Working Paper Series no. 665: Tax Simplicity and Heterogeneous Learning

Philippe Aghion, Ufuk Akcigit, Matthieu Lequien & Stefanie Stantcheva study how strongly individuals respond to tax simplicity and how they learn about the complexities of the tax system, using new French tax returns data on the self-employed from 1994 to 2012. France has three fiscal regimes for the self-employed, which differ in their monetary tax incentives and in their tax simplicity. These regimes are subject to eligibility thresholds: authors find large excess masses (bunching) right below the latter. The regimes impact different agents heterogeneously and have changed extensively over time. Aghion, Akcigit, Lequien & Stantcheva estimate a large value for tax simplicity of up to 650 euros per year per individual. Tax complexity has sizable costs: agents are not immediately able to understand what the right regime choice is, leave significant money on the table, and learn over time. These costs are “regressive”, impacting more the uneducated, low income, and low skill agents.

We study how strongly individuals respond to tax simplicity and how they learn about the complexities of the tax system. We focus on the self-employed, who can more easily adjust to tax incentives and whose responses directly stem from their own understanding of the tax system. We use new French tax returns data from 1994 to 2012. France serves as a good quasi-laboratory: it has three fiscal regimes for the self-employed, which differ in their monetary tax incentives and in their tax simplicity. Our methodology builds on the rich literature on the effect of taxes on income. In particular Saez (2010) found evidence of bunching around the first kink of the US Earned Income Tax Credit, but concentrated solely among the self-employed. Chetty et al (2011) show bunching at kinks of the Danish tax system and Kleven and Waseem (2013) do the same on Pakistanese tax data.

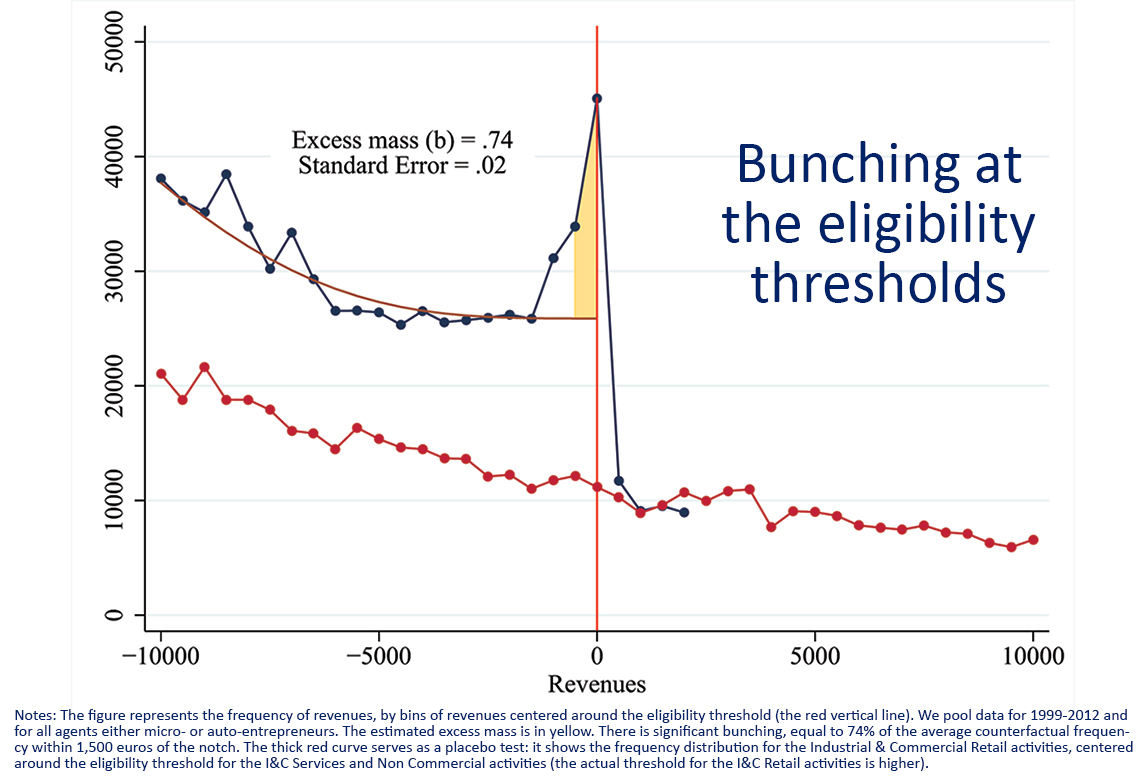

Two key features are that, first, these regimes are subject to eligibility thresholds; we find large excess masses (bunching) right below the latter (Figure). Second, the regimes impact different agents heterogeneously and have changed extensively over time. Taken together, these two key elements give us measures of tax responses (the bunching) as well as the variation needed to jointly estimate a value of tax simplicity and taxable income elasticities. They also give us an opportunity to study how individuals learn about and respond over time to changing policy parameters. We estimate a large value for tax simplicity of up to 650 euros per year per individual depending on the regime and activity. We also find sizable costs of tax complexity; agents are not immediately able to understand what the right regime choice is, leave significant money on the table, and learn over time. The cost of complexity is “regressive” in that it affects mostly the uneducated, low income, and low skill agents. Agents who can be viewed as more informed and knowledgeable (e.g., the more educated or high-skilled) are more likely to make the correct regime choice and to learn faster.

Download the PDF version of this document

- Published on 03/01/2018

- 74 pages

- EN

- PDF (2.65 MB)

Updated on: 03/01/2018 09:15