Working Paper Series no. 601: Inspecting the Mechanism of Quantitative Easing in the Euro Area

Using new data on security-level portfolio holdings by investor type and across countries in the euro area, Ralph S.J. Koijen, François Koulischer,

Benoît Nguyen & Motohiro Yogo study portfolio rebalancing during the European Central Bank’s (ECB) purchase programme that started in March 2015. To quantify changes in risk concentration, they estimate the evolution of the distribution of duration, sovereign, and corporate credit risk exposures across investor sectors and geographies. They find that 70% of ECB purchases are sold by the foreign sector and that risk mismatch, if anything, reduces. Authors use an instrumental variables estimator to show that the average impact on yields was -13bp. They connect the portfolio rebalancing and price effects by estimating a sector-level asset demand system for government debt.

In response to growing concerns about a prolonged period of low inflation, the ECB announced the expanded asset purchase programme on January 22, 2015. The objective of the programme is to increase inflation to a level close to, but below, 2%. The recent literature on central bank asset purchase programmes (or “Quantitative Easing,” QE) has explored various channels through which unconventional policy can affect asset prices, inflation, and economic growth more broadly. To analyze and test the importance of these channels, the literature has however mostly focused on event studies by looking at the response of various asset prices around key policy announcements. We extend the literature by considering the effect of quantitative easing both on asset prices and portfolio holdings of investors. To do so, we use a new micro-level data set from the Eurosystem on security-level portfolio holdings of the major investor sectors in each country such as banks, insurance companies and pension funds (ICPF), and mutual funds. The data covers most financial securities such as equities, government bonds, corporate bonds, and asset-backed securities, both in- and outside of the euro area. We combine these data with security-level data on the holdings of the ECB in the context of its asset purchase programmes. These datasets combined allow us to study several key questions regarding the QE programme: Who holds risk in the euro area? How do holdings of risk change with QE? Who sells to the ECB? How does QE affect asset prices?

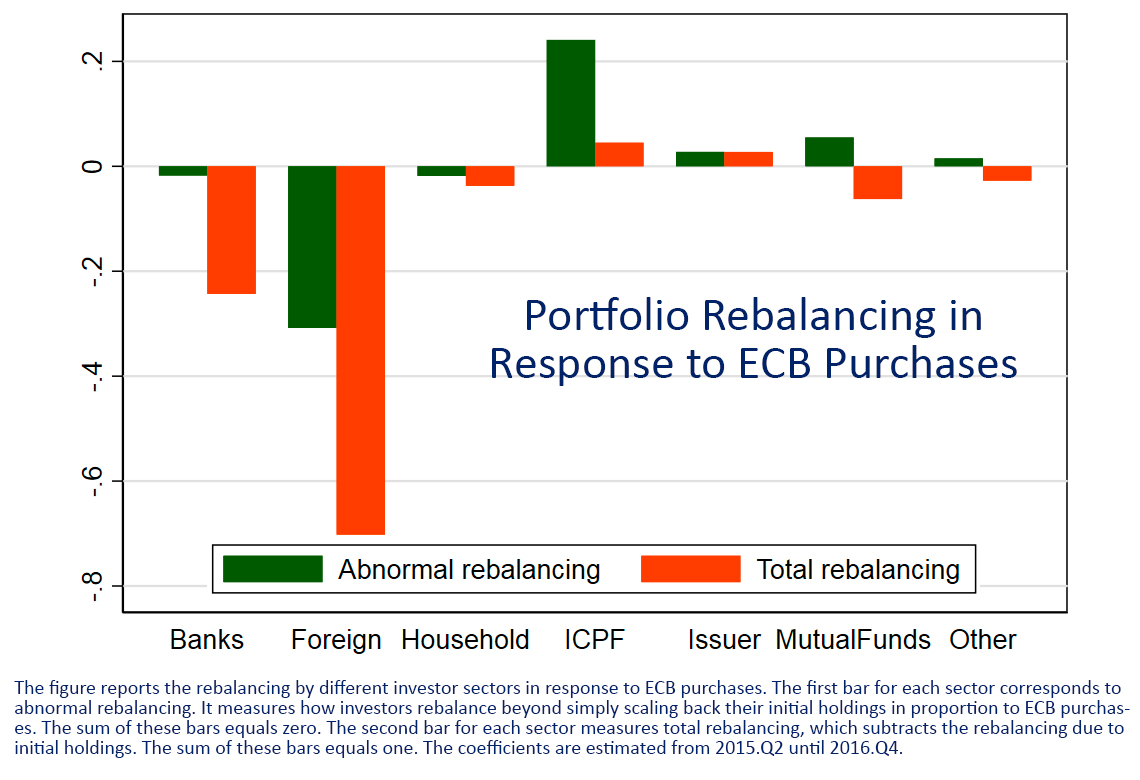

We provide stylized facts on investor portfolios before the purchase programmes (2013Q4-2014Q4), which summarizes how risk exposures are distributed across countries and institutional types. Following Altavilla, Pagano, and Simonelli (2016), we group countries into “vulnerable” (Italy, Spain, Portugal, Ireland, Greece and Cyprus) and “non-vulnerable” countries. We find that home bias mostly varies geographically instead of by institutional type. For instance, banks, insurance companies, and pension funds in vulnerable countries all hold more than 80% of their government bond portfolio in domestic government bonds. This suggests that the sovereign-bank feedback loop, which has received significant attention among academics and policymakers, is not limited to banks but could also apply to long-term investors such as insurers and pension funds. To summarize the risks in investors’ portfolios, we provide a simple framework to measure how the exposure to duration, sovereign, credit, equity, and foreign risks are distributed across investors. We then document how investors rebalance their portfolios during the first quarters of the purchase programme from 2015Q2 until 2016Q4. The purchases by the ECB are absorbed differently across institutions: Foreign investors outside of the Euro area sell most bonds, followed by banks and mutual funds. Insurance companies and pension funds, if anything, buy the same bonds as the ECB. This suggests that the QE programme may be reducing duration mismatch in the euro area. We do not find large portfolio shifts towards other assets such as corporate bonds or equities in the euro area.

We also estimate the effect of QE on asset prices using an instrumental variables strategy. To identify the effect of purchases on asset prices, we use that (i) purchases are split across countries using the capital key, which is a function of population size and GDP and (ii) that the ECB aims to conduct its purchases in a market neutral way. Our low-frequency, difference-in-difference estimate implies that bond yields decline (on average) by -13bp. We connect the portfolio rebalancing and price effects by estimating a sector-level asset demand system for government debt. Our findings have implications for the debate on the tools available to central banks in a low interest rate environment. While large scale asset purchases by central banks can be used to provide further accommodation at the lower bound, they may raise risks in particular relative to financial stability. Our paper explores both issues together. In addition to improving our understanding of the mechanics of asset purchase programmes, our findings however also have broader implications for asset pricing models. Traditional asset pricing models do not explicitly model institutional investors. In part in response to the financial crisis, a new generation of asset pricing models explores the role of institutional frictions and these models are used to study QE programmes. However, most models feature one class of intermediaries. Our results highlight the importance of heterogeneity across institutions, which determines the distribution of risk exposures and how demand shocks are absorbed.

Download the PDF version of this document

- Published on 09/01/2016

- 47 pages

- EN

- PDF (538.52 KB)

Updated on: 06/12/2018 10:58