Working Paper Series no. 836: The Cognitive Load of Financing Constraints: Evidence from Large-Scale Wage Surveys

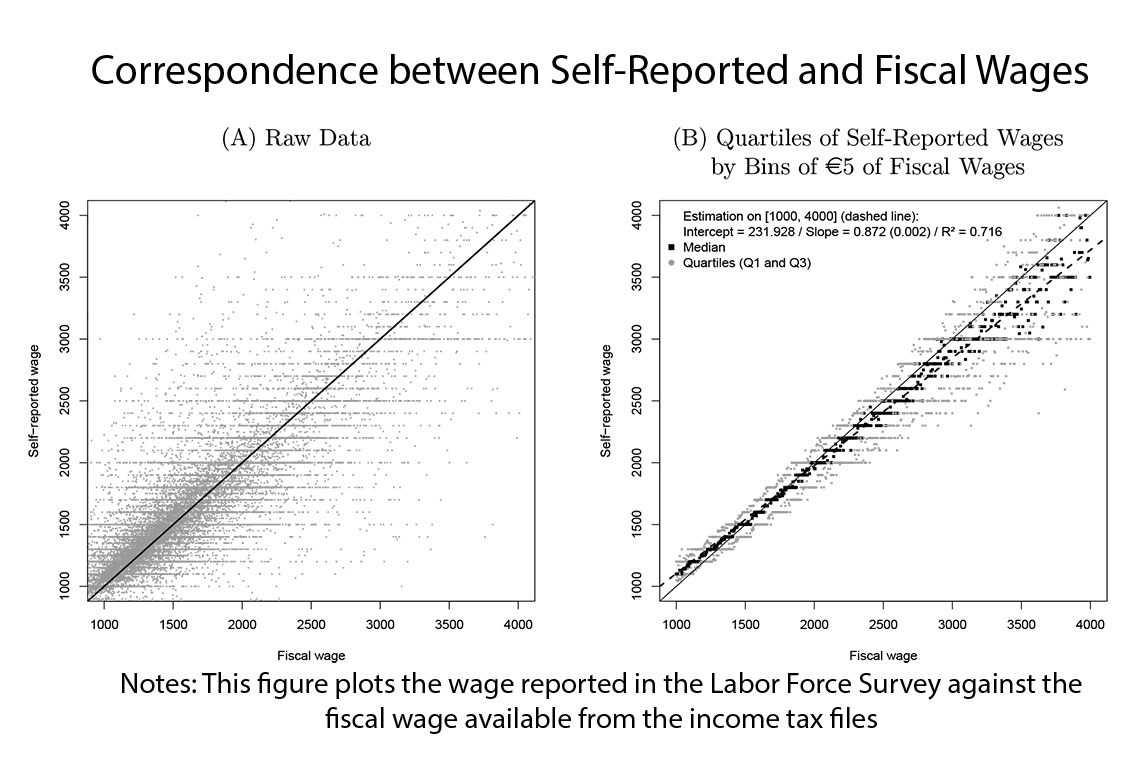

In this paper, we take advantage of the implicit cognitive exercise available in standard Labor Force Surveys to propose a new indicator of financing constraints which is based on the cognitive load they generate (Mullainathan and Shafir, 2013). Survey respondents are requested to report their monthly wages, which we compare to their administrative, fiscal counterparts. We propose a well-defined index of worker-level uncertainty, which filters out their potential rounding behavior and reporting biases. We estimate it using unsupervised ML/EM techniques and find that workers tend to perceive their own wages with a degree of uncertainty of around 10%.

Through the lens of a simple rational signal extraction model, this amounts to estimates of workers' attention ranging from 30% to 84% depending on their wage, education, tenure and gender. Most importantly, we show that the attention of the lowest paid 30% of workers is cyclical and increases steadily by 17 percentage points in the ten days preceding payday, before immediately dropping on that day, which, through the lens of a simple model, is indicative of end-of-month financing liquidity constraints. Furthermore, this pattern reveals that the cognitive cost induced by these financing constraints arises from the not too concave (or convex) costs of achieving high levels of attention, and the convex costs of maintaining it over time

Classic economic theory assumes that agents are fully rational and fully able to process information available in their economic environment. However, this framework has been increasingly challenged by a series of empirical and theoretical contributions, which reveal that many individual decisions are flawed and suffer from psychological biases. Faced with a complex informational environment and endowed with limited cognitive capacities, agents tend to focus their attention on the most relevant or the most salient characteristics of their economic environment, while they pay less attention to other characteristics or misunderstand them.

A growing body of literature in psychology, economics and cognitive sciences further suggests that the degree of inattention is related to the overall “cognitive load” of agents and affects different dimensions of individuals' decision-making and performance. We contribute to this literature by proposing an original way to measure the cognitive load in the population of French wage earners and by documenting its monthly fluctuations in different populations of workers. To that end, we leverage large-scale data from the French Labor Survey and reinterpret the items requesting workers to report their own wage as a cognition exercise enabling us to propose a well-defined and direct measure of workers' cognitive load. More precisely, we compare this self-reported wage with its fiscal counterpart and propose a structural mixture model, which delivers a well-defined index of worker-level uncertainty. Our method also addresses the issues raised by potential perception or reporting biases and rounding.

We find that over our period of analysis (2005 to 2015) workers tend to perceive their own wage with a degree of uncertainty of around 10%. Through the lens of a simple rational signal extraction model, this amounts to estimates of worker attention of between 30% and 84% depending on wage, education, tenure and gender. Secondly, the sampling scheme of the French LFS enables us to document whether attention evolves over time in different populations of workers. We find that the 30% lowest paid workers, who are most likely to struggle to make ends meet each month, exhibit suggestive patterns of cyclicality: their attention is minimal in the middle of the month, and increases steadily until payday, suggesting that their budget constraints become increasingly tight during this period of the month. Finally, their attention drops immediately once payday is reached. This feature of the cyclical evolution of attention is not compatible with a pure informational story, whereby workers are measured as more attentive simply because they are more informed. Conversely, we show that this feature of the data is well rationalized by a mechanism of credit constraints with costly budget constraint monitoring.

As workers are not incentivized to report accurate amounts in the LFS, we expect that they give information involving the least effort and simply provide approximate answers off the top of their heads. Our setting thus offers a precise depiction and quantification of the real-life variations in cognitive load associated with the potential necessity to keep a precise record of wages, for the general population of French workers. Overall, our results are indicative of the fact that the bottom 30% of workers in the wage distribution have a higher mental burden, especially in the last days before payday.

This proportion can furthermore be interpreted as an estimate of the share of the overall population suffering from liquidity financing constraints. Estimating the size of this population of agents who are at a kink of their intertemporal budget sets is important, as they typically have a high marginal propensity to consume, and are critical in heterogeneous agent macro models.

Download the PDF version of this document

- Published on 10/15/2021

- 63 pages

- EN

- PDF (2.34 MB)

Updated on: 10/15/2021 15:06