Working Paper Series no. 890: Consumption Inequality in the Digital Age

This paper studies how digitalization affects consumption inequality. We assemble a novel dataset of digital technology used in the production process, link it to US consumption data and establish a new stylized fact: High-income households consume a higher share of digitally produced products than low-income households. Building on this finding, we present a structural model in which digitalization affects consumption inequality in two ways: By a polarization of incomes and by a decline in the relative price of digitally produced goods. Both channels work in favour of high-income households. Calibrating the model to the US economy between 1960 and 2017, we demonstrate that the price channel has sizeable welfare effects and contributes the increase in consumption inequality that is caused by the effect of digitalization by around 25%.

Digital technology transforms our economy, as it fundamentally changes the way we consume and produce. The increased usage of computers and other digital assets in production has contributed to wage and employment polarization in the Western world. High-skilled workers have become more productive, whereas low-skilled or routine-intensive jobs have declined. As a result, the skill premium has increased, contributing to a rise in income inequality. However, progress in digital technology does not only affect wages: Sectors that rely more on digital capital in their production process can produce at a lower cost and offer lower prices to their customers. As consumption patterns differ across the income distribution, these price changes will affect rich and poor households differently and could either reinforce or counteract income changes. This paper studies how the increased usage of digital technology in the production process affects consumption inequality in the United States.

By combining household- and sector-level data, we establish that high-income households are the main beneficiaries of digitally-induced price changes, as they consume goods and services that are produced with a higher intensity of digital capital. Income and price changes thus work in the same direction, making the distribution of consumption more unequal, both in terms of consumption level but also in terms of share of ICT goods in total consumption. To assess how important the price changes are quantitatively, we present a structural growth model, which we calibrate to the US economy between 1960 and 2017. When explicitly including price changes, the effect of digitalization on consumption inequality is around 25% larger than what the income effect alone would suggest.

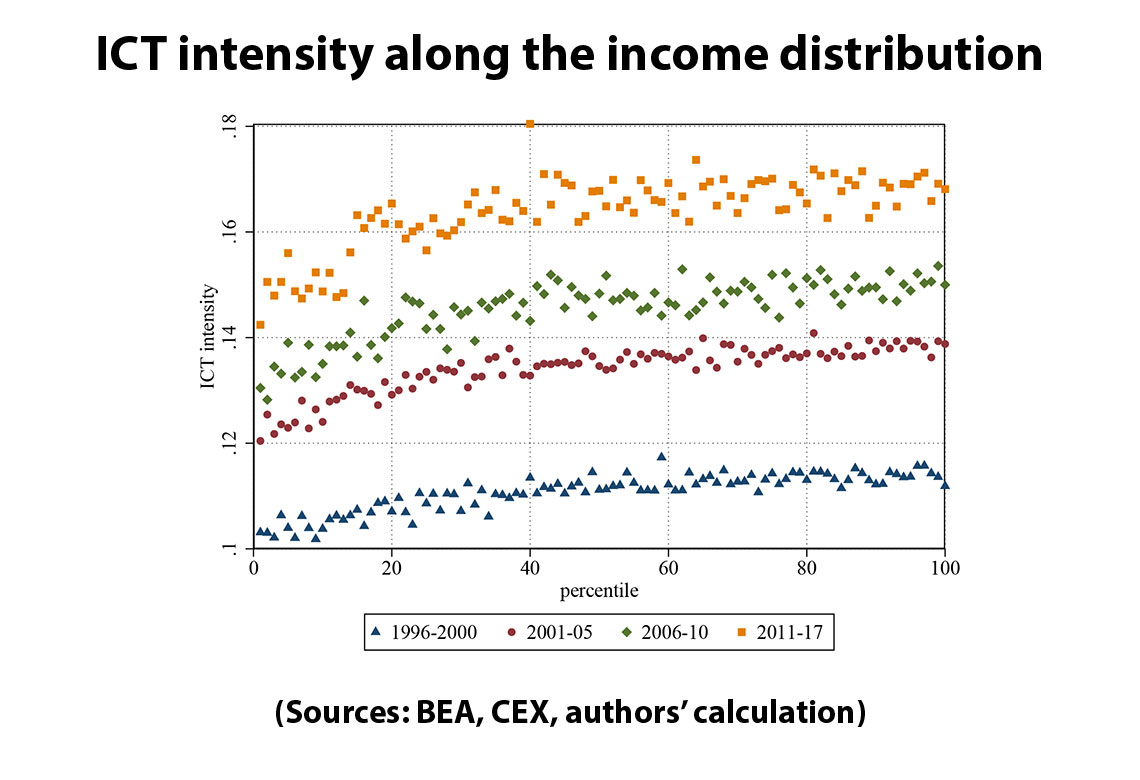

We pursue the following steps to measure digitalization in consumption: We first construct a digitalization measure on an industry level by considering which share of the capital stock of an industry consists of capital related to Information and Communication Technology (or ICT), such as computers, software and so on. In a next step, we consider the input-output structure of the US economy to construct the digitalization content of final goods. These final goods are then linked to consumption categories in the consumption expenditure survey. This yields a measure of ICT content in the production process for each consumption good. Together with the information of a household’s income, a consumption basket and the corresponding digital share of that basket can be computed along the income distribution. These results are depicted in Figure 1 below. In all considered time horizons, the ICT share is lower in particular for the bottom 30%, while the rest of the population displays a substantially higher share. Underlying this finding is the different consumption behaviour between groups: The poor spend a large share of their overall expenditures on food or textile which originate from industries with only little ICT content, while the rich spend much more on education or finance and insurance which relies more on digital technology in the production process. We also document that those consumption goods with higher ICT shares have also experienced lower consumer price inflation. Taken together, this implies that digitalization not only leads to more income polarization in the population, but also alters the purchasing power between groups, putting the poor part of the population at a disadvantage.

The second part of the paper constructs a structural model that aims to quantify the relevance of this price effect. We calibrate the model to match key moments of the data, such as differences in consumption behaviour between groups (see Figure 1), the rising skill premium and divergent relative prices between ICT intensive and non-intensive goods. Our simulation demonstrates that around 25% of the increase in the level of consumption inequality, can be attributed to relative price changes that favour the rich. The overall effect of digitalization on inequalities in terms of consumption level gets therefore substantially larger when considering the price effect as well.

Download the PDF version of this document

- Published on 11/09/2022

- 49 pages

- EN

- PDF (2.66 MB)

Updated on: 11/09/2022 10:15