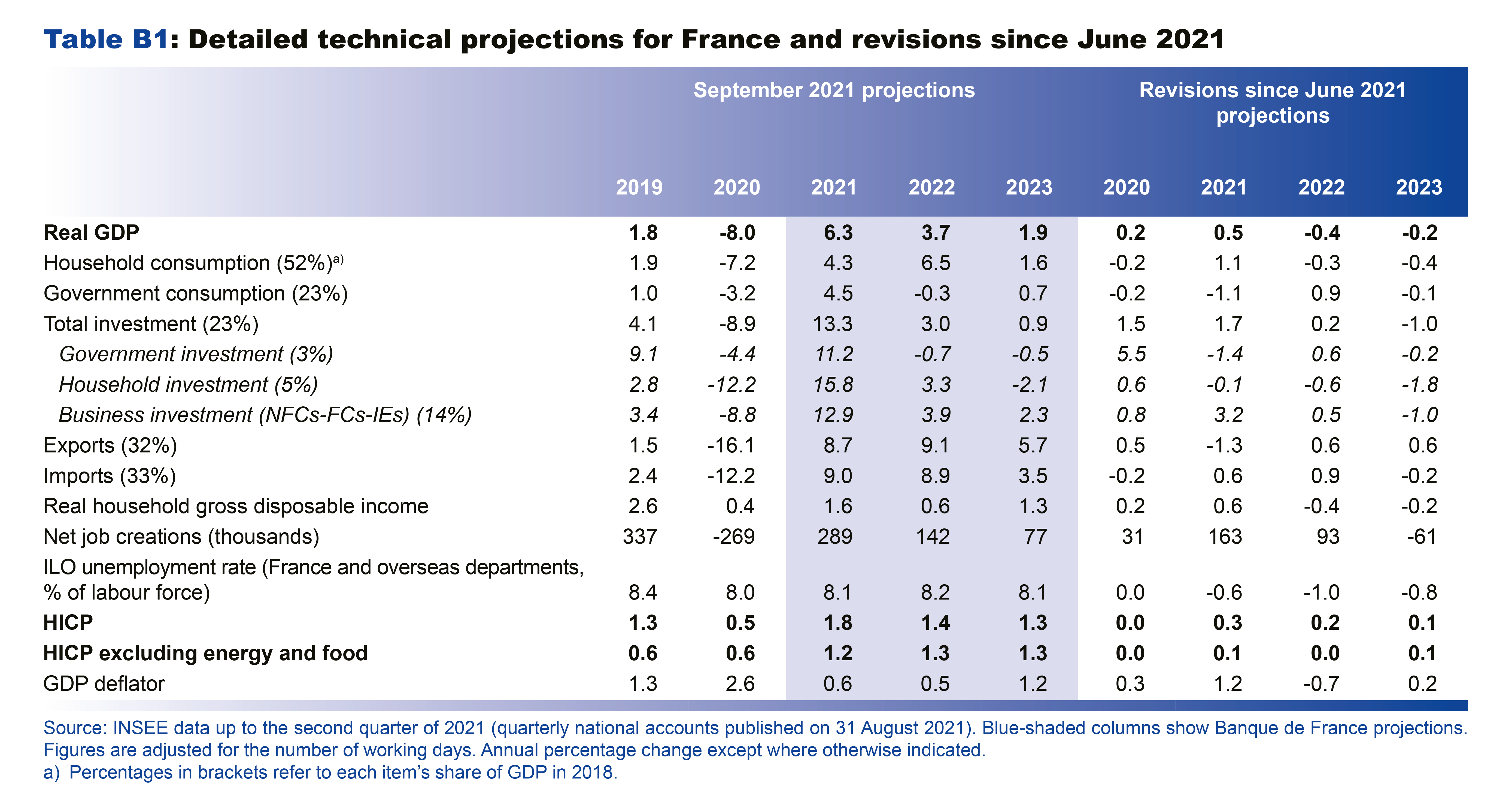

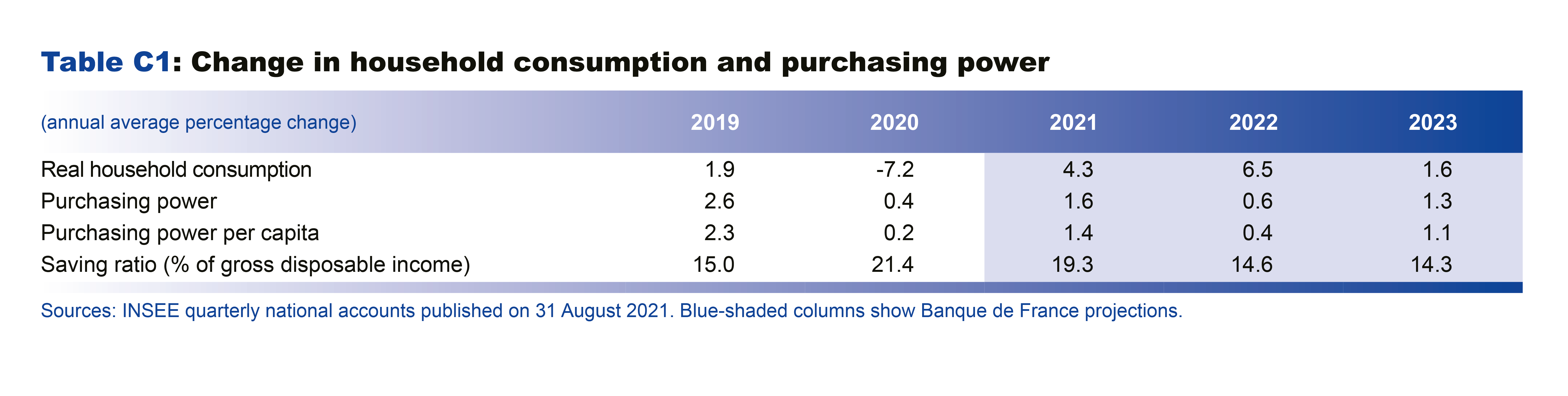

- GDP growth is expected to stand at 6.3% in 2021 as an annual average, and 3.7% in 2022, before returning to just under 2% in 2023. Activity is forecast to return to its pre-Covid level at the end of 2021. The upward revision of our projection for 2021 since June primarily reflects a slightly stronger-than-expected rebound at the end of the first half of the year. After being preserved in 2020 (0.2% on average), household purchasing power is expected to grow by almost 3% cumulatively over 2021-23.

