Rue de la Banque no. 49: Why is the Interest Rate an Inverted Leading Indicator of Macroeconomic Activity in the United States?

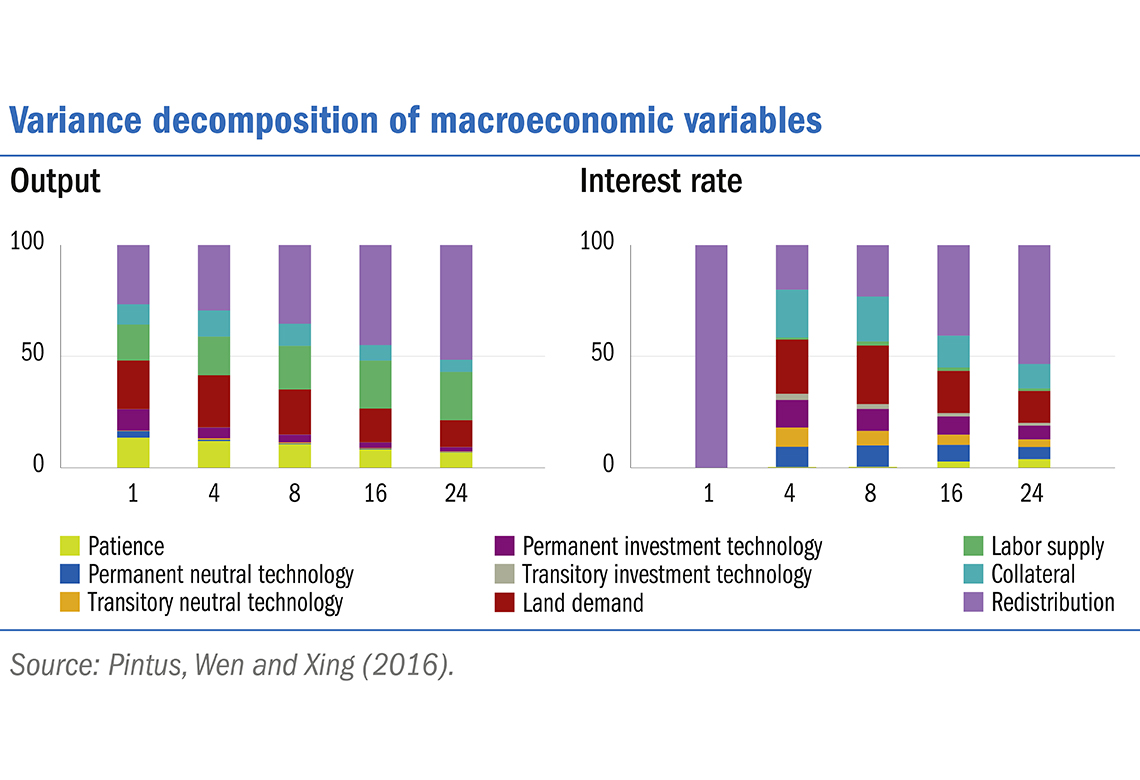

The real interest rate at which US firms borrow funds to finance their investment and other expenses has two striking features. It is low when GDP is high (and vice versa) and it is an inverted leading indicator of real economic activity. Low interest rates today forecast future booms in GDP, consumption, investment, and employment. This Rue de la Banque shows that inherent to such correlations is a redistribution channel through which resources typically flow from lending entities to borrowing firms during expansions. Such a redistribution channel is driven by expectations about future levels of the borrowing cost, which accounts for a large share of the volatility of output, investment and other macroeconomic variables during business cycles.

Download the PDF version of this document

- Published on 10/09/2017

- 5 pages

- EN

- PDF (891.33 KB)

Updated on: 12/14/2017 17:34