Working Paper Series no. 745: Population Ageing and the Macroeconomy

We quantify the impact of demographic change on real interest rates, house prices and household debt in an overlapping-generations model. Falling birth and death rates across advanced economies can explain much of the observed fall in real interest rates and the rise in house prices and household debt. Since households maintain relatively high wealth levels throughout retirement, these trends will persist as population ageing continues. Countries ageing relatively slowly, like the US, will increasingly accumulate net foreign liabilities. The availability of housing as an alternative store of value attenuates these trends, while raising the retirement age has limited effects.

The population of advanced countries has aged rapidly over the past half-century, with life expectancy and the old-age dependency ratio having already reached unprecedented highs and projected to continue to rise for several decades. At the same time, long-term real interest rates have been on a downward trend, while house prices and household debt have risen dramatically. This paper quantifies the link between these important trends and examines the wider macroeconomic implications of demographic change using an overlapping-generations model calibrated for 23 advanced economies. We introduce demographic change as observed in the data in terms of cohort size and death probabilities and we solve for the transition path of the economy, assuming that ageing is the only exogenous change and is perfectly anticipated by the agents.

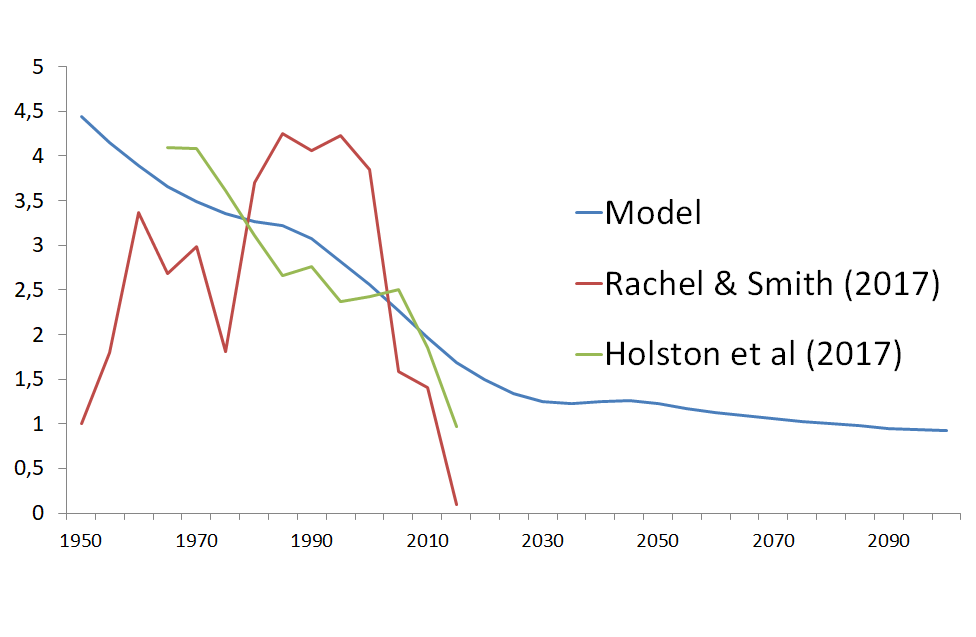

First, we compare the main outcome of our model, namely the natural real interest rate – the interest rate consistent with constant inflation and a closed output gap – to two empirical counterparts: the world real interest rate as estimated by Rachel and Smith (2017) and the model-based estimates of the natural interest rate from Holston et al. (2017).

In the model, demographic change implies a decrease in the annual interest rate by 157 basis points (bps) between 1980 and 2015, and is forecast to push down interest rates by a further 76bps by 2100. Compared to measures of the natural interest rate evolution between 1980 and 2015 obtained from the data, demographics are able to replicate 75% of the roughly 210bps drop estimated by Holston et al. (2017), and around 45% of the fall in the Rachel and Smith (2017) measure.

The key mechanism triggered by the demographic transition is the following. First, households anticipate that they will live longer and spend more time in retirement. They are therefore willing to transfer more of their income during working life to the future, in order to smooth their consumption. Second, the slower population growth and increased longevity imply that older households make up a larger share of the total population alive at each period. These two changes both increase the level of aggregate savings-to-GDP over time. To keep the capital market balanced given this higher capital supply, the interest rate decreases.

Unsurprisingly, demographic change alone cannot explain the whole interest rate fall since 1980 which leaves room for other, possibly more transitory, explanations of the current low level of interest rates. Yet, the demographic changes themselves do not reverse, and leave the economy with a permanently lower natural interest rate, as highlighted by the slowly decreasing trend in interest rates after 2030.

Second, our theoretical set-up allows for a broader diagnostic on the impact of ageing on housing wealth, housing prices, household debt-to-GDP and external net foreign assets position. Besides the utility they derive from housing, households can use it as an additional way of transferring wealth over time, in that it is durable and can be sold to fund consumption and bequests. As the interest rate falls, demand for housing rises, pushing up housing prices and increasing the housing wealth-to-GDP ratio.

To be able to afford the more expensive housing assets, young households have to borrow more, and so the rising house price contributes to the rising household-debt-to-GDP ratio. The lower interest rate also has a similar effect as it encourages more borrowing by the young, raising net household debt-to-GDP. Although this pushes down on aggregate savings-to-GDP, it is not strong enough to compensate the increase in savings implied by the change in the structure of the population, hence the increase in aggregate savings and decrease in interest rate along the transition path.

Last, extending our model to consider countries with different ageing speeds, we show that countries ageing faster (e.g. Germany) will accumulate positive net foreign assets, while the opposite is true for countries ageing at a slower pace. About 20% of the cross-country variations in net foreign assets-to-GDP can be explained by demographics in our model.

Download the PDF version of this document

- Published on 12/27/2019

- 53 pages

- EN

- PDF (6.1 MB)

Additional links

Updated on: 12/30/2019 12:52