Working Paper Series no. 625: Can Fiscal Budget-Neutral Reforms Stimulate Growth? Model-Based Results

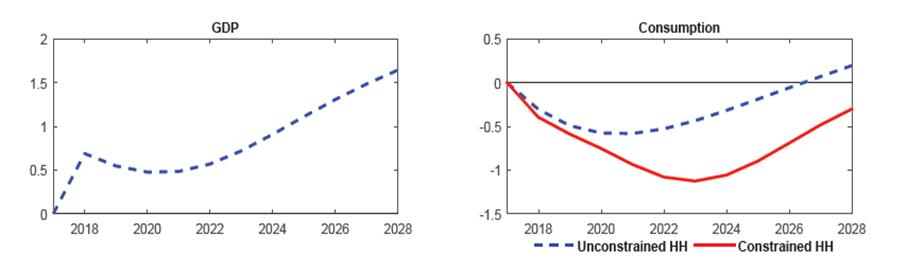

Figure: Output and redistribution effects of a revenue-spending mixed budget-neutral reform

Since the start of the global financial crisis, fiscal policy issues have been at the core of the policy debate and the subject of numerous academic papers. Most of the studies so far have focused on the stance of fiscal policy and the size of fiscal multipliers, following empirical (see, for example, Blanchard and Leigh [2013] and Alesina et al. [2015]) or theoretical approaches (as, among others, Freedman et al. [2010], Christiano et al. [2011] and Coenen et al. [2012]). More recently, however, the debate shifted towards the composition aspect of fiscal policy, for a given fiscal stance (see Furman [2016] for a review on the recent debate on fiscal policies). This evolution partly stems from the fact that, in the aftermath of the crisis, many countries have experienced strongly disappointing growth performance while facing limited fiscal space, which constrained the possibility of moving towards more accommodative fiscal stances to support growth. Against this background, alternative fiscal growth drivers should not be ignored.

The aim of this paper is to evaluate the impact on economic fluctuations of changes in the fiscal composition while keeping the ratio of the fiscal budget to GDP balanced. Particular attention is devoted to the international dimension of these reforms and to the interaction between fiscal and monetary policy decisions. Budget-neutral reforms, i.e. changes in the composition of fiscal revenue and spending that do not modify the total government budget with respect to GDP, have been proposed and discussed in recent policy debates.

Against this background, our objective is to further inform this growing policy debate by presenting results from a multi-country DSGE model on the macroeconomic impact of changes in fiscal composition while keeping the fiscal budget balanced. This is done using a three-country specification of the Global Integrated Monetary and Fiscal model (henceforth GIMF) calibrated at yearly frequency.

Throughout the paper, the analysis concentrates on the most growth-enhancing budget-neutral fiscal reforms selected first by separating fiscal revenues from spending and second by mixing the two budget sides. It is important to notice that our selection criterion will be GDP growth and not a measure of welfare. We claim that this selection criterion will help setting a clear upper bound to guide the policy debate. In line with this reasoning, we will deliberately select compositional fiscal changes maximizing GDP growth without relying extensively on the use of non-distortionary fiscal instruments (i.e. lump-sum taxes or transfers), which are barely implementable in reality. Reforms are supposed to be permanent (and fully credible) shocks in a given country to one (or a combination) of the eight fiscal instruments, normalized to 1% of GDP. Changes in one of the fiscal instruments are then compensated by one (or a combination) of the remaining seven instruments to maintain the ex-ante budget unaltered. We assume that these unexpected changes in fiscal composition are made during normal economic times. To our knowledge this is the first paper quantitatively and comprehensively analysing domestic and international effects of budget-neutral fiscal reforms within a multi-country DSGE model.

To keep the analysis tractable, we focus on three specific policy experiments. First, we concentrate on the fiscal revenue side. We run a simulation in which labor and capital taxes are cut, compensated by an increase in consumption tax. This scheme is sometimes referred to as fiscal devaluation in the literature. This strategy is generally considered in a country seeking to regain international competitiveness to boost the external trade channel without being able to devaluate (e.g. countries belonging to a monetary union). However, as explained by Farhi et al. [2014] for a fiscal devaluation to mimic standard nominal exchange rate devaluation, in some environment, it is necessary to do more than just increase value-added tax and reducing payroll taxes. This is also the case in the reform we consider, which on impact will generate a real exchange rate appreciation. To avoid confusions, we will refer to this reform as incomplete fiscal devaluation. Second, we focus separately on the spending side of the fiscal budget. We look at the effects of a fall in government consumption compensated by a rise in public investment. In other words, this experiment would consist in deploying government resources towards the most productive outlets (those that are, for instance, complementary to private investments). Third, based on lessons from the previous simulations, we consider the most growth enhancing mix of revenue and spending reforms. We look at the effects of an increase in government investment of 1 pp of GDP compensated by an increase in both labor and consumption taxes. The real income gain after one year is of 0.7 pp of GDP, though it declines in the following years (the level of GDP is increased by 1.6% after ten years). This reform is the one that presents the largest positive effect on output. On impact, the public debt to GDP ratio is reduced by 1pp and the deficit to GDP ratio is reduced by 0.2pp. However, the benefits are not symmetrically distributed across agents: liquidity-constrained households being the most negatively impacted in terms of consumption.

Finally, to better understand the relevance of those three budget-neutral reforms we investigate (i) the role of the monetary policy for both the domestic and the international responses, by examining the size of fiscal multipliers and the effects of those reforms when monetary policy is constrained and irresponsive for two years, due for example to the Zero Lower Bound (ZLB henceforth), and (ii) international spillovers from one country to the other. The main results suggest, first, that the absence of monetary policy reaction leads to much stronger multipliers, around twice the impacts obtained with monetary policy tightening. Second, we do not get large cross-border spillovers for such budget-neutral reforms. However, reforms coordinated across all countries in periods of accommodative monetary policy do have considerably amplified domestic effects.

Download the PDF version of this document

- Published on 04/14/2017

- 35 pages

- EN

- PDF (493.62 KB)

Updated on: 04/18/2017 12:43