Working Paper Series no. 891: Stock Return Predictability: comparing Macro- and Micro-Approaches

Economic theory identifies two potential sources of return predictability: time variation in expected returns (beta-predictability) or market inefficiencies (alpha-predictability). For the latter, Samuelson argued that macro-returns exhibit more inefficiencies than micro-returns, as individual stories are averaged out, leaving only harder-to-eliminate macro-mispricing at the index-level. To evaluate this claim, we compare macro- and micro-predictability on US data to gauge if the former turns out higher than the latter. Additionally, we extend over time the methodology of Rapach et al. (2011) to disentangle the two sources of predictability. We first find that Samuelson's view appears incorrect, as micro-predictability is not structurally lower than macro-predictability. Second, we find that our estimated alpha- and beta-predictability indices are coherent with their corresponding theoretical implications (the alpha-predictability being high in times of bullish markets, and the beta-predictability in recessive periods), thus suggesting that the two mechanisms are at play in our dataset.

Are macro-stock returns easier to predict than micro-returns? In other words, can we forecast more precisely next-period returns at the index-level compared to the sector- or to the firm-level (especially considering the low level of predictability usually found in the literature)?

To guide our analysis, Samuelson (Jung and Shiller, 2005) had the intuition that macro-returns exhibited more inefficiencies than micro-returns. His reasoning was that individual efficient stories (for example linked with firms’ future profitability) were averaged out in the aggregate, leaving only harder-to-eliminate macro-mispricing at the index-level. As a consequence, if return predictability stems from market inefficiencies, for example from speculative bubbles or from financial frictions, then we should observe higher predictability at the macro-level compared to the micro-level.

However, there are potentially several interpretations of return predictability. High level of predictability can indeed reflect market inefficiencies (the so-called “alpha-predictability”), but it can also mirror variations in aggregate risk aversion (“beta-predictability”). More precisely, Cochrane (2008) argues that, as investors' risk aversion varies over time, expected returns vary as well. Taking into account time variation in expected returns along the business cycle can therefore generate return predictability even in the absence of market inefficiencies. As a result, alpha-predictability should be especially present in times of elevated market inefficiencies (e.g. during speculative episodes), while empirical papers argued that beta-predictability should be at play during economic downturns (Henkel et al., 2011, Dangl and Halling, 2012).

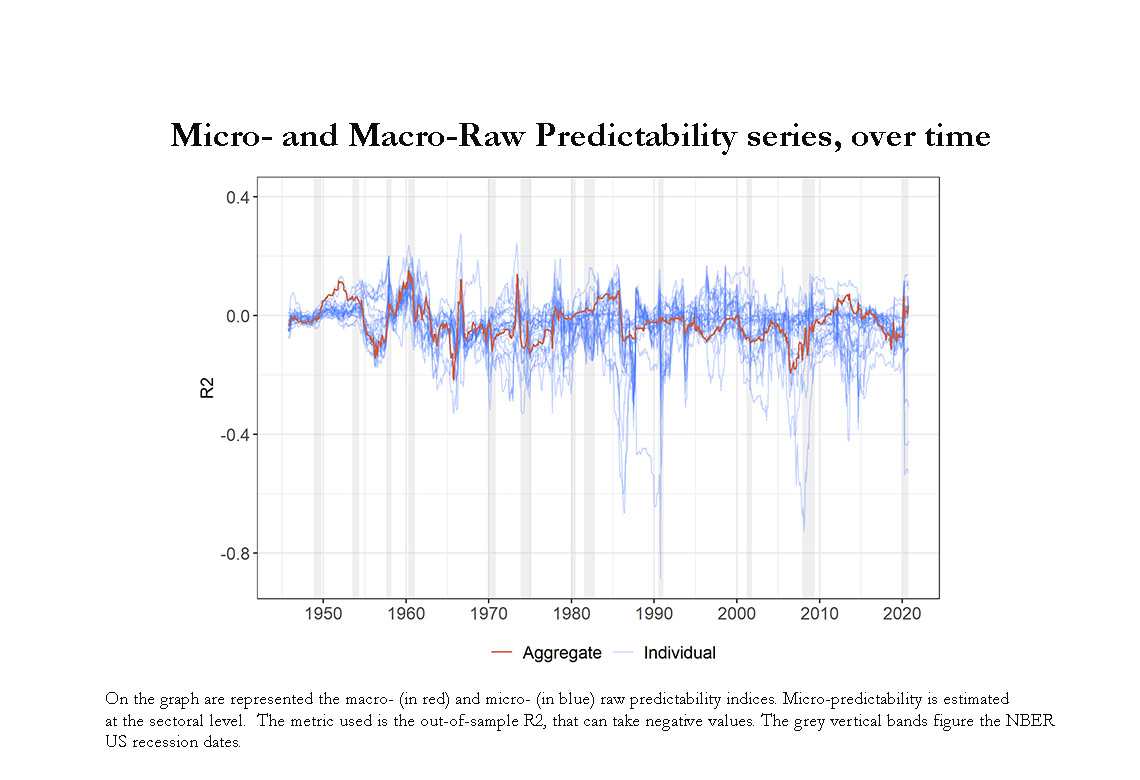

To evaluate these different claims, we compare, over time, macro- and micro-predictability on US data to gauge if the former turns out higher than the latter. Additionally, we extend over time the methodology of Rapach et al. (2011) to disentangle the two sources of predictability. We first find, as indicated on the figure below, that Samuelson's view appears incorrect, since micro-predictability (in blue) is not structurally lower than macro-predictability (in red). Second, we find that our additional indices, that are supposed to reflect the two sources of predictability, are consistent with their corresponding theoretical implications (the alpha-predictability being high in times of bullish markets, and the beta-predictability in recessive periods), thus suggesting that the two mechanisms are at play in our dataset. Eventually, from a policy perspective, the alpha-predictability index can be a useful metric in the financial stability toolkit to spot periods of market exuberance.

Download the PDF version of this document

- Published on 11/10/2022

- 53 pages

- EN

- PDF (1.95 MB)

Updated on: 11/10/2022 14:51