Working Paper Series no. 901: Sovereign Debt and International Trade

Evidence suggests that sovereign defaults disrupt international trade. As a consequence, countries that are more open have more to lose from a sovereign default and are less inclined to renege on their debt. In turn, lenders should trust more open countries and charge them with lower interest rate. In most cases, the country should also borrow more debt as it gets more open. This paper formalizes this idea in a sovereign debt model à la Eaton and Gersovitz (1981), proves these theoretical relations, and quantifies them in a calibrating model. We also provide evidence suggesting a causal relationship between trade and debt or CDS spreads, using gravitational instrumental variables from Frankel and Romer (1999) and Feyrer (2019) as a source for exogenous variation in trade openness.

One of the consequences of a sovereign default is that it makes it more difficult in a country to borrow from foreigners but also to trade with foreigners. As a consequence, a sovereign default is more frightening for more open economies, which should make more open economies more reluctant to default. Consequently, more open economies should be able to sustain higher debt-to-GDP ratios because their willingness to pay their debt back should be higher. Moreover, this higher willingness to pay should be anticipated by the financial markets, which should translate into lower cost of financial borrowing. Finally, countries should be tempted to enjoy this lower cost of borrowing and borrow more debt – although not enough to make default more likely.

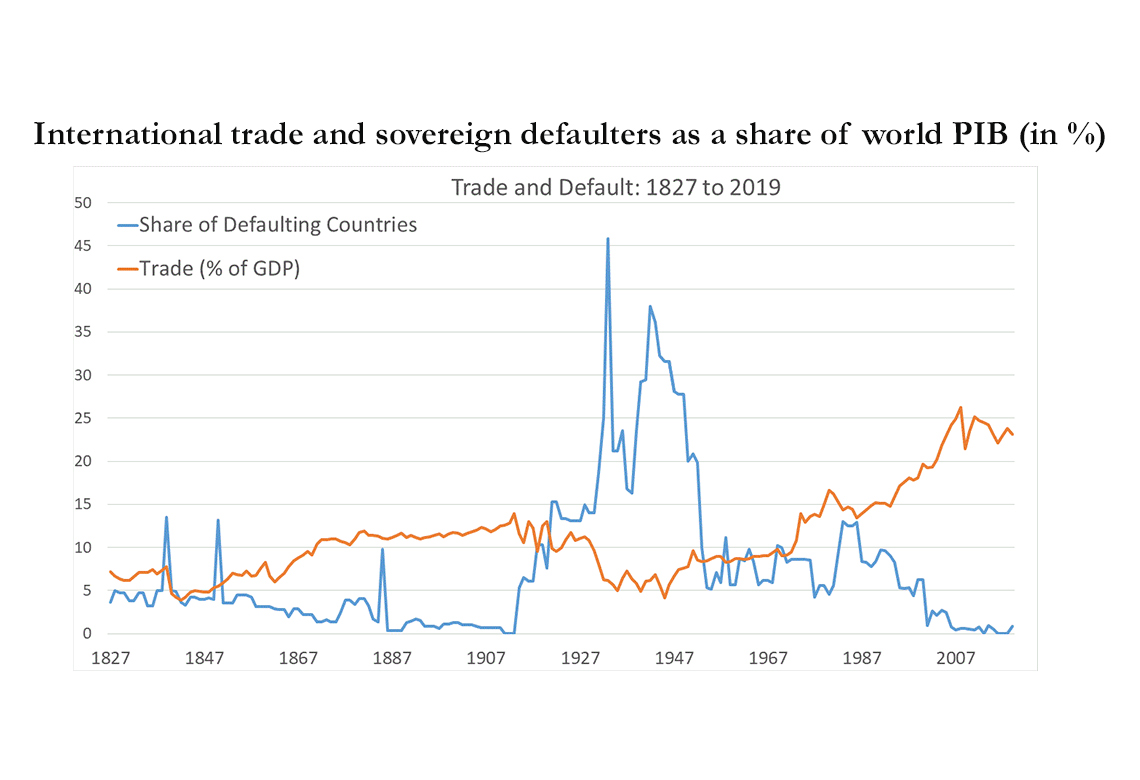

The starting point of the paper is the long-run relationship between sovereign defaults in the world (as measured by the share of countries in the world that default weighted by their GDP) and international trade (total volume of trade divided by world GDP). It is apparent on the data that waves of default coincide with decreases in commercial integration.

Moreover, a regression using historical data shows that, in the years following a sovereign default, imports decrease by 10% or more depending on the specification. The same is true for exports, though the magnitude tends to be lower, as defaulting countries are generally equilibrating their trade balance. Therefore, total gains from trade are lower after a default.

From these stylized facts, I write a sovereign debt model with strategic default and international trade. Not only do countries borrow from other countries to smooth their consumption over time, but they also trade with the rest of the world to enjoy the benefits associated with specialization. The gains from trade can be computed directly from the openness ratio in the model. If a country defaults, it loses its ability to borrow from financial markets and its trade costs increase, which reflects a disruption in trade market credits. Since imports and exports tend to decrease proportionally because of this increase in trade costs, more open countries find it more costly to default. I prove that, because rational markets anticipate that, more open countries benefit from lower default costs through lower interest rates. Impatient governments benefit from that discount to borrow more debt. In general equilibrium, these properties stay true. Calibrations of a rich model including realistic debt maturities and possibility to redeem from default as well as fluctuations from terms of trade shows that governments emit more debt, which they borrow at a lower interest rate, and are less likely to default.

Finally, I test these theoretical predictions empirically. To avoid reverse causality issues or spurious regressions driven by political cycles, I use geographic instruments from the international trade literature as proxies for trade. The Frankel-Romer instrument is an instrument that predicts total trade in a country based on its geographic proximity with other big countries: small countries surrounded by big populated countries tend to be more than isolated large countries. The Feyrer instrument is a similar instrument that is dynamic: it takes advantage of the technical transformations in transport costs: air transport, that was too expensive for trade, became a more common tool for trade in the last decades. As a consequence, the propension to trade of a country does not depend the same way on sea distance and air distance depending on the period we consider: air distance has become a more important determinant. Thanks to these instruments, I can estimate plausible causal estimates for the effect of trade openness on spreads and debt. Let us assume that a country suddenly trades twice as much relative to its GDP, as it happened in France between the 1960s and today. I find that such a country benefits from a 300 b.p. decrease in its spreads. Moreover, this country tends to borrow twice as much debt

Download the PDF version of this document

- Published on 12/26/2022

- 70 pages

- EN

- PDF (2.46 MB)

Updated on: 12/26/2022 17:23