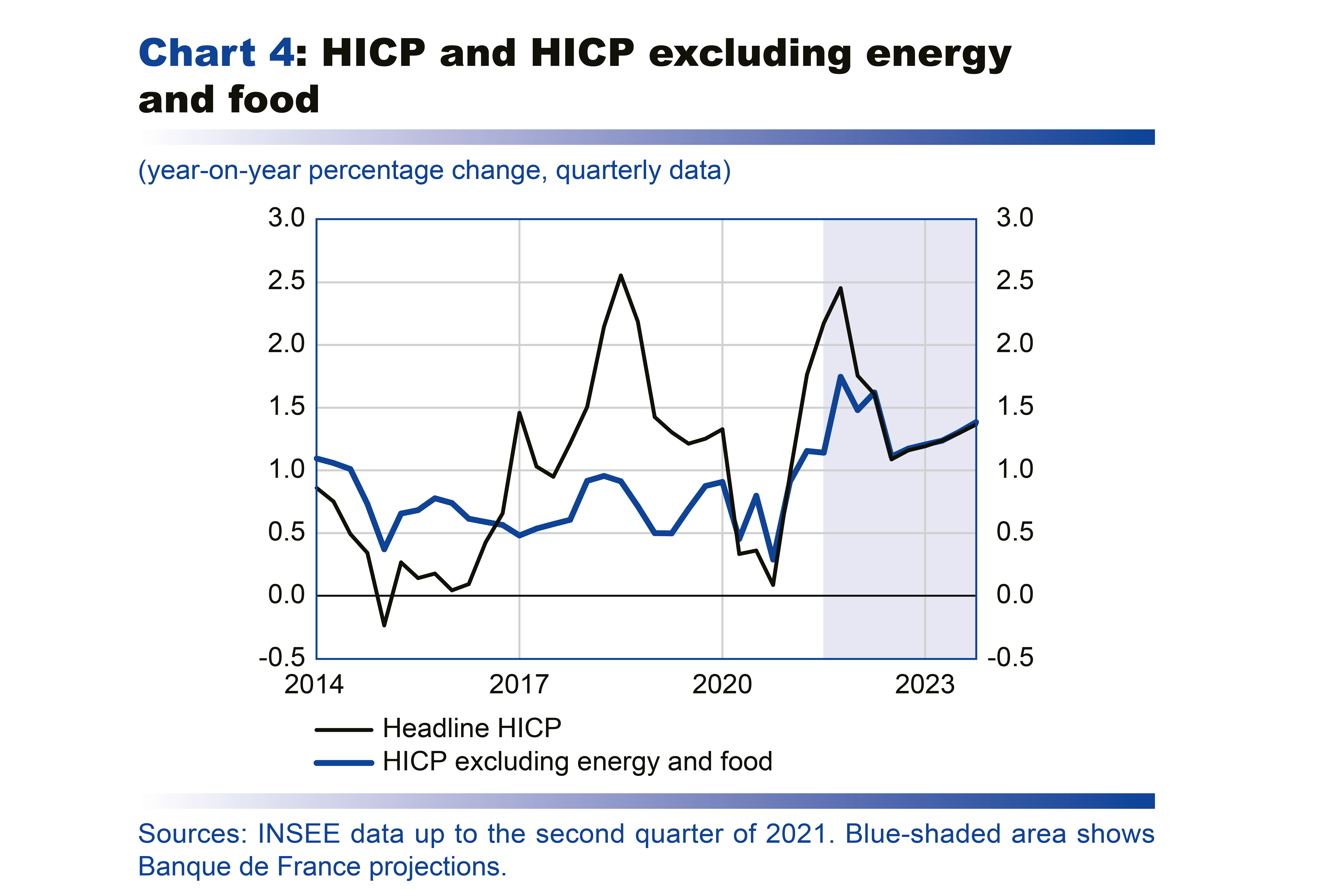

- Headline inflation (HICP) is expected to come in at 1.8% in 2021 (annual average) with more pronounced peaks, meaning that it should remain at over 2% between August and December 2021 (year-on-year). However, this significant upturn, due essentially to the effects of higher input prices for manufactured goods, should remain temporary. Annual average HICP inflation is expected to decrease to 1.4% in 2022 due to the stabilisation of energy prices. In 2023, both headline and underlying inflation are expected to stand at 1.3%. Nevertheless, the risks around this inflation forecast are titled to the upside.

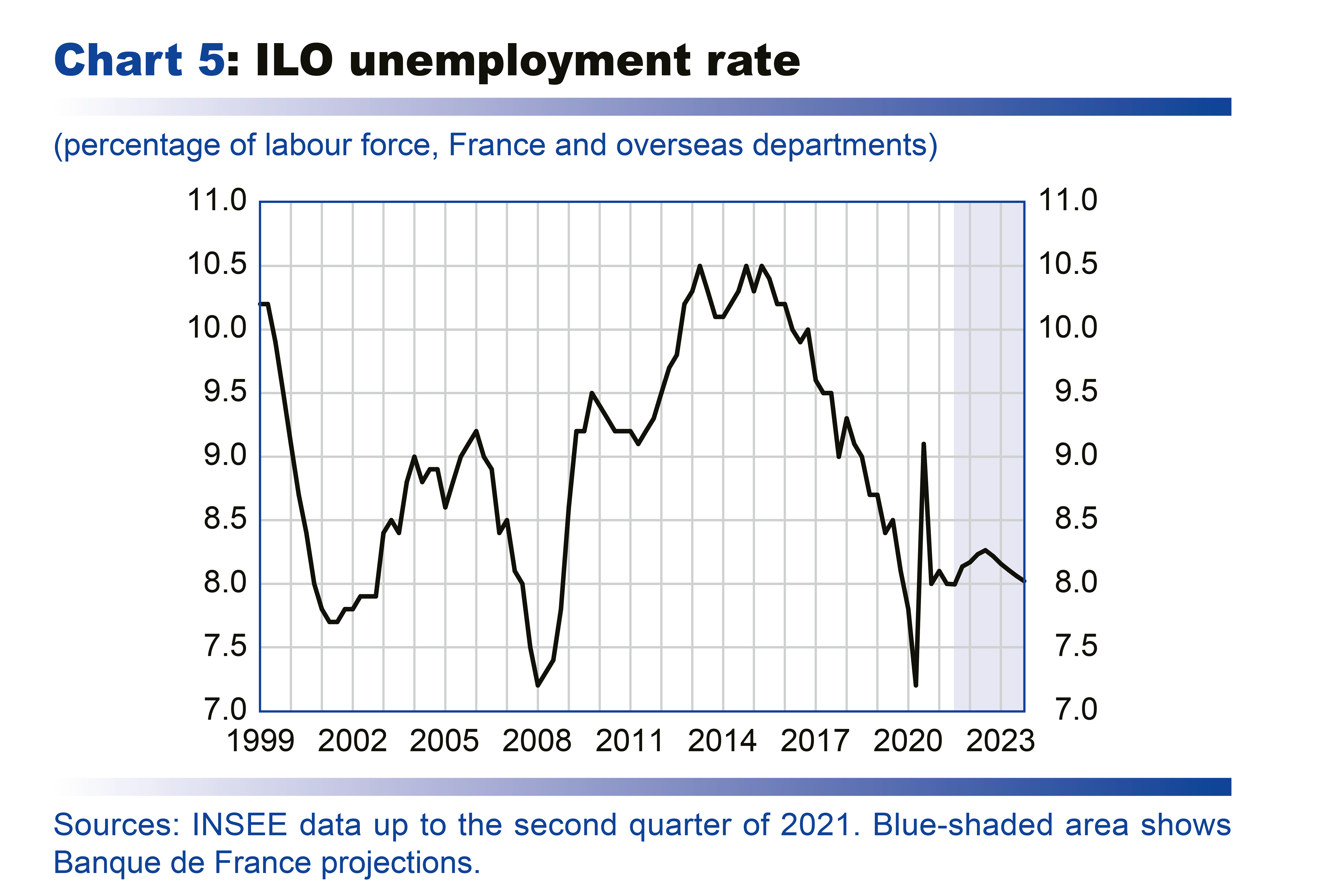

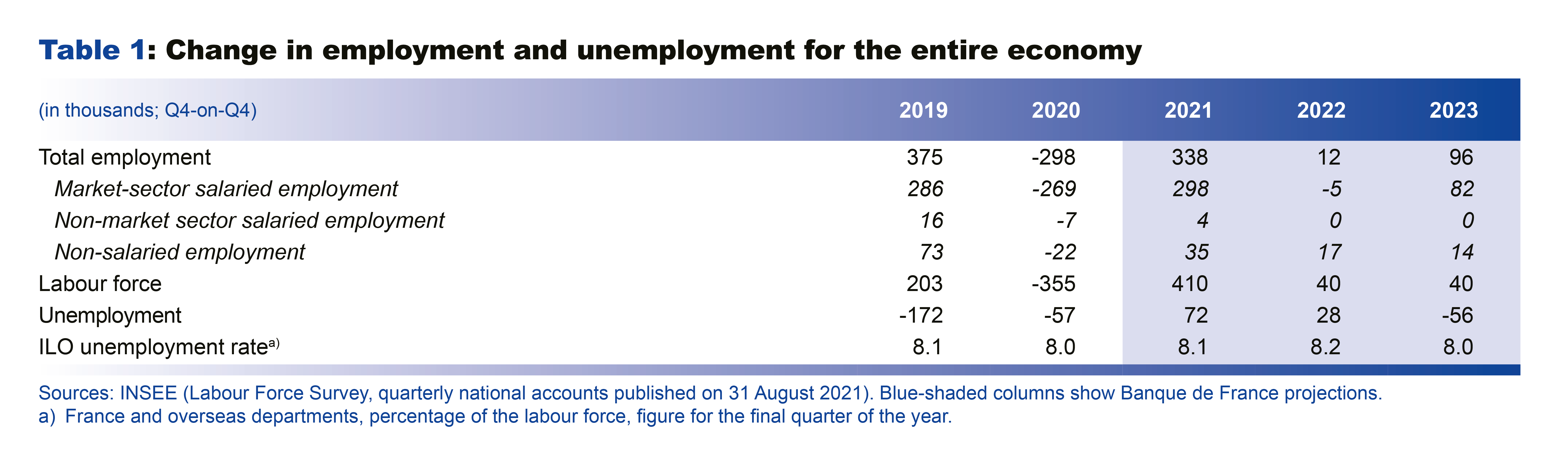

- The resilience of the labour market has proved better than expected, thanks in particular to the support provided by public measures. Salaried employment thus returned to its pre-crisis level in mid-2021, although the number of hours worked per employee remained lower due to the ongoing short-time work arrangement (240,000 in full time equivalent in July). The French economy is now facing its main pre-crisis challenge: major recruitment difficulties (for half of the companies) even though unemployment remains high at 8%.

