Working Paper Series no. 638: The Failure of a Clearinghouse: Empirical Evidence

We provide the first detailed empirical analysis of the failure of a derivatives clearinghouse: the Caisse de Liquidation, which defaulted in Paris in 1974. Using archival data, we find three main causes of the failure: (i) a weak pool of investors, (ii) the inability to contain the growth of a large member position, and (iii) risk-shifting decisions by the clearinghouse. Risk-shifting incentives aligned the clearinghouse’s interests with those of the defaulting member, induced delays in the liquidation of the defaulted position, and led private renegotiation attempts to fail. Our results have implications for the design of clearing institutions.[1]

Non-technical summary

By insulating its members from bilateral default risk, clearinghouses, or central clearing counterparties (CCPs), play a critical role in the orderly settlement of transactions, both in over-the-counter and in exchange-based markets. Following the objective decided at the G20 Pittsburg summit in 2009, central clearing is mandatory for standardized derivatives in most countries, as regulators expect it to prevent market breakdowns or financial contagion. However, a new risk arises: the CCP itself could fail, with dramatic effects for financial stability.

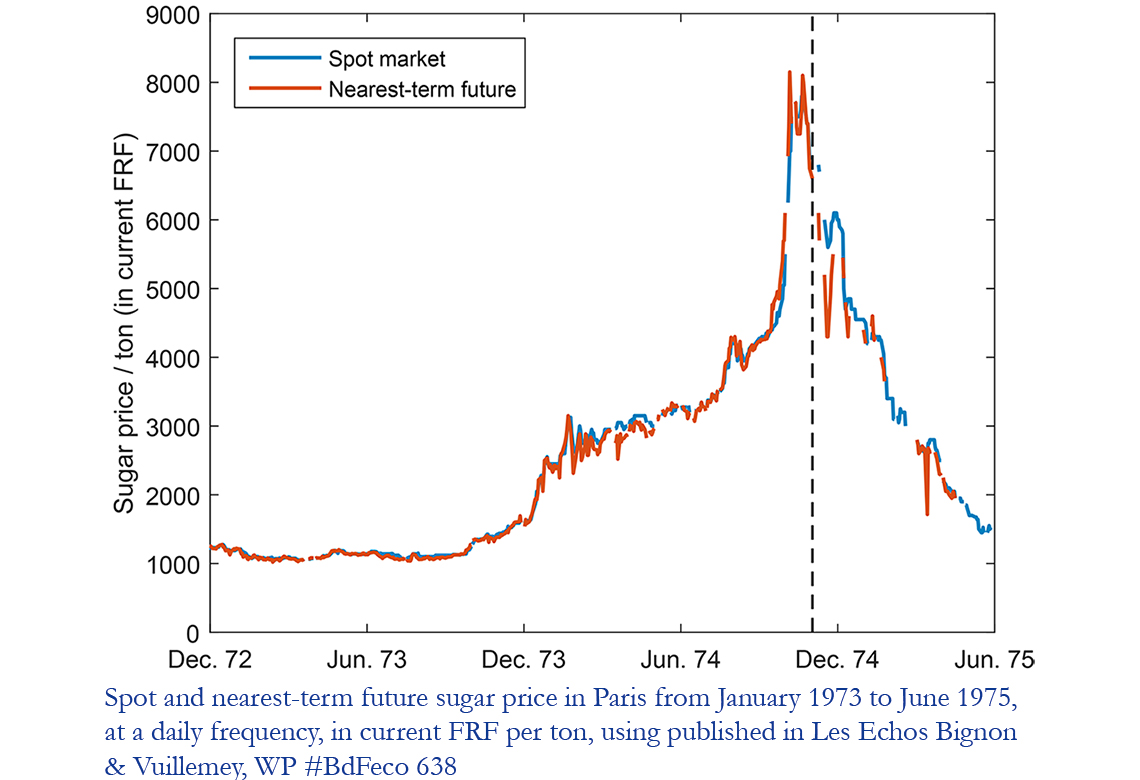

Against this background, our paper is the first to empirically study the failure of a CCP by relying on internal documents from both the CCP and the major clearing member which failed. The failing CCP was the Caisse de Liquidation des Affaires en Marchandises. It was the only clearinghouse operating in the Paris Commodity Exchange, a market most active for sugar futures. Between 1973 and 1974, a six-fold increase in global sugar prices (see Figure I) spurred trading activities. Starting in November 1974, margins calls due to the collapse of prices induced the largest clearing member, and ultimately the CCP, to fail. A novel “Le Sucre” was written to account for the unfolding of the events and a movie appeared on screens in 1978 with the same title. Yet the failure has not been studied before, except through a brief account by Professor Simon in 1981.

We argue that three main causes led to the failure of the CLAM. First, the pool of investors comprised unsophisticated and non-diversified retail investors. Many of them defaulted on margin calls exactly at the moment when the price of sugar priced dropped. Second, the CLAM relied on the erroneous idea that initial margins are a sufficient instrument for risk management. Therefore, it failed to contain the growth of a large position by one of its member, who ultimately failed. Third, risk-shifting incentives dominated the incentives to preserve the CCP’s charter value. This is due to the fact that the CLAM was not adequately capitalized and that its governance gave little weight to hedgers (the producers of sugar), who have stronger incentives to ensure the continuation of clearing services.

Based on our results, one can draw several policy implications.

Our results highlight the need for a CCP to monitor the pool of ultimate investors in cleared contracts. While this task may prove difficult in the case of client clearing (i.e., investors trading and clearing through a broker), margins can play a useful screening role: by asking for higher margins, a CCP can exclude traders that are financially more constrained. Furthermore, uniform margins are not a sufficient instrument for risk management, and a CCP needs to control the growth and the concentration of exposures using e.g. member-specific margin adjustments and position limits.

We also find that risk-shifting incentives in CCPs can be large. Risk-shifting can first be limited by better CCP capitalization. However, given the size of cleared markets, it is unlikely that CCPs can operate with equity levels that completely rule out risk shifting. In this context, the governance structure of a CCP can also prevent risk-shifting near default. Our findings highlight the importance of two types of members: (i) hedgers, who value the continuation of clearing services, and (ii) liquidity providers, who derive little value from future clearing services. A governance structure that gives more weight to hedgers is less likely to allow for risk-shifting strategies. Our findings show that a CCP free from risk-shifting is more likely to engage in rigorous risk management and, in distress, to accept value-increasing renegotiation plans.

Finally, our results have implications for the design of CCP default waterfalls. At the CLAM, in the absence of pre-specified procedure to call extra resources from solvent members, equity holders were taking losses up to their limited liability. Instead, in the default waterfalls of many modern CCPs, only one tranche of equity is impaired before additional resources are called from members, or losses are directly imposed onto members, before additional equity is impaired. While a structure of default waterfalls with multiple tranches of equity is seen as a way to give CCP equity holders skin-in-the-game, we highlight that it can also be valuable to mitigate risk-shifting incentives. Indeed, this structure reduces the sensitivity of a CCP’s equity value to settlement prices near default. However, sharing losses with surviving members comes at a cost: the CCP provides less insurance against counterparty risk, which is its primary function. In this respect, our study is silent on how exactly the tranching of a CCP’s equity within its default waterfall should be designed. This is left for future research.

Download the PDF version of this document

- Published on 08/23/2017

- 68 pages

- EN

- PDF (3.92 MB)

Updated on: 08/23/2017 16:58