Working Paper Series no. 887: An Evaluation of the French Innovation Tax Credit

The Innovation tax credit (crédit d’impôt innovation, CII) is an extension of the Research tax credit (crédit d’impôt recherche, CIR) intended to boost the incentive effect of the latter on SMEs to encourage them to engage in the creation of new products via the development of prototypes or pilot plants. Introduced in 2013, it amounted to €120 million of tax credit in 2014 for some 5,300 recipients. This article seeks to measure the impact of the introduction of this scheme on its beneficiaries over the period from 2013 to 2016. Using a difference in differences method following propensity score matching, we find a greater increase in employment in the short term for firms benefiting from the scheme, along with a more pronounced increase in their sales turnover in the medium term. A greater increase in the number of new products produced by the beneficiaries is also observed. Finally, the introduction of the CII went along with a reduction in the research expenditure reported under the CIR.

Introduced in 2013, the Innovation tax credit (crédit d’impôt innovation, CII) is an extension of the research tax credit (CIR) aimed at SMEs. While the CIR applies to all companies that declare research and development (R&D) expenses, the CII aims at "strengthen[ing] the competitiveness of innovative SMEs" (Projet de loi de finances, 2013) by encouraging the creation of new products and thereby promoting the economic value of R&D activities. Its tax base is made up of innovation expenditure relating to prototypes design or pilot plants for new products up to a limit of 400,000 euros per firm per year and at a rate of 20%, which automatically limits the tax credit to 80,000 euros per year and per SME.

This paper describes the beneficiary SMEs of the CII at the time the scheme was set up, in 2013 and 2014. Then, it studies the future of these beneficiary SMEs along two main lines. On the one hand, their economic development, particularly in terms of employment and turnover. On the other hand, the evolution of their research, development and innovation (R&D&I) activities, and the consequences in terms of creation of new products. In both cases, the methodology consists in comparing beneficiary SMEs to other non-beneficiary SMEs with comparable characteristics ex ante.

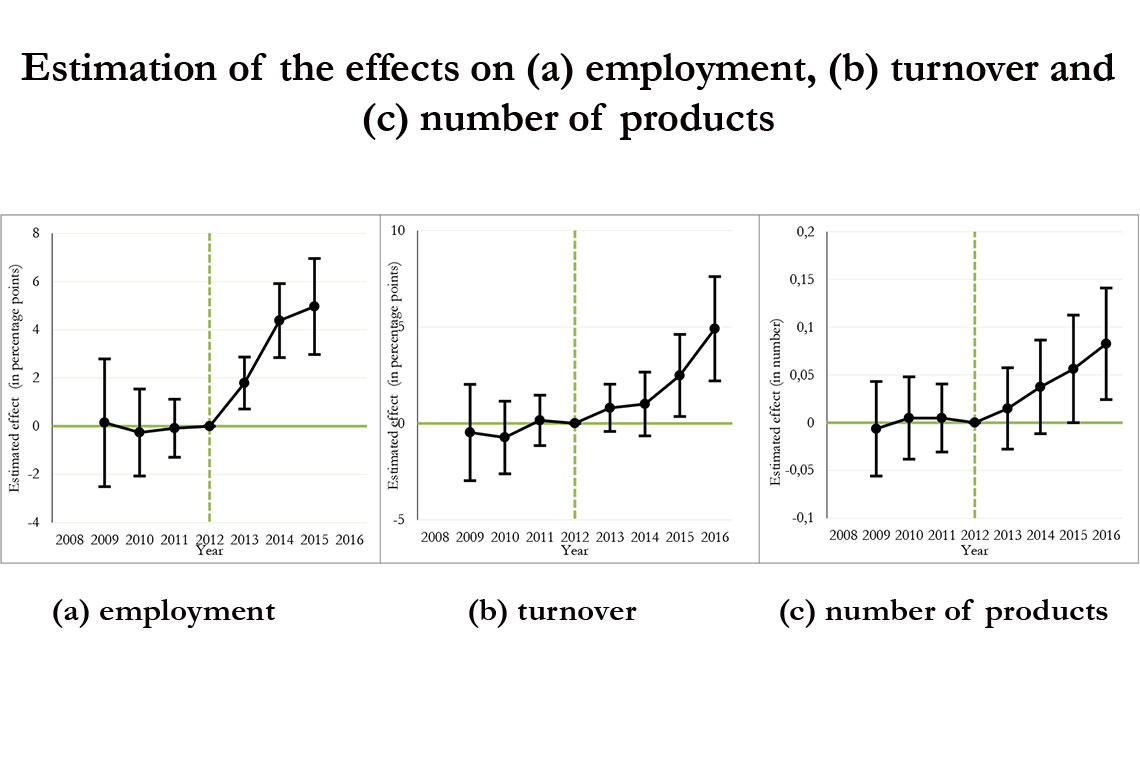

Figure 1 presents the estimated effects of the introduction of the CII on beneficiary firms. In all three figures, the coefficients for 2009, 2010 and 2011 are statistically non‑significant and confirm a similar evolution of the variables of interest before the introduction of the CII. First, figure 1a shows that a higher level of employment is observed from the first year of the scheme for the beneficiary firms. The gap between the two groups widens over time, increasing from 1.8 percentage point in 2013 to 4.4 percentage points in 2014 and 5.0 percentage points in 2015. This results is line with one of the initial goals of the CII, namely “contribute to job creation by [SMEs]” (PLF, 2013). Second, we observe a greater increase in the sales turnover of the beneficiary firms, which increases in magnitude over time (Figure 1b) In the medium term, it therefore appears that those benefiting from the CII are experiencing greater increases in their sales.

The path of the effect is very similar to the effect on the number of different products sold by the firms (figure 1c). This result reflects the ability of the beneficiary firms to offer additional products that are fairly different from the products they offered prior to the introduction of the CII. All in all, beneficiary firms seems to employ more people on the short run in order to develop new products, increasing their turnover three years after the introduction of the CII.

Nevertheless, the interpretation of these results as causal effects of the CII on the variables presented must be qualified. Indeed, matching methods allow for the correction of observable pre‑treatment differences, but they do not provide any guarantee as to the balance of non‑observable variables. Persistent differences in the latter could lead to a misinterpretation of the findings presented above. Moreover, it is important to keep in mind that there is a significant risk of endogeneity with regard to the use of the CII, since these are the firms that have chosen to use it.

Download the PDF version of this document

- Published on 09/30/2022

- 37 pages

- FR

- PDF (3.06 MB)

Updated on: 09/30/2022 11:42