- The French economy is thus emerging from the Covid crisis and will enter a new phase. After the strong rebound in 2021 resulting from the reopening of the economy and the support measures, GDP will gradually return to its potential level. Conditions should still be favourable at the horizon of this projection (excess household disposable savings, generally preserved financial situation of companies, recovery plan) but will therefore steadily become more dependent on the more structural drivers of growth.

The rebound in economic activity observed in the second quarter of 2021 is expected to continue, driven by strong consumption and investment

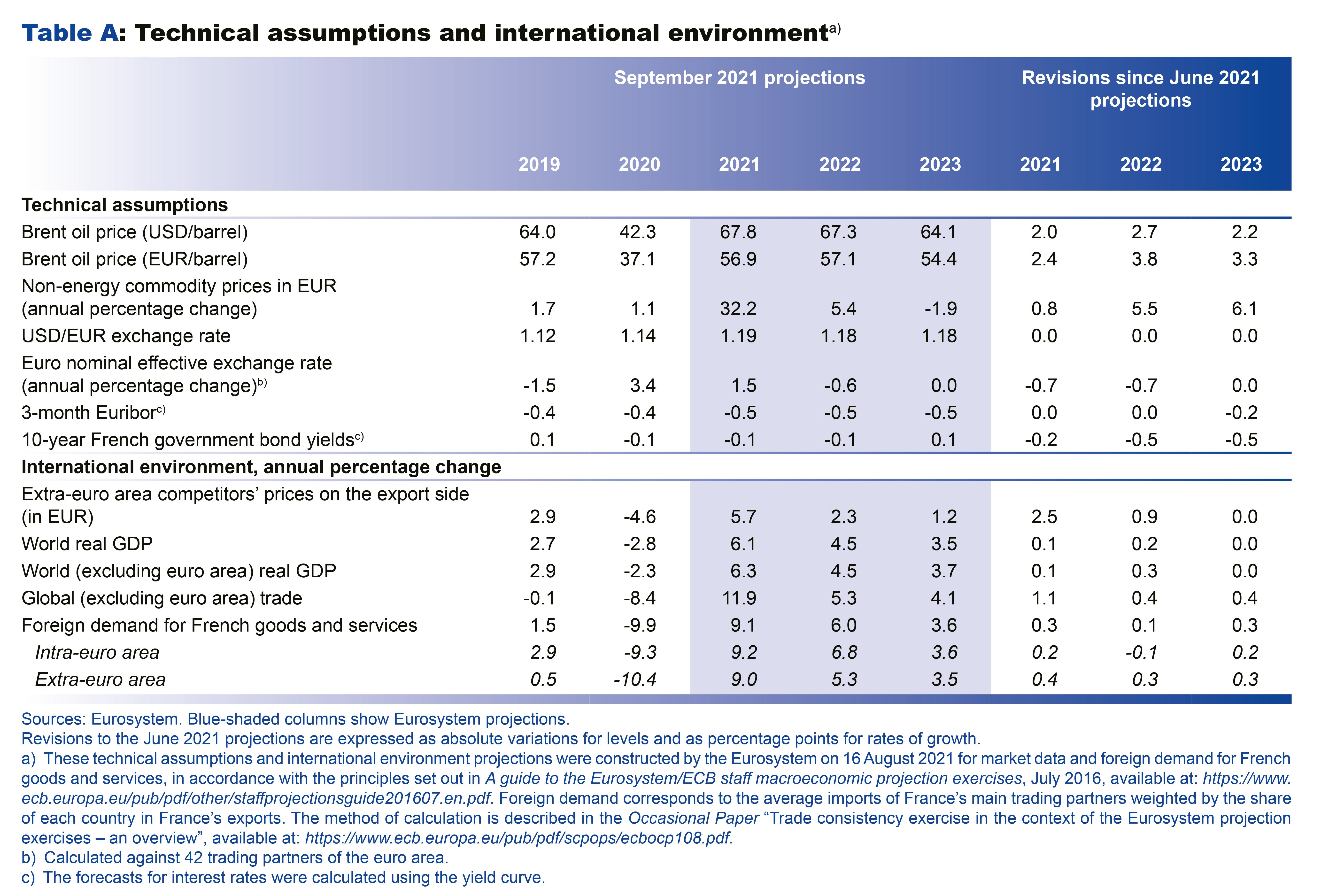

Our economic growth projections for 2021-23 are based on a number of assumptions. They incorporate the second estimate of the national accounts for the second quarter of 2021, which were published by INSEE on 31 August 2021. The assumptions concerning the international and financial environment, for which the cut-off date is 16 August (see Table A in the appendix), are those used in the Eurosystem projections for the entire euro area. These assumptions confirm a strong rebound in foreign demand for French goods and services in 2021 (9.1%, after –9.9% in 2020), which has been slightly revised upwards compared to that of the June projection, even though the sectoral composition of French foreign trade is such that it will not be possible to take full advantage of this rebound for the moment. Moreover, the increase in oil and commodity prices has become even more pronounced since June. The economic outlook in all countries nevertheless remains contingent on the evolution of the pandemic, and on the pace of the vaccination programme which will determine when restrictions are eased. We assume that the vaccination campaign and the effectiveness of the vaccines against variants will allow health restrictions to continue to be eased and their impact on the economy to be limited, both in France and in our main euro area partners in particular.

