Working Paper Series no. 837: The channels of banks’ response to negative interest rates

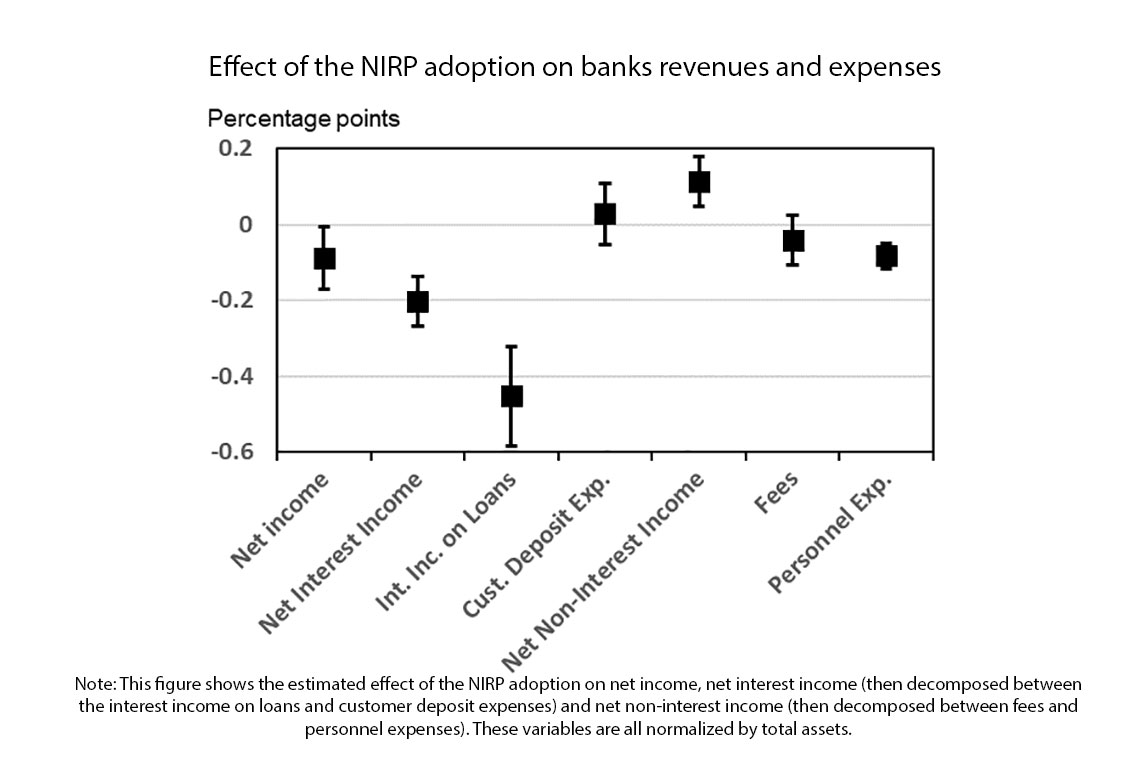

Faced with a potential zero lower bound on deposit interest rates, how do banks pass on the fall in net interest income due to negative interest rates? This paper aims to investigate the different channels of banks’ responses to negative interest rates using a detailed breakdown of the profit and loss account of 3637 banks in 59 countries from 2011 to 2018. We find that the decrease in interest income due to negative interest rates is mitigated by an increase in non-interest income, but only partially. We find that banks respond to that shock by reducing the interest paid on non-customer deposit liabilities and their personnel expenses. We also show that banks’ responses are not instantaneous and that they adjust their response as negative interest rates persist over time such that how long negative interest rates are implemented matters. Finally, our results suggest that large banks with higher deposits and higher leverage ratios are the most affected by the implementation of negative interest rates.

Since 2012, several central banks in Europe and the Bank of Japan have introduced negative policy interest rates. The effectiveness of such policy depends crucially on the pass-through to the lending and deposit rates. However, it seems that the pass-through of negative interest rates to deposit rates is not perfect because of their downward rigidity. At least, two reasons can explain the reluctance of banks to introduce a negative deposit rate: (i) some legal constraints and (ii) the fear of a “cash rush”. Therefore, negative interest rate policies (NIRP) could negatively affect banks’ profitability by compressing net interest margins due to the lower bound for deposit rates.

In order to preserve their profitability and offset the fall in net interest margins, commercial banks face different options: (i) foster credit supply to mitigate the reduction in margins with an increase in volumes, (ii) redirect their income from interest products towards non-interest sources (such as fees and commissions), (iii) reduce their operating costs (such as salaries and employee benefits), by focusing more on digital banking for instance, or (iv) reduce the interest rate paid on non-customer deposit liabilities.

The analysis draws on yearly bank-level data for 3637 banks in 59 countries between 2011 and 2018. Our identification relies on the comparison between banks in the 25 countries that have adopted negative interest rates and those in the remaining countries that have not. We find that negative interest rates reduce banks’ net interest income by around 0.2 percentage points. Our results confirm evidence of the existence of a zero-lower bound on deposit interest rates: banks located in countries that have adopted NIRP are reluctant to charge a negative interest rate on customer deposits. We also find that banks increase their net non-interest income to offset the effects of negative interest rates on their net interest income. Our results indicate that the increase in banks’ net non-interest income, in response to NIRP, is related to a reduction in non-interest expenses rather than to an increase in fees and commissions. We find a 0.1 percentage point reduction in personnel expenses following the NIRP implementation.

Download the PDF version of this document

- Published on 10/18/2021

- 48 pages

- EN

- PDF (1017.32 KB)

Updated on: 10/18/2021 14:29