Working Paper Series no. 852: Anchoring of Inflation Expectations: Do Inflation Target Formulations Matter?

Inflation target formulations differ across countries and over time. Most widespread are point targets, target ranges, hybrid combinations of the two, or mere definitions of price stability. This paper proposes a novel empirical measure of expectations anchoring based on the cross-sectional distribution of private sector inflation point forecasts. Applying this to a panel of 29 countries, it finds three main results. First, a numerical target definition per se does not improve anchoring compared to a definition of price stability, while the formulation of a numerical reference point increases the degree of anchoring. Second, point targets and hybrid target formulations are associated with better anchoring than target ranges. Third, periods of persistent target deviations lead to an increase in tail risks to the inflation outlook. Conditional on such periods, point targets and hybrid targets attenuate tail risks to the inflation outlook, with a stronger quantitative effect for point targets. The results are consistent with models suggesting that targets ranges are interpreted as zones where monetary policy is less active.

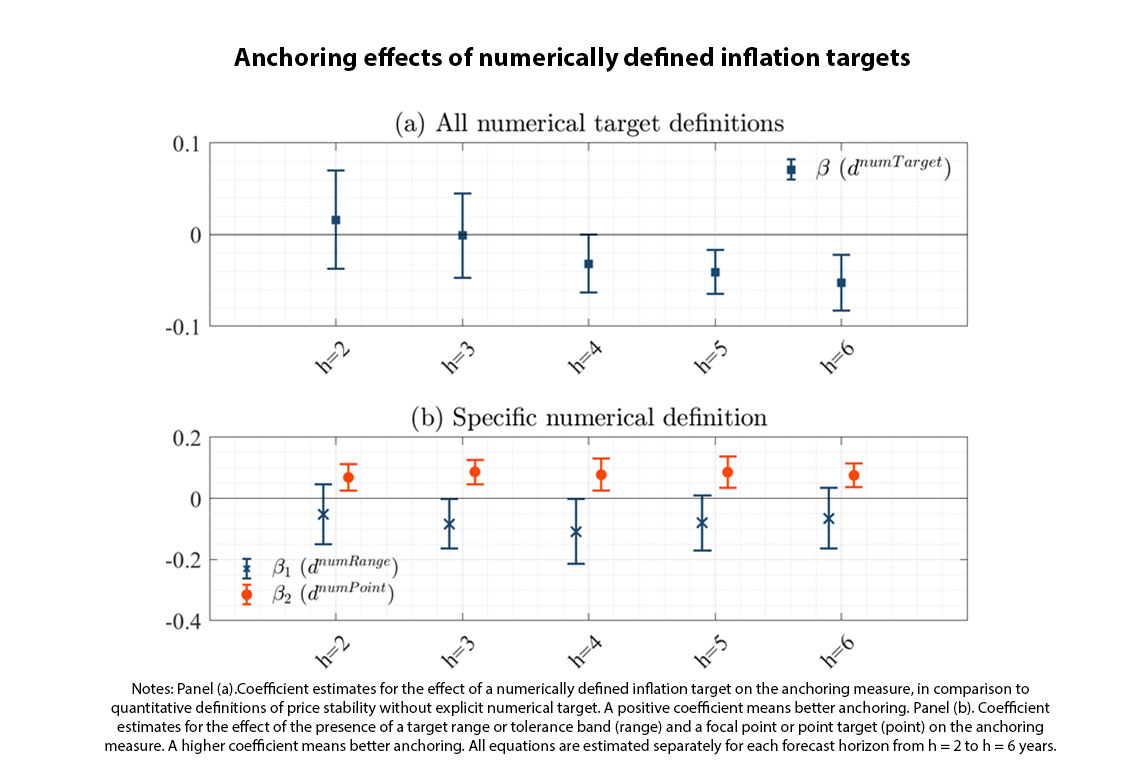

Inflation target formulations differ across countries and over time. Most widespread are point targets, target ranges, hybrid combinations of the two, or mere definitions of price stability. This paper proposes a novel empirical measure of expectations anchoring based on the cross-sectional distribution of private sector inflation point forecasts. Applying this to a panel of 29 countries, it finds three main results. First, a numerical target definition per se does not improve anchoring compared to a definition of price stability, while the formulation of a numerical reference point increases the degree of anchoring. Second, point targets and hybrid target formulations are associated with better anchoring than target ranges. Third, periods of persistent target deviations lead to an increase in tail risks to the inflation outlook. Conditional on such periods, point targets and hybrid targets attenuate tail risks to the inflation outlook, with a stronger quantitative effect for point targets. The results are consistent with models suggesting that targets ranges are interpreted as zones where monetary policy is less active.Inflation expectations are a pivotal intermediate target for central banks to achieve their inflation objective. While short-term inflation expectations are affected by economic conditions, longer-term inflation expectations reveal the credibility of central bank's inflation objective. Inflation targeting (IT) underscores this link by announcing an explicit numerical value for the inflation objective. Looking at real-world target formulations, the degree of heterogeneity of target formulations is striking. While some countries provide a point target, others define a range for inflation outcomes that the central bank intends to achieve. Hybrid solutions are also widespread, including a target range with emphasis on a focal point or point targets with a numerically defined tolerance band around it. Surprisingly little is known about the anchoring properties of alternative inflation target formulations. This paper investigates empirically whether inflation target formulations matter for the anchoring of medium- to long-term inflation expectations

We use data from an unbalanced panel of 29 countries, covering the period from 2005m4 to 2020m4. To quantify the degree of anchoring, we propose a novel measure based on the cross-sectional distribution of private sector inflation point forecasts based on Consensus data for horizons of two to six years ahead.

We find four main results. First, a numerical target definition per se does not improve anchoring, while the formulation of a numerical reference point increases unconditionally the degree of anchoring compared to a quantitative definition of price stability for forecast horizons of two to six years (see Figure). Second, point targets and hybrid target formulations are associated with better anchoring properties than target ranges. Third, periods of persistent inflation overshooting and undershooting lead to an increase in tail risks to the inflation outlook. Fourth, conditional on periods of persistent target deviations, a point target is associated with lower tail risks to the inflation outlook. Our results are consistent with models suggesting that targets ranges are interpreted as zones where monetary policy is less active.

Download the PDF version of this document

- Published on 12/09/2021

- 67 pages

- EN

- PDF (5.62 MB)

Updated on: 12/10/2021 10:06