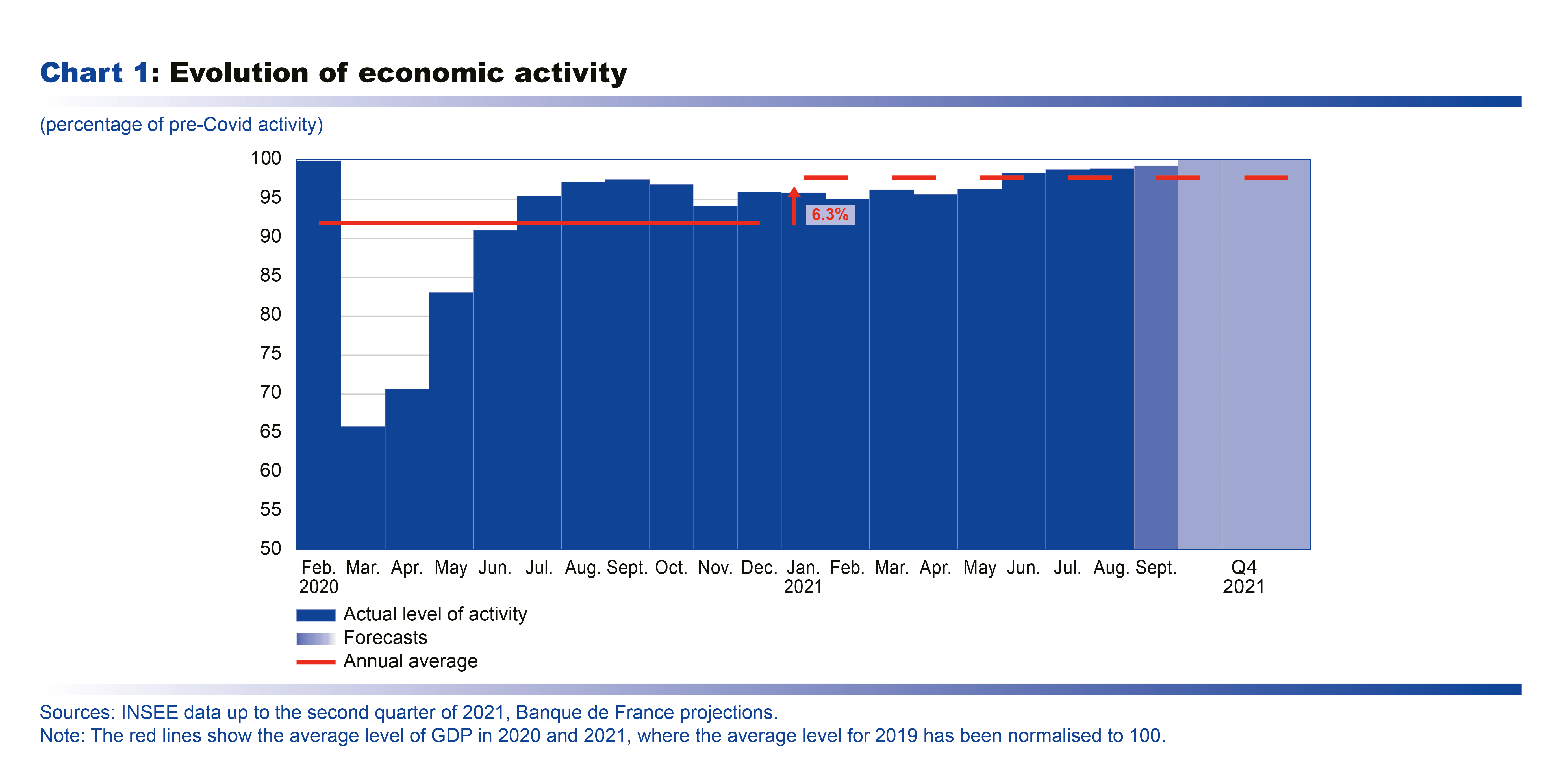

From November 2020 to spring 2021, economic activity in France plateaued (see Chart 1), with some variations associated with the differing severity of health restrictions. Since May 2021 and the acceleration of the vaccination campaign, the rebound has become more pronounced, with a return to a positive GDP growth rate in the second quarter of 2021 (1.1%).

This trend was confirmed in the third quarter, according to the Banque de France's business surveys. The level of economic activity recorded in July should be the highest since the beginning of the health crisis and GDP growth for the third quarter of 2021 as a whole should be strong at between 2% and 2.5%, despite some sectoral supply and recruitment difficulties. Activity should be buoyed by the rise in household consumer spending, as well as by the strength of private investment, by both firms and households.

