Working Paper Series no. 868: On the Choice of Central Counterparties in the EU

New regulations promote the role of Central Counter-Parties (CCPs) as insurers of counterparty risk to stabilize derivative markets. Focusing on the demand side, we investigate how pairs of dealers choose the CCP on which they clear a given transaction. We use transaction data on three main CDS indices and focus on major dealers who are members of the two EU CCPs. Descriptive analysis shows that dealers do not optimize their positions across CCPs. Then, we build and test a reduced form model of CCP's choice. Differences in transaction size, two indicators of CCP's robustness and activities, squared positions to account for dealers' risk aversion, and market volatility affect this choice, but not the collateral costs, proxied by the dealers' positions.

The 2009 G-20 Pittsburgh summit has been pushing for profound changes in the organization of markets for derivatives to limit the complexity and opacity of contracts between financial institutions and to better control contagion effects. For that purpose, regulators mandated the use of Central Counter-Parties (CCPs) for transactions on major standardized derivatives. The main economic function of a CCP is to insure each party in a transaction against the default of its counterparty -the counterparty risk- during the whole life of the derivative contract. CCPs are thus called to play a crucial role to safeguard financial stability. Leaving aside political concerns, there is an economic debate regarding the appropriate level of competition for central clearing. Central clearing generates network effects and presents features of natural monopoly calling for a single CCP clearing similar assets. Furthermore, competition between CCPs could lead to a race to the bottom regarding their risk management practices, potentially generating instabilities. The benefits of a single CCP, however, may be outweighed by monopoly rents. Weighing the benefits and costs of competition between CCPs is not easy explaining why there is no unanimous regulatory doctrine between the US and the EU.

To shed light on the effect of the multiplicity of CCPs, we investigate how major EU dealers effectively choose the CCPs on which they clear their transactions. These dealers are members of the two EU CCPs clearing three main CDS indices and use them alternatively for clearing their transactions. We test whether their choice is influenced by CCPs' fees, the cost of exposure to the CCP, and the cost of collateral. These factors depend on the CCPs' risk management policies, in particular the setting of margins and contributions to the default fund and their adjustment to the market conditions. According to our results, the major dealers in our sample are not so much concerned with collateral costs but rather care about the soundness of the CCPs. This suggests CCPs have no incentives to engage in race-to-the-bottom policies to attract major dealers.

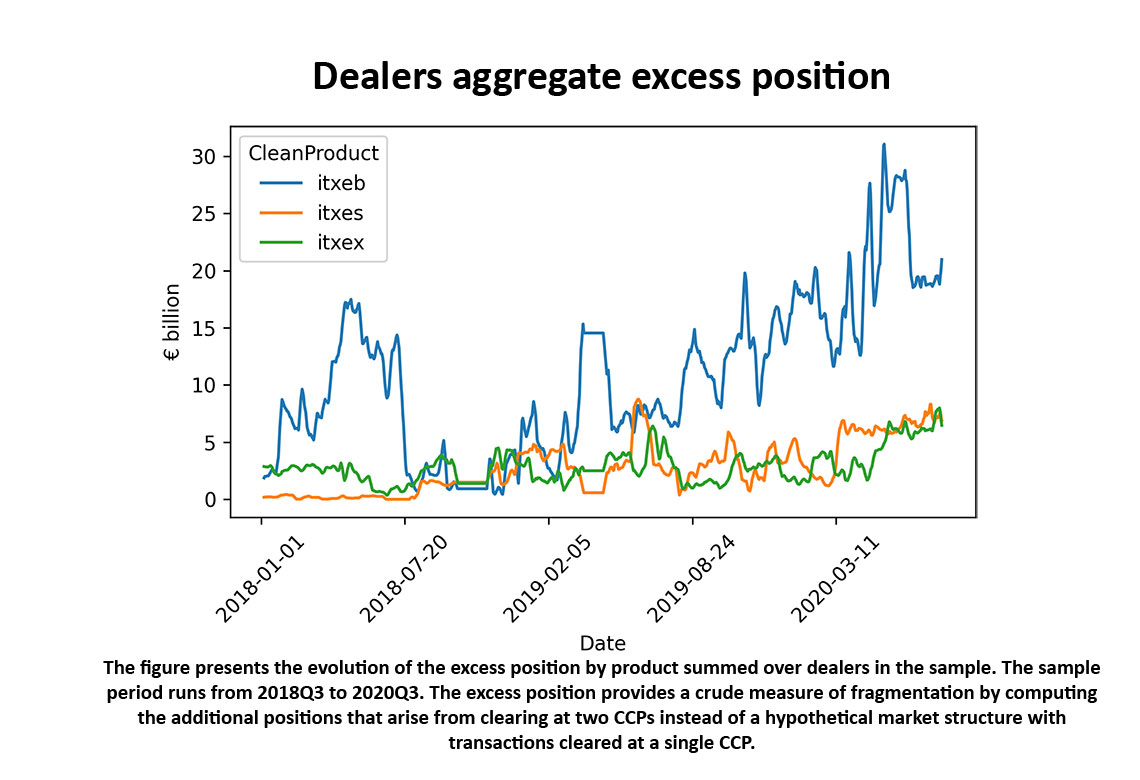

Our analysis uses transaction data reported under EMIR to Banque de France. The 12 dealers from the study are members of the two EU CCPs, LCH SA and ICE-EU, and all of them except one are major systemic institutions. When a pair of such dealers enters into a transaction, it must choose a CCP to clear it. Descriptive statistics highlight that the choice of CCP is segmented since a substantial proportion of dealers' pairs, around 35%, always choose to clear at a single CCP. They also indicate that dealers do not seem to optimize the additional cost of collateral stemming from clearing at two CCPs. A simple test of dealers' choice of CCP based on the sign of their positions shows that they do not seem to choose their CCP to decrease their position. Furthermore, as Figure 1 depicts, the current market structure with two CCPs generates up to €35bn more of dealers' positions in absolute value for the largest CDS index compared to a hypothetical market structure with a single CCP.

We build and estimate a reduced form model to investigate the determinants of the CCP's choice by dealers. The model assumes pairs' decisions result from an evaluation and comparison of the costs of clearing on each CCP. These costs fall into three categories: fees, the cost of exposure to the CCP, and the cost of collateral. Which CCP is chosen by a pair significantly depends on the size of the transaction being cleared, two indicators on the CCPs' robustness, the dealers' squared positions, and the volatility index. It does not relate to the buyer and seller's positions. The absence of significant relation between buyer or seller's positions and the choice of CCP suggests that collateral costs do not drive this latter.

Download the PDF version of this document

- Published on 03/07/2022

- 43 pages

- EN

- PDF (691.07 KB)

Updated on: 03/07/2022 18:39