Working Paper Series no. 840: Firms’ Inflation Expectations: New Evidence from France

Using a new survey of firms’ inflation expectations in France, we provide novel evidence about the measurement and formation of inflation expectations on the part of firms. First, French firms report inflation expectations with a smaller, but still positive, bias than households and display less disagreement. Second, we characterize the extent and manner in which the wording of questions matters for the measurement of firms’ inflation expectations. Third, we document whether and how the position of the respondent within the firm affects the provided responses. Fourth, because our survey measures firms’ expectations about aggregate and firm-level wage growth along with their inflation expectations, we are able to show that expectations about wages are even more condensed than firms’ inflation expectations and almost completely uncorrelated with them, indicating that firms perceive little link between price and wage inflation. Finally, an experimental treatment indicates that an exogenous change in firms’ inflation expectations has no effect on their aggregate wage expectations.

The role that firms’ inflation expectations can play in macroeconomic dynamics has long been recognized. These expectations can affect firms’ decisions along a variety of margins such as the prices they choose to charge (since future inflation determines the rate at which their relative price will fall) or how much to invest (via the perceived real interest rate). But measuring these expectations has presented many challenges and, as a result, there are very few high-quality surveys of firms’ inflation expectations, especially in advanced economies. In this paper, we report results from a new survey of firms’ inflation expectations in France.

This survey was implemented in five different waves in 2020 and 2021 using about nine hundred firms in total drawn from different sizes and sectors. Different formulations of the question about expected inflation were used, allowing us to provide new evidence on how the phrasing of the question matters for the measurement of expectations. To the best of our knowledge, this is the first survey of firms that allows us to explicitly characterize the position of the respondent within the firm and to study how it relates to their reported inflation expectations. Moreover, the survey measures not just inflation expectations but also what respondents expect about aggregate and firms’ wages. Fourth, 75% of firms are surveyed twice: a first time at the end of 2020 when inflation was close to 0 and again in May 2021 when inflation was significantly higher and concerns about inflation were more prominent.

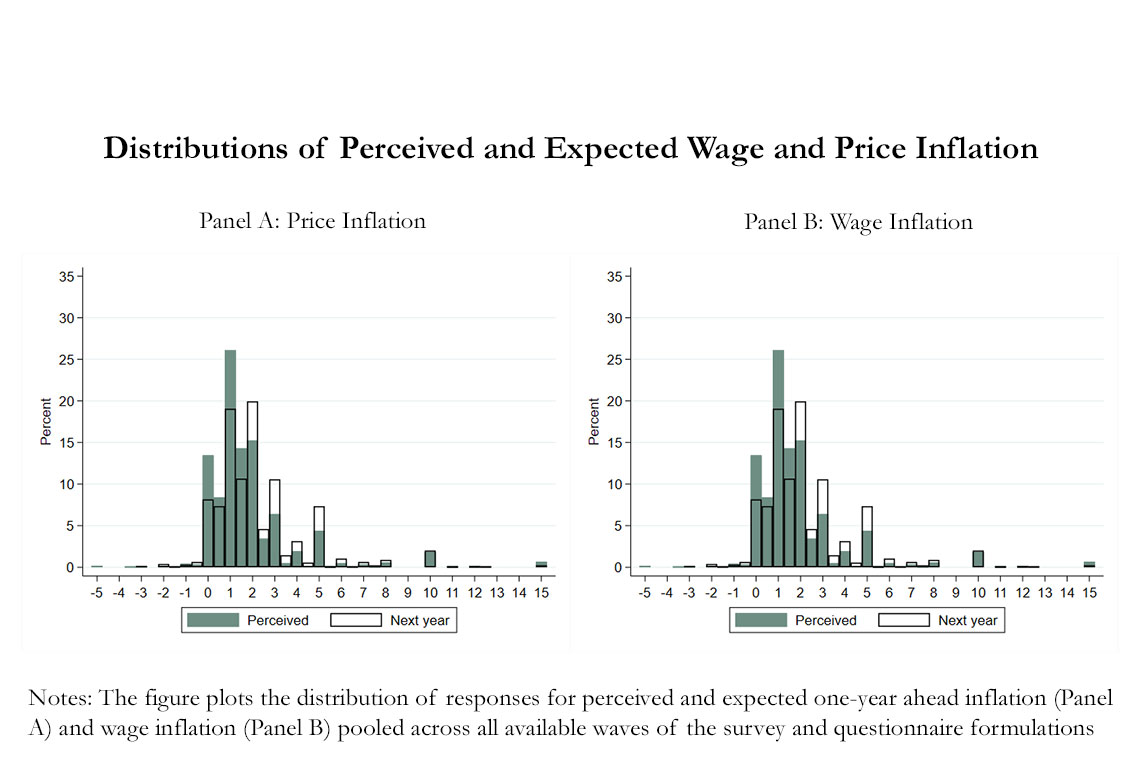

We emphasize several key results. First, the inflation expectations of firms in France were relatively low during the time of survey, close to 2% on average, but still higher than actual inflation over that period, which was running between 0 at the end of 2020 to about 1 percent over the first six months of 2021. Results are broadly similar across forecasting horizons, ranging from one-year ahead to two or five years ahead. Firms’ inflation forecasts therefore display a positive bias, as documented in other settings but significantly smaller than the one found in household forecasts. Second, the dispersion in answers about inflation in France (as shown in Figure A) is lower than observed in comparable surveys in other advanced economies and is also lower than dispersion in inflation forecasts among French households. Firm inflation forecasts nonetheless reveal significant disagreement about the evolution of the future aggregate price level. Third, firms in France disagree not just about future inflation but also about recent inflation. This indicates that inattention to macroeconomic conditions is pervasive among firms. Fourth, we find that when inflation is higher like in May 2021 when concerns about inflation were more prominent, the bias and the level of disagreement are more limited. Finally, firms’ perceptions about recent inflation are a strong predictor of what they anticipate future inflation to be, indicating that imperfect information provides an important rationale in accounting for disagreement about the future. We also document a positive link between firms’ expectations about their own prices and their expectations about aggregate inflation.

The unique characteristics of this survey allow us to further address three questions. The first is how sensitive are responses to the formulation of the question. We find only limited sensitivity of reported expectations to whether questions refer to inflation or prices in general, in contrast to what is often found for households. In contrast, when questions about future inflation first include information about recent inflation rates, we find that this has very large effects on the reported expectations of firms, leading to a strong reduction in the dispersion of forecasts and a movement in the mean toward the provided signal. We find that this information has a rather short-lived effect. We also use several different formulations to capture the long term inflation expectation of firms by varying the specific horizon used: 2 years, 3 to 5 years and 5 years and find that firms provide highly correlated answers for these different horizons. The second question that we address is how/whether responses differ based on the respondent’s position in the firm. CEOs and Financial Executives have, on average, significantly lower inflation expectations than those at lower levels within the firm or with positions unrelated to finance. We confirm this novel finding through a survey of French households and shows that observable socio-demographic characteristics of CEOs cannot fully explain why their expectations are so much lower. We interpret this as providing novel evidence that inflation expectations can differ within the firm, and therefore that one should try to ascertain the expectations of individuals making specific decisions: e.g. price-setters, recruiters, etc. Third, we find only a weak link between the aggregate wage expectations of firms and their price expectations, which suggests that, at least in the minds of firms, the link between wages and prices is not a particularly strong one.

Download the PDF version of this document

- Published on 10/21/2021

- 50 pages

- EN

- PDF (2.2 MB)

Updated on: 10/21/2021 14:32