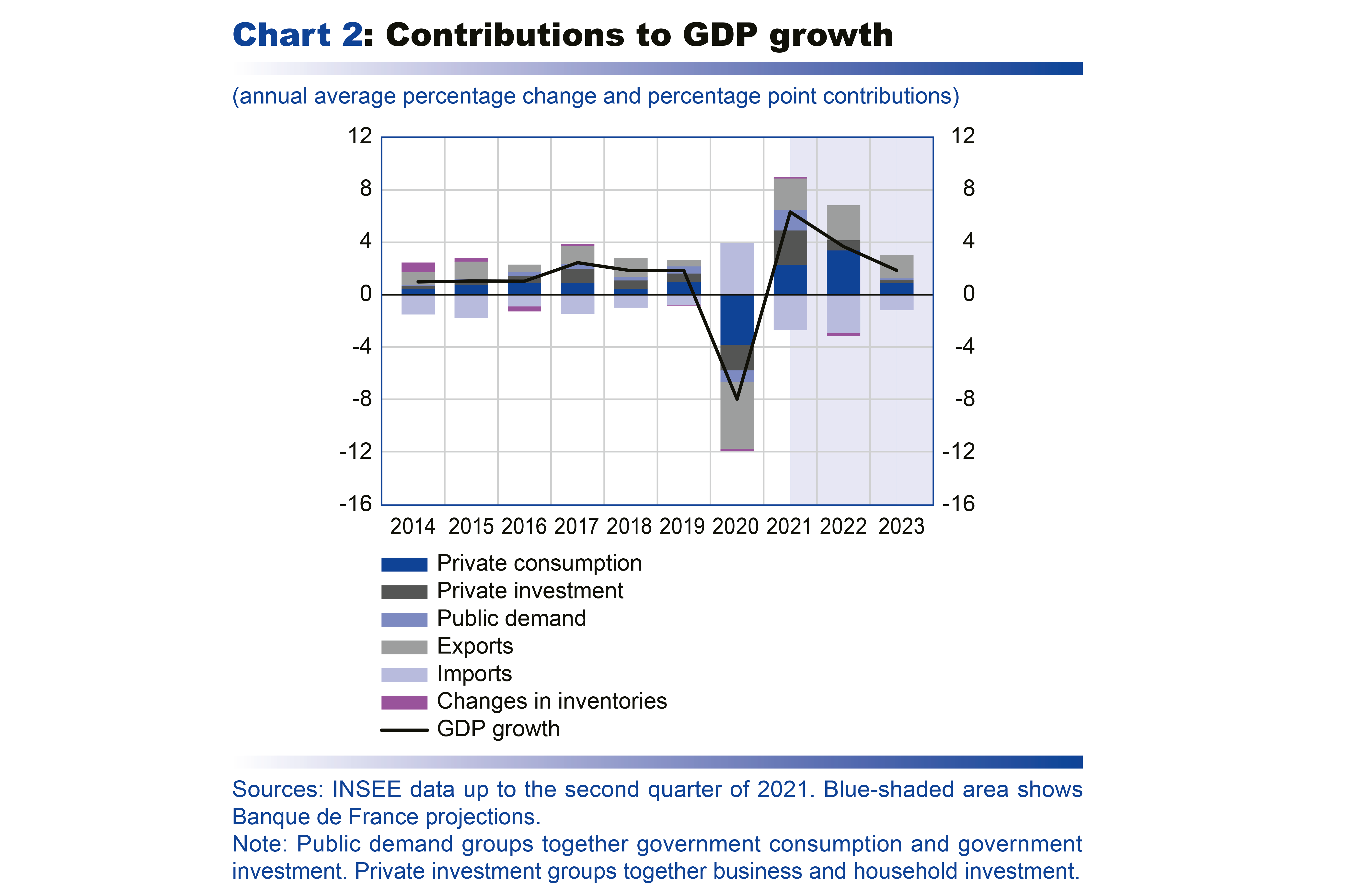

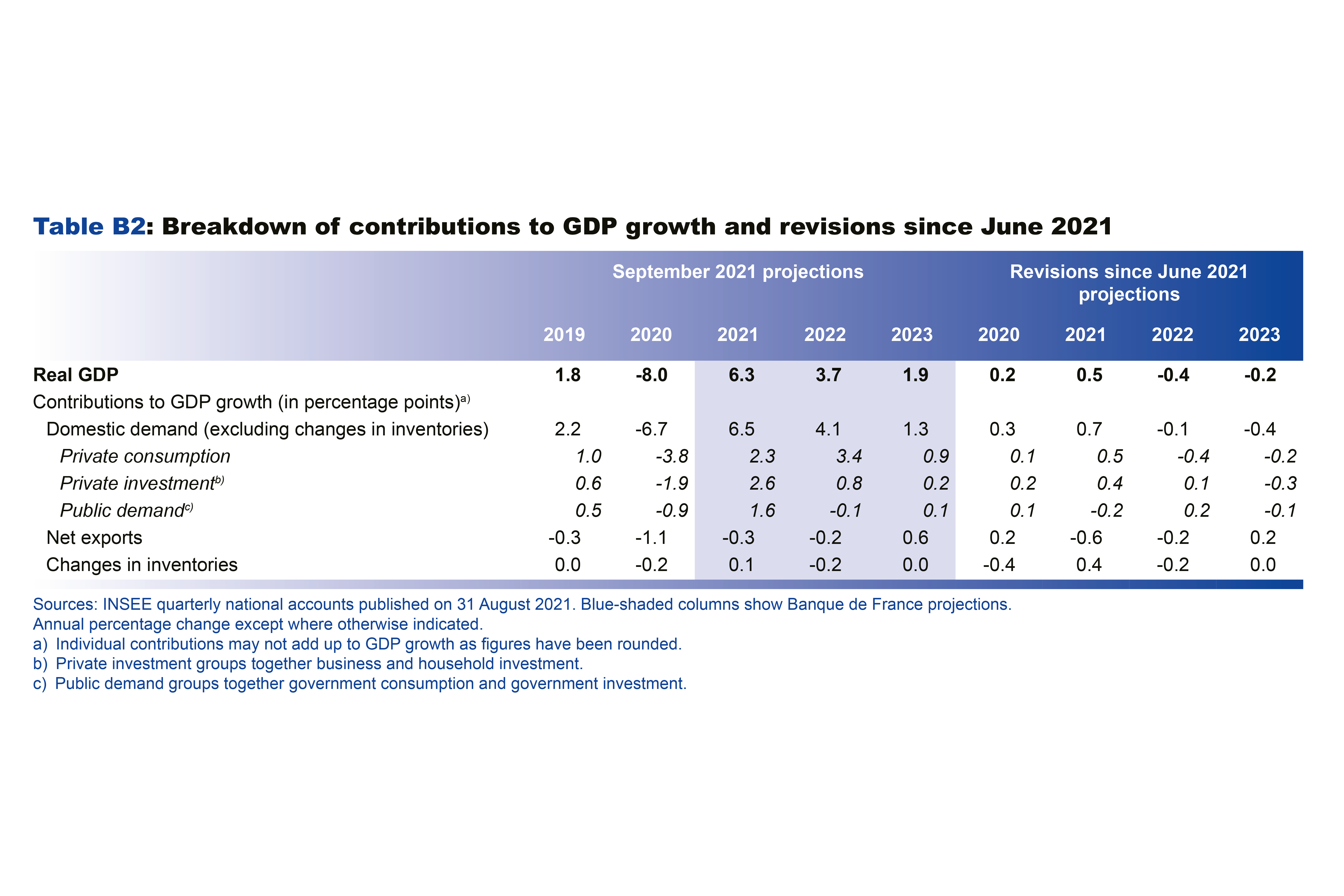

On average over 2021, GDP is expected to grow very strongly, by 6.3%, underpinned by a strong rebound in all components of domestic demand, investment, consumption and public spending, as well as by the recovery in exports (see Chart 2). As the health restrictions ease, household consumption should increase significantly in the second half of 2021, thanks to the fact that incomes have been preserved on average during the crisis. Similarly, household investment should be stimulated by their accumulated excess savings. Corporate investment, which proved relatively resilient during the recession, is expected to be boosted by the rebound in demand, continued corporate profitability and favourable financial conditions. The combined impact of the ongoing implementation of emergency and support measures as well as the initial effects of the recovery plan should ensure strong public demand. GDP is slated to return to its pre-crisis level by the end of 2021.

In 2022, GDP growth is expected to remain very robust (3.7%), driven once again by the strength of household spending, whose recovery in the second half of 2021 should be fully apparent in 2022 as an annual average. In 2023, the pace of activity growth should begin to normalise (at 1.9%). Activity should continue to be driven by domestic demand, but also by foreign trade, bolstered by global demand and the recovery of export performance, particularly in those sectors that have been affected for longer by the consequences of Covid (aeronautics in particular).

Overall, on the basis of the latest available data, we are revising upwards the trajectory of GDP in level terms, mainly in 2021 (see Chart3). In the medium term, beyond cyclical fluctuations, which have been significant, economic activity is expected to converge towards the estimated potential GDP. We confirm the assumption of our June assessment that the permanent loss of GDP due to the crisis should be limited. Public policies have helped to avert a wave of bankruptcies and redundancies, and the loss of activity has been concentrated in a small number of sectors (retail, accommodation and food services, transport, etc.), which are expected to gradually recover. This suggests that losses in productivity should remain limited, unlike in the financial crisis of 2008-09.

Headline inflation is expected to rebound significantly in 2021, but to varying degrees for its different components. It should rise moderately in 2022 and 2023

In the current context of economic recovery, inflation measured by the Harmonised Index of Consumer Prices (HICP) has continued to recover in recent months, rising from 0.1% year-on-year in the fourth quarter of 2020 to 1.0% in the first quarter of 2021 and 1.8% in the second quarter of 2021. In August, according to Flash data, HICP inflation stood at 2.4%, while national CPI (Consumer Price Index) inflation was 1.9%. A positive gap between the two indices is usual (0.15 percentage point on average) but it is now temporarily larger due to the greater weight of energy in the HICP basket.

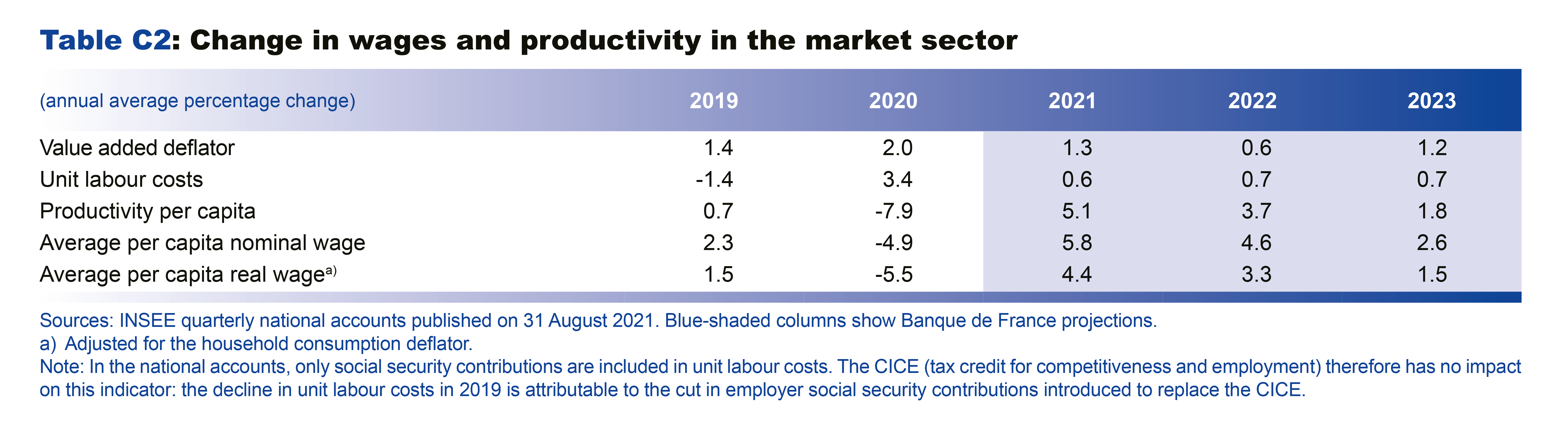

The rise in inflation largely reflects the increase in oil prices from their low level in 2020. It also reflects a recovery in inflation excluding food and energy (from 0.3% in the fourth quarter of 2020 to 0.9% in the first quarter of 2021, then 1.2% in the second quarter of 2021), with the prices of services and manufactured goods (affected by global tensions) regaining momentum after their slowdown in 2020.

Compared to our June projections, the rise in inflation in June-July-August was even stronger than expected. On the one hand, oil prices continued to increase, and gas prices in France were raised significantly. On the other hand, the rise in the prices of manufactured goods was stronger and more persistent than expected. Beyond the temporary fluctuations generated by the lifting of lockdowns and changes in sales dates, this could reflect a faster-than-expected propagation of commodity and industrial input price rises along the production chain. Since the beginning of 2021, these have already caused manufactured goods excluding pharmaceuticals to rise above their long-term average (0.7% in the first half of 2021, compared with an average of 0.1% over 2000-20).

