Banque de France Bulletin no. 230: Article 2 Covid-19 and value chains

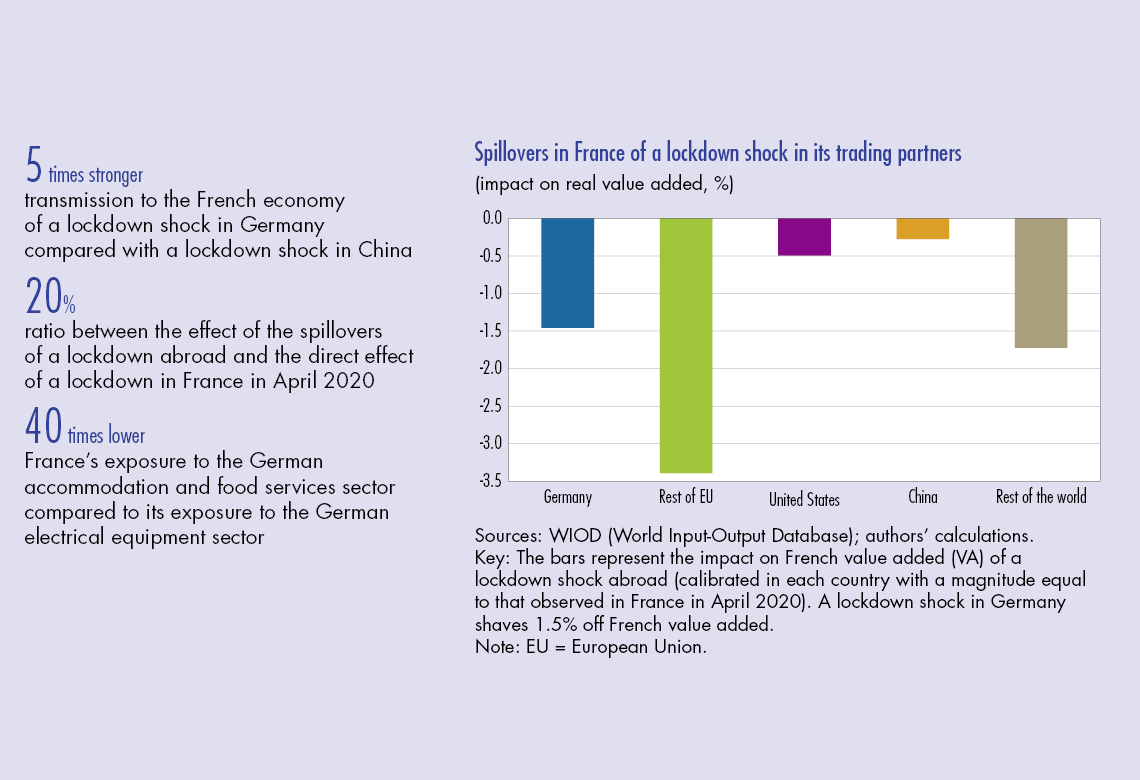

The lockdown measures put in place to contain the spread of the Covid-19 pandemic not only have a direct impact on the economies of the countries concerned, but also spillover to the rest of the world via value chains and external demand. A short-term analysis suggests that these international spillovers have a significant impact on France, albeit less strong than the internal shock caused by the lockdown. France is more exposed to lockdown shocks from the rest of the European Union and relatively less exposed to shocks from China. The most adverse situation for France would be that it suffer a supply shock (a fall in productivity caused by the health measures, or second wave) while the rest of the world emerges from the crisis, leading to a decline in France’s competitiveness.

This article addresses the international contagion effects of the lockdown measures implemented to contain the spread of the Covid-19 pandemic. After detailing the approach adopted and studying the strength of the transmission of the shocks to France, it presents the possible impact of a desynchronized deconfinement and the mechanisms at work according to the type of shock considered.

1 Approach

The effects of the lockdown measures applied abroad spread to the French economy through value chains and external demand. This international transmission means that the French economy is not only affected by the lockdown measures in France, but also by the lockdown shocks abroad, in particular in the sectors most exposed to the other confined countries.

In order to assess these effects, this article adapts the multi-country and multi-sector model developed by Devulder and Lisack (2020) to the context of the Covid-19 crisis (see Box). This production network model represents the interconnections linked to international value chains and highlights France’s vulnerabilities to shocks originating abroad. Countries are broken down into six blocks: France, Germany, the rest of the European Union (including the United Kingdom), the United States, China and the rest of the world. As this is a short-term analysis, it is assumed that labour input cannot be reallocated between the different economic sectors, and that producers have very few possibilities to substitute between their inputs.

To calibrate the lockdown shock at the nation-wide level, we use the impacts of the lockdown shock on sectoral activity in France estimated by the Banque de France (2020) for the month of April. These are broken down between supply and demand shocks using the breakdown put forward by the Observatoire français des conjonctures économiques (OFCE, 2020a). Finally, these shocks are set so as to obtain an aggregate effect on French value added, in the global lockdown situation at 30 April 2020, corresponding to the figure estimated by the Banque de France, i.e. –27%.

In order to measure the importance of the transmission of a lockdown shock from abroad to France (section 2), the same shock is used, as calibrated above, for each country. Subsequently (section 3), to study desynchronized lockdown scenarios, international variations in the intensity of lockdown are taken into account in the size of the shock. In this case, for simplification purposes, the sectoral distribution of supply and demand shocks in the other blocks of countries is assumed to be similar…

Download the PDF version of this document

- Published on 10/27/2020

- 9 pages

- EN

- PDF (306.31 KB)

Bulletin Banque de France 230

Updated on: 10/27/2020 16:48