Working Paper Series no. 838: Promoting Self-employment: Does it create more Employment and Business Activity?

We assess the economic impact of reforms promoting self-employment in the three countries that have implemented such reforms since the early 2000s: the Netherlands, the United Kingdom and France. To that end, we use an unbalanced cross country-industry dataset of 4,226 observations, including 12 OECD countries and 20 market industries, over the 1995-2016 period.

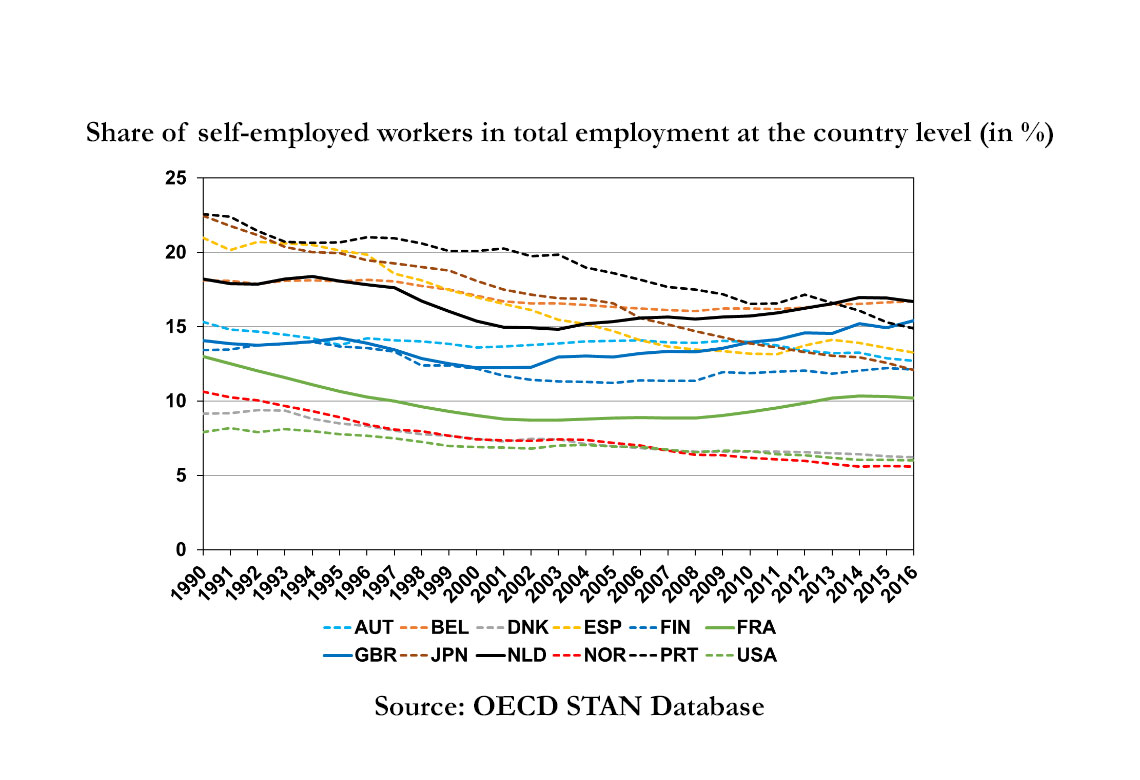

We first observe, using country-level data, that the share of self-employed workers in total employment is quite stable or declines over the period in all countries in our dataset, except in the three countries where large reforms promoting self-employment have been implemented, and only after these reforms. We econometrically confirm this impact on self-employment in our set of 20 industries and we find that, at the end of the period, the reforms may have increased the share of self-employed workers in total employment by 5.5pp on average in the Netherlands, 2.5pp in the United Kingdom and 2pp in France. Then, we investigate the impact of reforms on total employment and value added using a difference-in-differences approach. In spite of a broad sensitivity analysis, we find no evidence that the reforms may have impacted either total employment or value-added. These results suggest that the reforms promoting self-employment may have raised the number of self-employed workers, but mostly through a substitution effect between the self-employed and employees, and not through a supply effect or a substitution effect with informal activities. This means that the reforms may have failed to achieve their main objectives.