We take into account price pressures in some sectors, which are also highlighted in our business survey, and expect HICP inflation to continue to rise over the remainder of 2021. Its year-on-year rate should peak at 2¾% by the end of 2021. It is projected to average 1.8% over the year 2021 (after 0.5% in 2020). HICP inflation excluding energy and food is also expected to stand, in 2021, at 1.2% as an annual average (after 0.6% in 2020) and should peak at slightly below 2% at the end of 2021, which would correspond to the peak of the pass-through of the increase in global commodity prices into manufactured goods prices.

Beyond 2021, annual average HICP inflation is expected to decline initially, and then to increase at a rate of

1.3-1.4% on average in 2022-23, with smaller fluctuations and rising towards the end of the projection horizon (see Chart 4). After the peak at the end of 2021, the factors driving inflation are likely to change. The impact of past input price increases on energy and manufactured goods is likely to diminish. HICP inflation would then be driven more by its services component, due to a strong labour market and higher wages. The effects of these factors should be greater than expected in our June forecast, which leads us to revise upwards our projection for headline inflation and inflation excluding food and energy for 2022-23.

Thus, in our baseline scenario (see the risks surrounding this scenario below), HICP inflation is expected to be moderate but should nevertheless rise in 2023, with an expected year-on-year rate of 1.4% by the end of 2023.

Thanks to public support, the labour market proved to be more resilient than expected and job creations are expected to stabilise the unemployment rate over the entire projection horizon

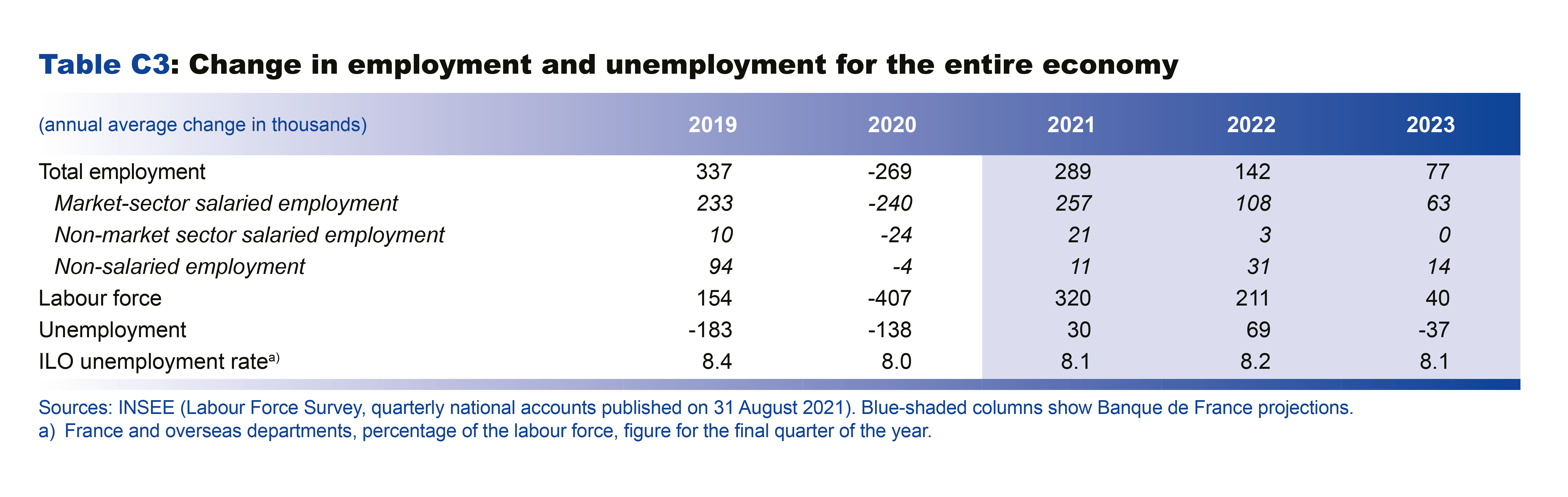

The deterioration in the labour market has been more limited and shorter-lived than expected. Total employment grew strongly in the second quarter of 2021 (job numbers were up by 130,000 on a quarterly average in the sense of the quarterly accounts). The unemployment rate remained virtually stable in this same quarter (8.0%, after 8.1% in the first quarter of 2021, see Chart 5) as the labour force returned to a level close to its pre-crisis level. However, the short-time work scheme, which aims to prevent a deterioration in structural unemployment, also continued to support employment in the short term: in July, it still concerned 240,000 full-time equivalent jobs and the working hours per capita in the market sector were 6% below their pre-crisis level in the second quarter of 2021.

The context of economic recovery, combined with the persistence of public support, should contribute to furthering the rebound in employment in the second half of 2021. At the same time, recruitment difficulties are widely reported in the surveys. Once it has returned to a level higher than that of the pre-crisis period, employment may then temporarily slow down at the beginning of 2022, as the ending of the short-time work scheme would lead to a return to normal of employment conditions in all companies, and in particular of working hours per capita. In this context, the unemployment rate should stabilise around its current level over the projection horizon.

With employment and income preserved during the crisis, the recovery in household consumption spending is expected to be strong

