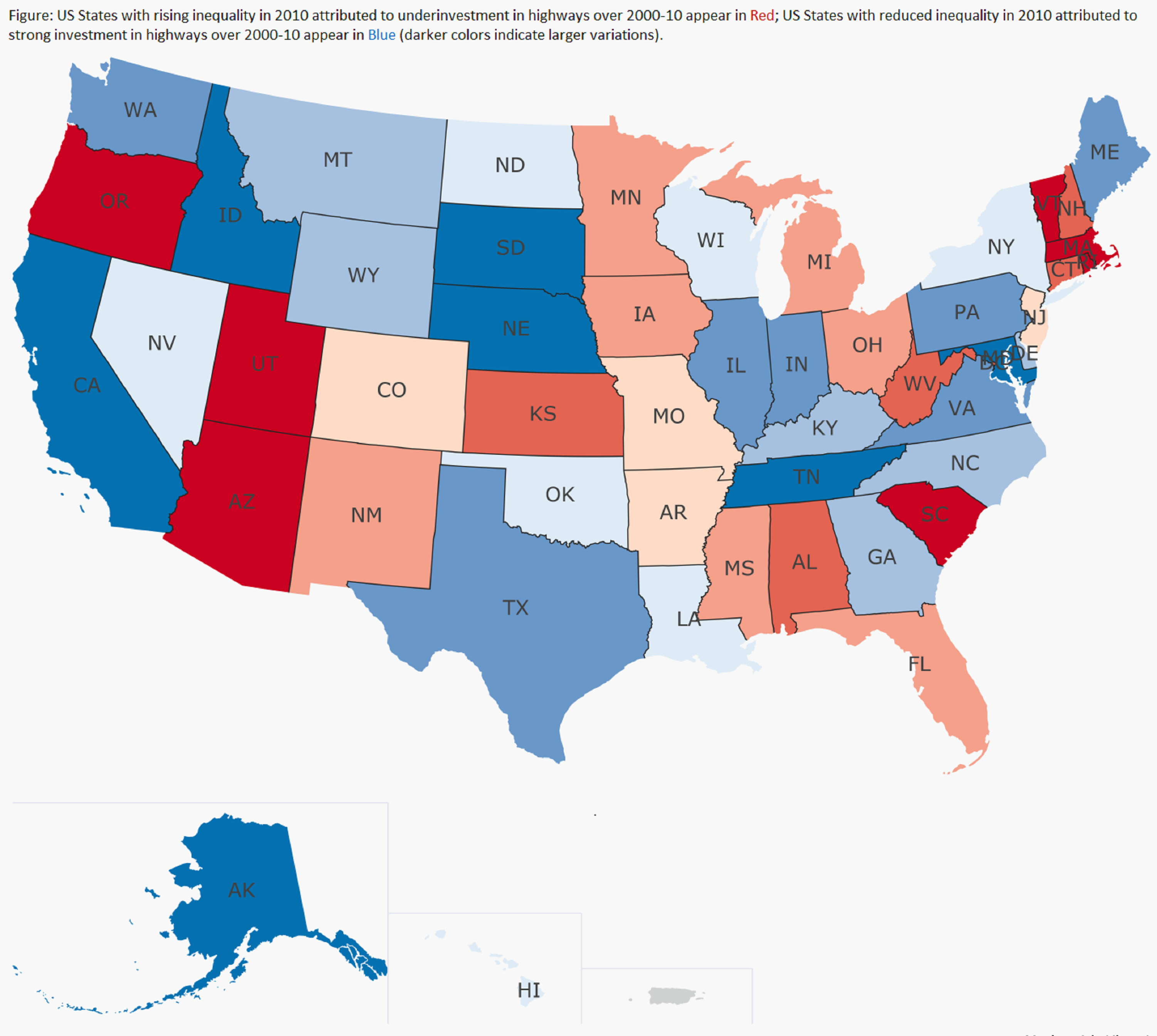

Working Paper Series no. 624: To What Extent Can Long-Term Investment in Infrastructure Reduce Inequality?

Long-term investments in infrastructure are now at the center of many policy initiatives worldwide. In particular, many global institutions are betting on the development of infrastructure to pave the way for future growth, both in developed countries as well as in developing countries. The most noteworthy initiatives linked to infrastructure that have attracted a lot of interest in the media and are debated at a policy-making level include the launch of the Asian Infrastructure Investment Bank (AIIB) under the leadership of China. In Europe, the Juncker Plan as well as several actions that have been undertaken by the European Investment Bank (EIB) and by the European Bank for Reconstruction and Development (EBRD) to promote infrastructure investment can be seen as a vehicle to resuscitate the European Union project. In addition, the World Bank, through its Global Infrastructure Facility (GIF), has designed a platform to channel funds to rich as well as developing countries, while numerous global investment banks such as Goldman Sachs and J.P. Morgan have set up infrastructure investment divisions within their operations. Infrastructure financing also surfaced as a major topic during the recent US election, with explicit infrastructure plans proposed by both the Clinton and Trump camp.

Download the PDF version of this document

- Published on 03/27/2017

- EN

- PDF (2.96 MB)

Updated on: 03/28/2017 17:50