Working Paper Series no. 922: Using Short-Term Scenarios to Assess the Macroeconomic Impacts of Climate Transition

This paper proposes a set of short-term scenarios that reflect the diversity of climate transition shocks -- increase in carbon and energy prices, increase in public or private investment in the low-carbon transition, increase in the cost of capital due to uncertainty, deterioration of confidence, accelerated obsolescence of part of the installed capital, etc. Using a suite-of-model approach, we assess the implications of these scenarios for the dynamics of activity and inflation. By considering multiple scenarios, we therefore account for the uncertainty around future political decisions regarding climate change mitigation. The results show that the magnitude and duration of the macroeconomic effects of the transition to carbon neutrality will depend on the transition strategy chosen. While a number of short-term scenarios being inflationary or even stagflationary, there are also factors that could curb inflation and boost economic growth.

As the world shifts towards a low-carbon economy, economic agents need to understand the risks and opportunities associated with this major change. Existing empirical evidence - mainly based on carbon taxation - shows relatively limited impacts of transition policies on the macroeconomy. However, these empirical assessments are based on past observations of periods in which the transition was only modest and carbon price increases were limited. They may thus ignore transmission mechanisms that will emerge in the future when transition risks are much more material.

The present research builds upon this existing work and brings three main novelties. First, instead of considering emission-pricing policies only, we develop eight different short-term scenarios, which cover representative cases of a wider spectrum of transition shocks. Second, it considers extremely adverse, though probable, narratives in order to assess credibly the largest impacts that can be expected from transition shocks. Third, by exploring shocks of different natures (positive/negative supply and demand drivers), it accounts for the uncertainty around the transition paths, providing a quantification of the range of likely effects over short-term horizons.

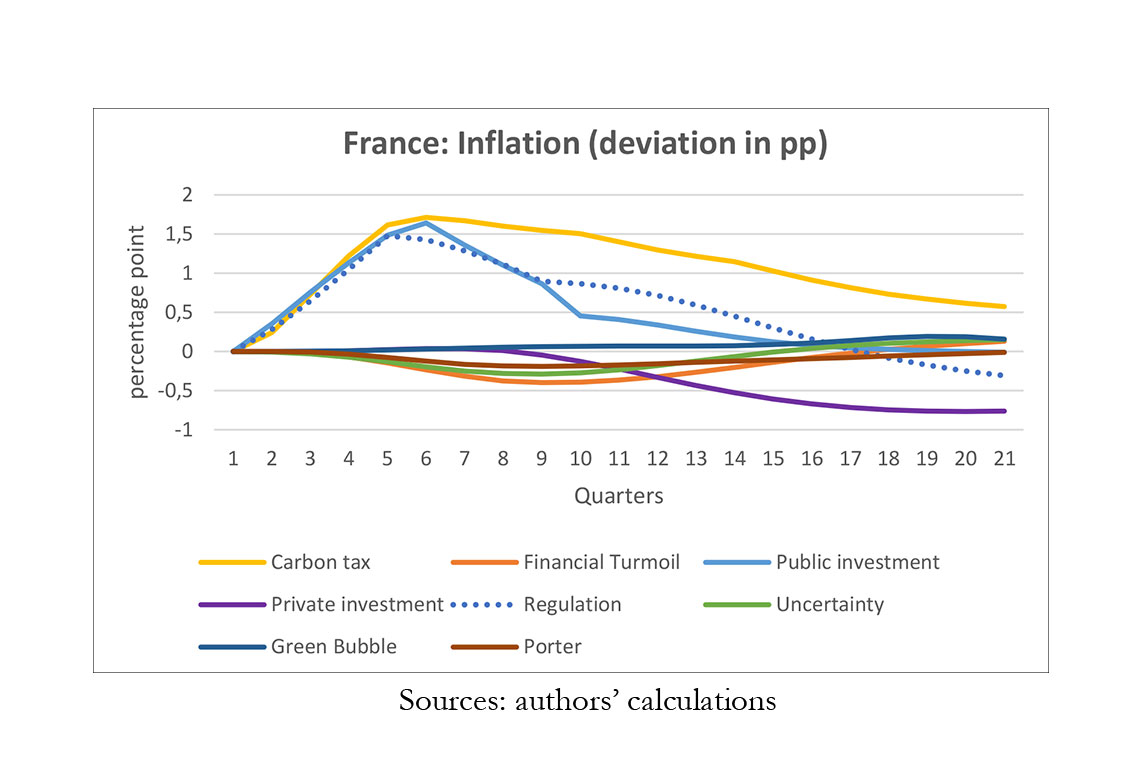

We start with detailed narratives that provide a story line behind each scenario: we first assess the consequences of negative supply shocks, such as a disorderly carbon taxation or a sudden tightening of environmental regulations. We also analyze negative demand shocks, like uncertainty on transition policies, or a scenario of financial market turmoil, which accounts for stranded assets due to environmental regulation. In addition, we consider positive demand shocks, such as a boom in green public investment or a green bubble, spurred by investors’ exuberance for transition-related assets. Lastly, we simulate the effects of positive supply shocks, like a boom in green private capital expenditures and a scenario of green innovation that spills over to aggregate productivity.

Contrary to long-term scenarios, whose dynamics are generally smooth and gradual, the short-term scenarios simulated in this paper show how the transition to a low-carbon economy can become critical for policy-makers to achieve their objective to stabilize growth and inflation and ensure financial stability.

Our results show that the magnitude and duration of the macroeconomic effects of the transition to carbon neutrality will depend on the transition strategy chosen. A positive demand shock - the one usually presented in the orderly/optimistic scenarios - could have a positive effect on economic activity but also inflationary implications. In contrast, negative demand shocks - triggered by uncertainty or financial market turbulence - could be disinflationary and recessionary. On the supply side, positive shocks such as private investment boom or a green innovation scenario could stimulate economic growth and reduce inflation if they foster technological progress and productivity. On the contrary, if they are negative, triggered for example by higher costs due to carbon taxation or regulation, stagflationary episodes could appear. Scenarios based on financial turmoil or mispricing could endanger both financial and price stability. These different scenarios also illustrate the importance of private and public investment and of the support for households in limiting the macroeconomic cost of the transition.

From a policy perspective, our results show that the earlier and more gradually the transition is implemented, the lower the risks to macroeconomic stability. By contrast, if not properly anticipated, the transition to carbon neutrality could also lead to a rapid succession of shocks, increasing macroeconomic volatility. This increased volatility could then disrupt the decisions of economic agents, weaken inflation expectations and therefore constitute a real challenge for the conduct of a monetary policy adapted to the challenges of transition.

Download the PDF version of this document

- Published on 09/06/2023

- 55 pages

- EN

- PDF (2.07 MB)

Updated on: 09/06/2023 12:17