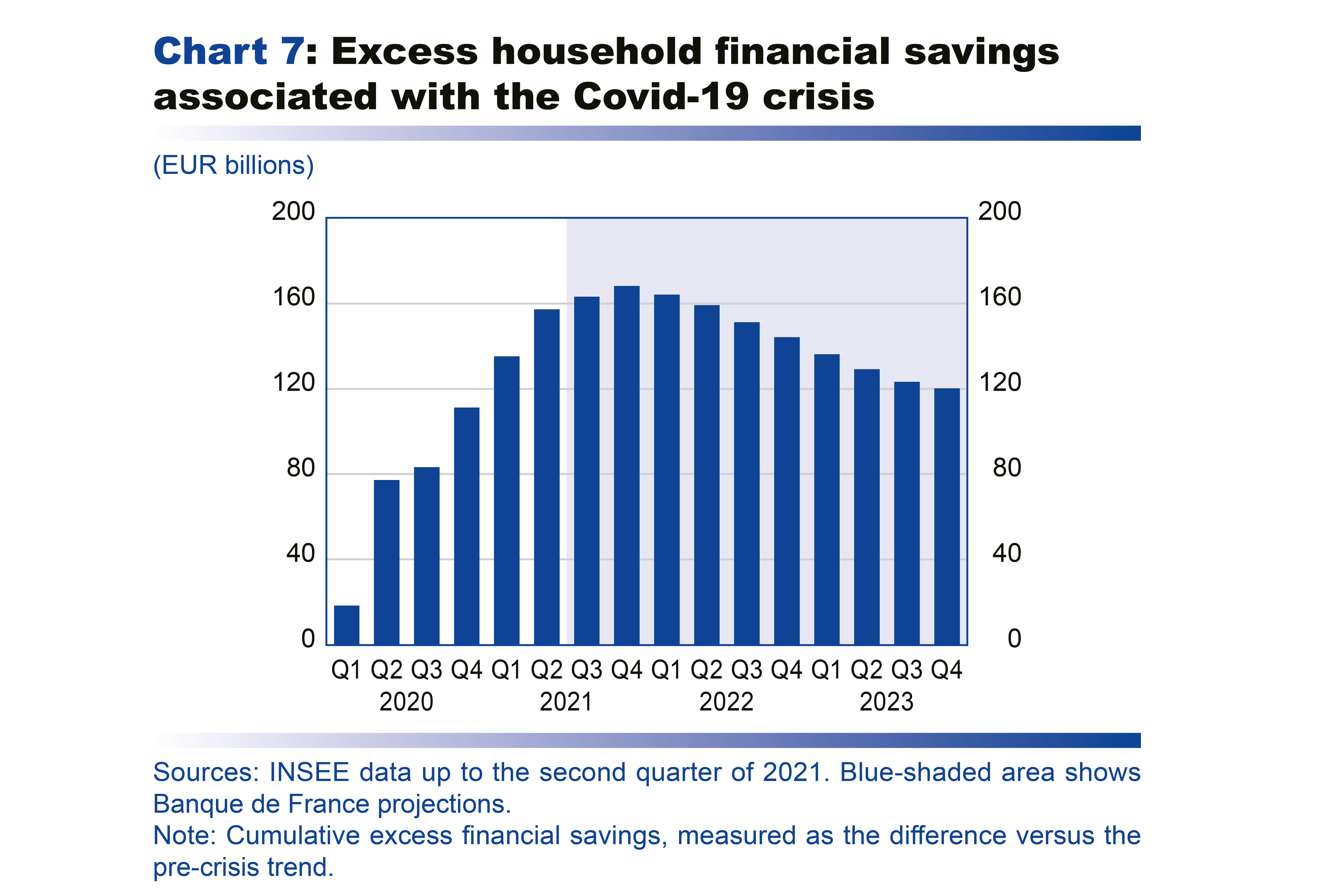

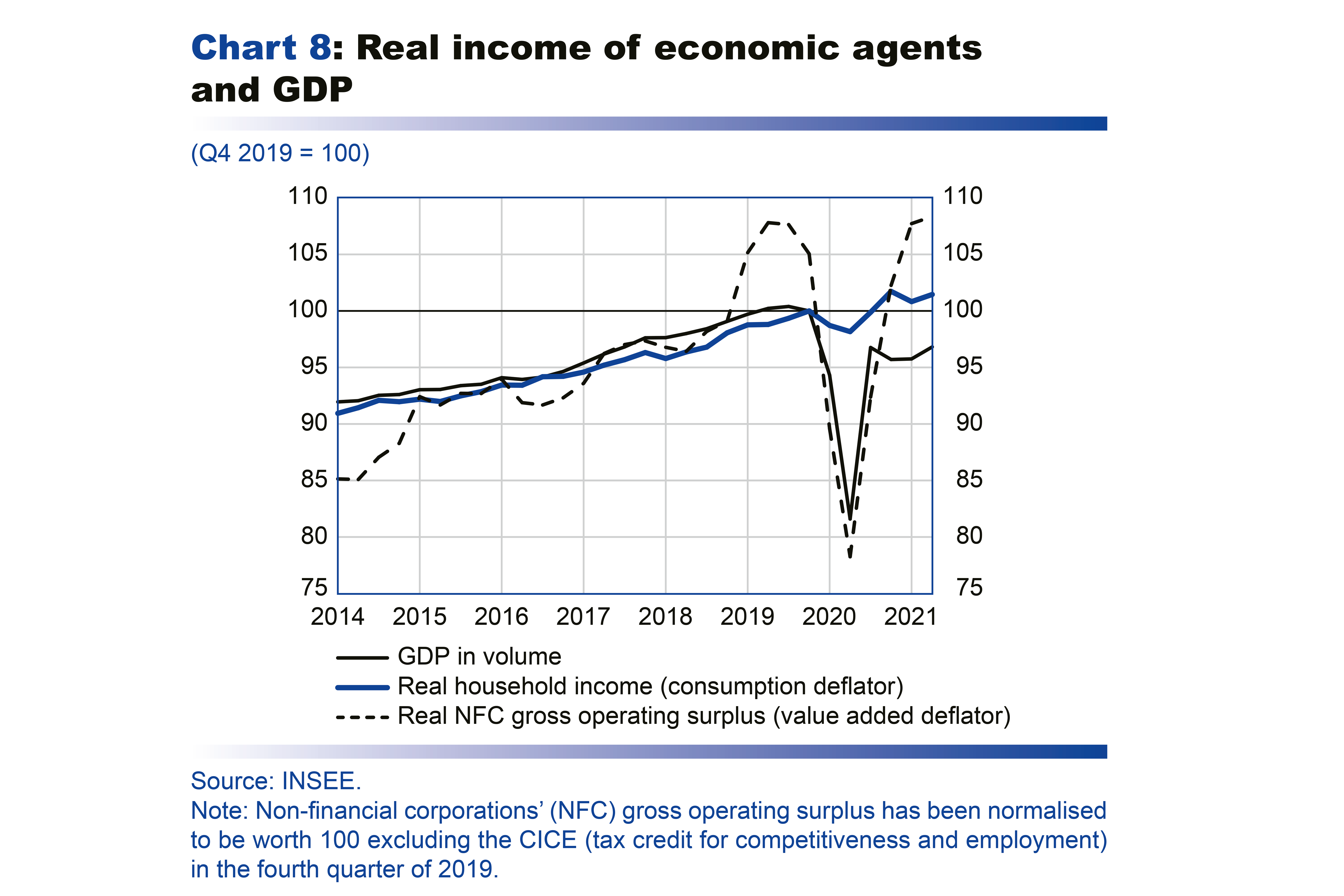

In 2020, the government cushioning mechanisms prevented a sharp deterioration in the labour market and preserved household purchasing power (see Chart 6) from a macroeconomic point of view, even if this aggregate view may mask more contrasted specific situations. The purchasing power of households’ gross disposable income was thus 1.4% above its pre-crisis level in the second quarter of 2021 (see Chart 8). Given that household consumption and investment spending has been curbed by the successive lockdowns, the unspent income has accumulated into excess financial savings (the difference between income and consumption plus investment), which is expected to reach a peak of EUR 170 billion at the end of 2021 (after EUR 111 billion at the end of 2020 and EUR 157 billion at mid‑2021, see Chart 7), i.e. around 7 GDP points. This should represent an additional potential reservoir of support for future activity, and our baseline scenario assumes that households should spend a little more than a quarter of it on consumption and investment by the end of the projection horizon. Household consumption spending should also be boosted by overall favourable labour market conditions, with labour income, and therefore purchasing power, further increasing.

Specifically, the rebound in household consumption that started in June 2021 is expected to be confirmed over the following months, in a context of less restrictive health conditions following the spread of vaccination. This would rapidly bring down households’ savings rate, which should fall below its pre-crisis level at the beginning of 2022, before reaching it again at the end of the projection horizon. Households should thus make up for some of their under-consumption in 2020-2021.

Similarly, the rebound in household investment in home builds is already well underway, as it was at a higher level in the second quarter of 2021 than at the end of 2019. Short-term indicators for the construction sector suggest that this recovery will continue, in a context of very favourable financing conditions. Households should thus completely make up for their under-investment during the crisis.

With their financial situation largely preserved on average, firms are expected to maintain their investment spending at a high level

As with households, public aid measures, such as the short-time work scheme and the solidarity fund, helped to preserve businesses’ income and their margin rate: the decline in the latter on average over the year 2020 is close to the mechanical effect expected from the ending of the CICE, a tax credit for competitiveness and employment. At mid-2021, the gross operating surplus of non-financial corporations (NFCs), deflated by the price of value added, was thus 3.1% above its level at the end of 2019 (see Chart 8). The corporate margin rate should then remain at a high level, close to that achieved in 2019 and well above its average level over the previous decade. The joint effect of the economic recovery and the aid measures included in the recovery plan, such as the investment and hiring subsidies and the cuts to production taxes, should make up for a certain dynamism in wages and the gradual disappearance of short-time work.