Over the last two decades, three countries have implemented important reforms to promote self-employment: the Netherlands and the United Kingdom from the early 2000s and France from the late 2000s. These reforms consist both in a decrease of the administrative burdens on self-employment and a decrease in the fiscal and social taxes levied specifically on these types of jobs.

These reforms could have an economic impact through three different types of channels:

- Supply effects. Lowering administrative burdens and introducing fiscal and social tax advantages for the self-employed provide incentives for entrepreneurship and for activities in industries where production can be done by the self-employed. Self-employed activities become more profitable and then more attractive. The impact of this pure supply effect should be more value-added and more self-employed workers, not more employees but more total employment only from more self-employed workers.

-Substitution effects between informal and formal activities. Lowering administrative burdens and lowering costs for the self-employed make this type of declared activity more attractive compared to informal and undeclared ones, which are associated with a risk of sanctions in the event of an audit. The pure impact of this channel should be more self-employed workers, not more employees but more total employment, and not necessarily more value-added in the national accounts, as accountants usually try to take into account informal activities in value-added measurements, to get a better evaluation of GDP at the country level.

-Substitution effects between the self-employed and employees. Lowering administrative burdens and lowering costs for the self-employed make these types of jobs more attractive compared to employee ones. The impact of this pure substitution effect should be more self-employed workers and fewer employees, with no significant change in total employment or in the value-added produced.

These three different channels could in reality act together, due to different reasons. One of these reasons is that the complementarity between employees and self-employed people is not nil, even more at the industry or the global level. None of these three channels act solely, but the hierarchy of their impact is paramount for policy-makers. When states implement reforms promoting self-employment, they expect impacts corresponding mainly to the first and second channels. From official declarations, it appears clearly that this has been the goal for the three countries which have implemented such reforms since the early 2000s. But if the third channel is the only one activated, then this means the reforms have failed.

Few papers have looked at the economic impact of such reforms. But to the best of our knowledge, there has been no analysis of the impact of such reforms on overall employment and activity.

The aim of our analysis is to propose an evaluation of the impact of these reforms on total employment and value-added in order to see which of the three channels was activated in each of these three countries. To estimate this impact, we use cross country-industry panel data from the OECD STructural ANalysis (STAN) database on the number of self-employed workers, the total number of workers and value-added in real terms. After cleaning, our main estimation sample is an unbalanced panel of 4,226 observations, including 12 OECD countries and 20 market industries over the 1995-2016 period.

We first observe that in all countries in our dataset the share of self-employed workers in total employment is quite stable or declines over the period, except in the three countries where reforms promoting self-employment were implemented (the Netherlands, the United Kingdom and France). In these three countries, after remaining stable or even declining, the share of self-employed workers increases from the 2000s, and more specifically following the implementation of the reforms. This result is consistent with the previous literature.

We then test econometrically this observation for our set of 20 industries by estimating a relation explaining the share of self-employed workers with post-reform country-year coefficients. These coefficients are found to be positive and significant from the implementation of the reforms. According to our estimation results, the reforms may have increased the share of self-employed workers in total employment at the end of the period by 5.5pp in the Netherlands, 2.5pp in the United Kingdom and 2pp in France. In order to check the robustness of these results we also investigate the impact of the reforms for each industry separately and we run a broad sensitivity analysis. We find a positive impact for a large proportion of country-industry pairs, this impact being significant and robust in the most self-employment intensive industries.

We then investigate the impact of the reforms on the logarithm of the total number of workers and the logarithm of value-added in real terms. If the reforms promoting self-employment have an impact on total employment or on value-added, we would expect this impact to be higher in industries that are self-employment intensive. We use a difference-in-differences approach to test this assumption, and we find no evidence of any impact of the reforms either on total employment or on value-added in spite of a broad sensitivity analysis.

These results suggest that the reforms promoting self-employment may have increased the number of self-employed workers, but mostly through a substitution effect between the self-employed and employees, not through a supply effect or a substitution effect with informal activities. Only the third channel distinguished above appears to be significant, which means that the reforms may have failed to achieve their main objectives. To the best of our knowledge, such results are original and should of course be confirmed by other studies.

Download the PDF version of this document

- Published on 10/19/2021

- 21 pages

- EN

- PDF (3.1 MB)

Updated on: 10/19/2021 11:13