Working Paper Series no. 882: The Rise and Fall of Global Currencies over Two Centuries

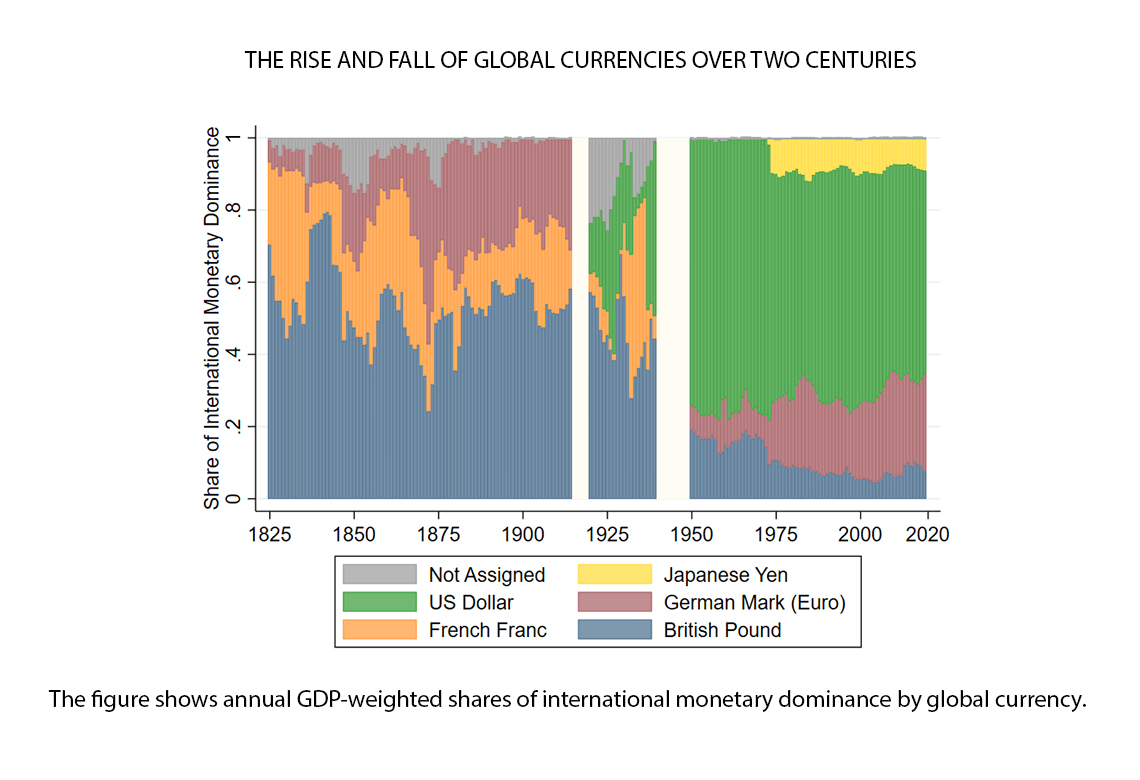

This paper quantifies the relative dominance of global currencies and the competitive structure of the international monetary system since 1825. I find the post-1945 experience of dollar hegemony to have no historical precedent. No currency has ever maintained such a large, long-lasting lead over global currency rivals. Close competitors frequently challenged the previous hegemon, the pound sterling. I confirm the dollar temporarily overtook the sterling for the first time in the mid-1920s. Among previously overlooked episodes of monetary competition, I highlight the rise of the French franc in the 1850s and 1930s as well as of the German mark in the 1870s. In light of the recent debate on the costs and benefits of a multipolar international monetary system, I document a positive correlation between higher global currency competition and the prevalence of financial crises, which is however highly dependent on specific sub-periods.

The hegemony of the dollar on the international monetary system has long been the subject of controversy, going back to Valéry Giscard d’Estaing denouncing the “privilège exhorbitant” in the 1960s. Today, dollar dominance means that policy in third countries, and particularly developing economies, is constrained by financial spillovers from the Fed. A hegemonic supplier of global safe assets might also be problematic for global financial stability, as growing demand for safe assets might outstrip the fiscal capacity of the United States, giving rise to a new “Triffin Dilemma”. Many policy makers outside of the United States have long been arguing in favour of a transition to a more multipolar international monetary system. More recently, the decision by the United States and its allies to freeze the reserves of the Russian central bank has spurred new concerns regarding the sustainability of dollar hegemony in the current geopolitical context.

What would a transition of the international monetary system out of dollar dominance might look like? As discontinuities in the international monetary order are rare events, empirical evidence is hard to come by without recurring to historical analysis. A recent literature, informed by the experience of dollar hegemony, has characterised the international monetary system as a winner-takes all equilibrium, driven by network effects and strategic interactions, where a transition out of the dollar is likely to translate into the rise of a new hegemon. Additionally, a multipolar international monetary system might be subject to destabilising shifts of investors in and out of competing global safe assets, leading to financial instability. On the other hand, the historical literature underlines how a more multipolar international monetary system has been the norm in the past, and, subject to appropriate international cooperation and institutions, it proved consistent with global financial stability.

This paper provides for the first time a continuous measurement of the relative importance of global currencies over two centuries, relying on a newly collected dataset of foreign exchange returns, covering the entire London FX market at weekly frequency since the 1840s. I employ a simple algorithm, based on foreign-exchange co-movement models, to compute an international monetary dominance weight for each global currency since 1825. This indicator of relative dominance is comparable over time and significantly extends the coverage of existing quantifications. Based on the estimated weights, I also quantify the structure and competition intensity of the international monetary system over two centuries.

The key finding of this measurement exercise is that current dollar hegemony is a historical idiosyncrasy, in terms of its length, the size of its lead and its stability. The previous hegemon, the pound sterling, was frequently challenged. I confirm previous findings that the dollar temporarily overtook the sterling a first time in the mid-1920s, but I also uncover previously overlooked episodes of heightened international monetary competition. The French franc was a close match to the pound in the run up to the creation of the Latin Union in 1865, while a clear episode of French monetary dominance is recorded in the 1930s, following the collapse of the British and American currencies. The run up to the creation of the German Empire also coincides with the deutschemark briefly overtaking the pound twice. All in all, these findings suggest that either network effects were historically too weak to force current levels of hegemonic equilibrium, but a structural shift has now occurred, or that we might be underestimating the likelihood of international monetary multipolarity in the future.

Looking at the relationship between the multipolarity of the international monetary system and financial stability, I find a positive correlation between the intensity of global currency competition and the prevalence of financial crises globally. While this finding is consistent with recent theoretical predictions, it should be noted that the relationship is not causal and is driven by specific sub-periods, warranting further research.

Download the PDF version of this document

- Published on 07/21/2022

- 65 pages

- EN

- PDF (6.84 MB)

Updated on: 07/21/2022 16:40