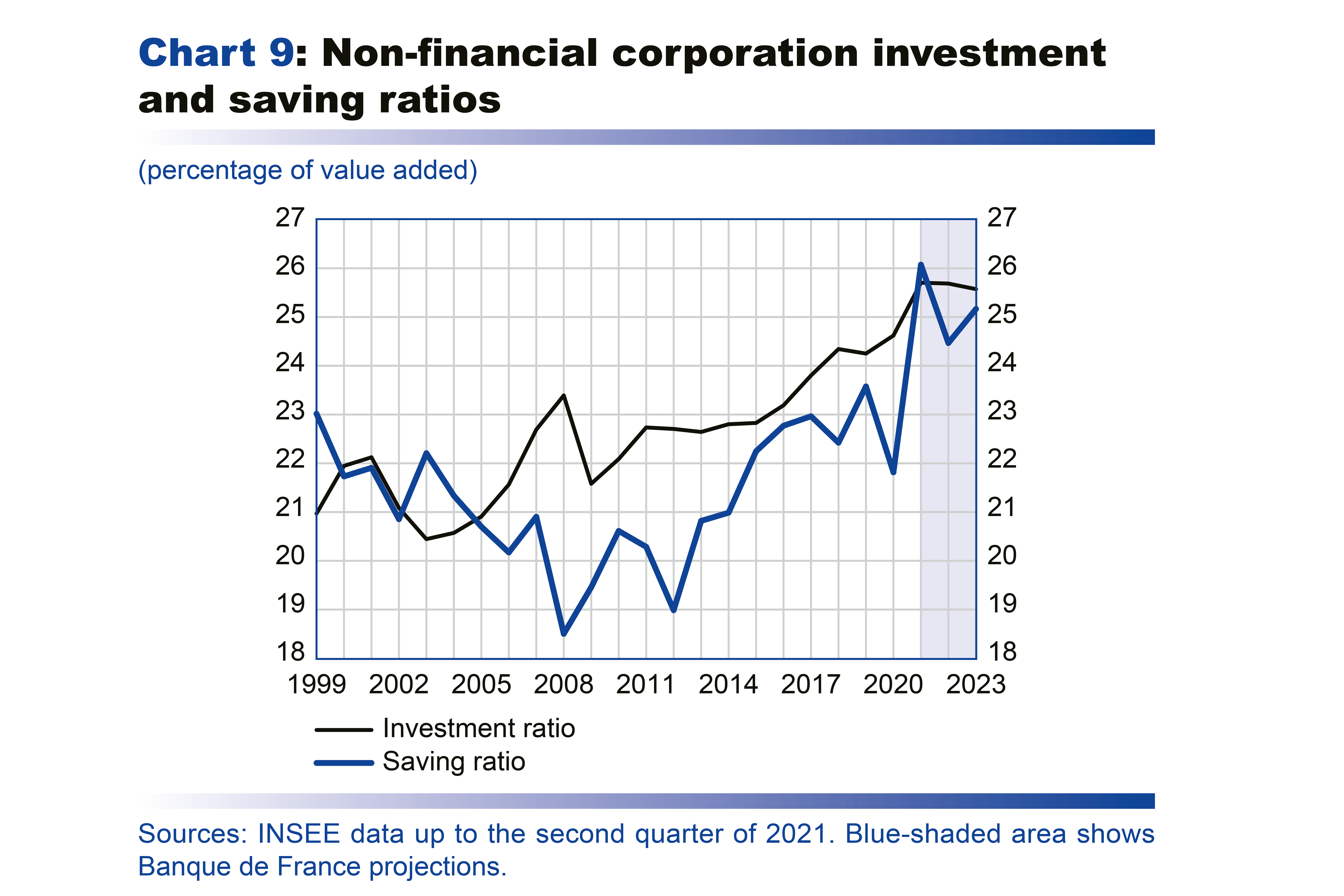

Business investment also showed strong resilience during the crisis, since it had already returned to its pre-crisis level by the second quarter of 2021, driven in particular by strong margins, favourable financing conditions and vigorous intangible investment. After a temporary peak in 2021, linked to the divergence between investment and overall activity, NFCs’ investment ratio is expected to decline somewhat, while remaining above its pre-crisis level over the entire projection horizon (see Chart 9). Despite this sustained investment effort, businesses should maintain a high level of self-financing, close to 100% and to its 2019 level, thanks to their considerable savings (see Table 2).

Exports are expected to rebound vigorously thanks to the recovery in international trade

After falling sharply in 2020, exports are expected to benefit from the recovery of the world economy and in particular of foreign demand addressed to France. However, they should pick up with a lag compared to GDP (see Chart 10) and will continue to be hampered by the aeronautics and tourism sectors, whose situation will probably only partially return to normal.

In 2020, the net contribution of global trade to growth was strongly negative due to a sharper fall in exports than imports. It is expected to remain slightly negative in 2021 and 2022: exports should pick up but imports should remain dynamic given buoyant domestic demand. It is only in 2023 that the contribution of global trade is expected to partly offset the fall of 2020 as exports continue to recover while imports, like domestic demand, return to normal.

The government deficit, which massively supported household and business income during the crisis, is expected to remain too high to bring about a lasting reduction in the government debt ratio

In our forecast, the strength of the economic recovery should enable the government deficit-to-GDP ratio to fall to around 8% in 2021, after 9.2% in 2020, despite high spending and cuts to taxes and social security contributions, which have supported household and business incomes (see Chart 8). Indeed, the maintenance of the principal emergency and support measures, such as the solidarity funds, the short-time work scheme, the cancellation of social security contributions and the additional spending on health, which amount to around EUR 60 billion, combined with the roll-out of the recovery plan, which provides for expenditure of just over EUR 25 billion in 2021, and with the Ségur health programme, which provides for expenditure of almost EUR 10 billion, is expected to lead to a further rise in government spending excluding tax credits in 2021 (2% in volume), after the very sharp increase in 2020 (almost 7% in volume). The tax cuts agreed in the recovery plan, such as the cuts of EUR 10 billion to production taxes, and those planned before the crisis, such as the reduction in the housing tax and the lowering of the corporation tax rate, should help curb the tax-to-GDP ratio in 2021. The tax-to-GDP ratio should thus reach a level slightly below its pre-crisis level in 2021 (43.5% against 43.8% in 2019). In addition to the rebound in growth, the European financing of the recovery plan should also contribute to limiting the deficit in 2021. Thanks to very strong GDP growth and the use of part of the cash reserves built up by general government, the government debt-to-GDP ratio is expected to dip slightly, from around 115% in 2020 to just over 114% in 2021, but more than 15 points above the ratio of around 98% in 2019.

The government deficit is expected to continue to trend downward thanks to still vigorous growth, the return to normal of certain expenditures, a lower interest charge and the continued European financing of the recovery plan. It should nonetheless, in the absence of any new measures which could be decided in the next budget laws, remain around 4% of GDP in 2023, due to the combination of two factors: (i) a decline in the tax-to-GDP ratio of almost one percentage point compared to the pre-crisis period (44.7% in 2019, excluding the double-counting of the CICE) and (ii) a rise in the ratio of primary spending to GDP of slightly over one percentage point of GDP compared to its pre-crisis level (52.3% in 2019).

The government debt ratio could therefore decline in 2022, but with a deficit at the end of the horizon still above the level that would stabilise the debt, it could pick up again slightly in 2023.

Our projection remains subject to several factors of uncertainty, both health-related and macroeconomic, and in particular upside risks to inflation

This projection still depends on the evolution of the health situation in France and in the world. In addition to the uncertainty surrounding the evolution of the epidemic and health measures, macroeconomic risks may affect economic activity and inflation in a more favourable, but also more unfavourable manner.

The supply constraints that emerged during the economic recovery could continue and slow the recovery. In particular, the supply and recruitment difficulties observed in certain sectors could worsen and affect companies’ ability to meet the demand addressed to them for longer than in our baseline scenario. Similarly, the tensions in input prices could spread further to prices and slow both the dynamism of purchasing power and the recovery. Conversely, a faster return to confidence, thanks in particular to favourable developments in the labour market, could encourage households to consume more rapidly their excess financial savings accumulated during the crisis. Over a somewhat longer time horizon, post-crisis efficiency gains, including reallocations between economic sectors and reorganisations, could help prevent losses in potential GDP and even gradually raise the pace of potential growth.

As regards inflation, our baseline scenario takes account of the observed rise in industrial input prices, but the magnitude and duration of its effects constitute an upside hazard for our inflation projection. Of course, we cannot rule out a fall in input prices, which could lead to disinflationary pressures on manufactured goods prices, as happened after the 2011 peak. In addition, to date, according to leading input price indicators, such as the PMI and Banque de France monthly surveys, input prices seem to have stabilised at a level close to the 2011 peak, after the sharp increases recorded in the previous months. However, given the supply constraints, input prices may continue to rise. In this context, combined with the pressure on recruitment, higher than expected wage increases may occur, a risk highlighted by certain business surveys.

Download the PDF version of this document

- Published on 09/13/2021

- 11 pages

- EN

- PDF (2.95 MB)

Updated on: 09/23/2021 09:53