Working Paper Series no. 771: Heterogeneity in Bank Leverage: the Funding Channels of Complexity

This paper assesses the net impact of complexity on leverage, at the Bank Holding Companies (BHCs) level using unique French supervisory data from 2010 to 2017. Geographical and structural complexity introduce diversification benefits and agency problems that affect the risk of BHCs. Whether investors price this risk or not is decisive for the cost of equity and finally leverage. Our results show a negative impact of complexity on leverage. To explain this result, we then focus on the funding channels of complexity. We find that complexity goes hand in hand with additional capital surplus and increasing cost of equity. As a second major finding, our results show that the impact of complexity on leverage and the funding channels of complexity are heterogeneous across BHCs and depend on their systemic status. In fact, size, complexity and systemic status complement each other. Omitting one of these dimensions leads to misleading conclusions on bank stability.

This paper assesses the net impact of complexity on leverage, at the Bank Holding Companies (BHCs) level. As leverage of BHCs is a risk factor that drives bank systemic risk, assessing the net impact of bank complexity on leverage is of the utmost importance to banking supervisors. Using unique supervisory data from 2010 to 2017, we focus on BHCs located in France and provide novel descriptive statistics on geographical and structural complexity. In this paper, complexity measures are based either on the international implementation of BHCs affiliates or on the business activities covered by BHCs through their affiliates specialization.

Leverage, defined as the ratio of total assets over equity, is derived from a trade-off between the fiscal benefit of debt and the cost of equity. Depending on how the relationship between complexity and risk is perceived by investors, complexity may affect the cost of equity and leverage. Assuming that complexity decreases risk thanks to risk diversification, the capital structure theory suggests that complexity reduces the cost of equity and increases bank optimal leverage. But as complexity increases bank risk for significant monitoring costs and agency problems, complexity potentially increases the cost of equity, leading to an increase in capital and a decline in leverage. The net impact of complexity on leverage is then ambiguous.

Empirically, the literature shows that complexity - implying income-based and asset-based diversification - introduces a diversification discount on financial conglomerates market values. It supports the agency problem hypothesis where investors price the additional risk due to complexity. All in all, it suggests that significant level of complexity may constrain leverage through high cost of equity.

Our data include information on complexity, accounting variables and prudential indicators at the BHCs level. Our data show a strong heterogeneity in complexity between systemic BHCs and other BHCs. Systemic BHCs account for 80\% of the total affiliates reported by all BHCs. While both the number of countries and the number of industries a BHC is active in decrease for systemic BHCs over the period, the number of countries increases and the number of industries stays quite stable for other BHCs. The particular profile of systemic BHCs is also observed in major bank control variables and we believe that the relationship between complexity, risk and leverage depends on BHCs profile (systemic Vs other).

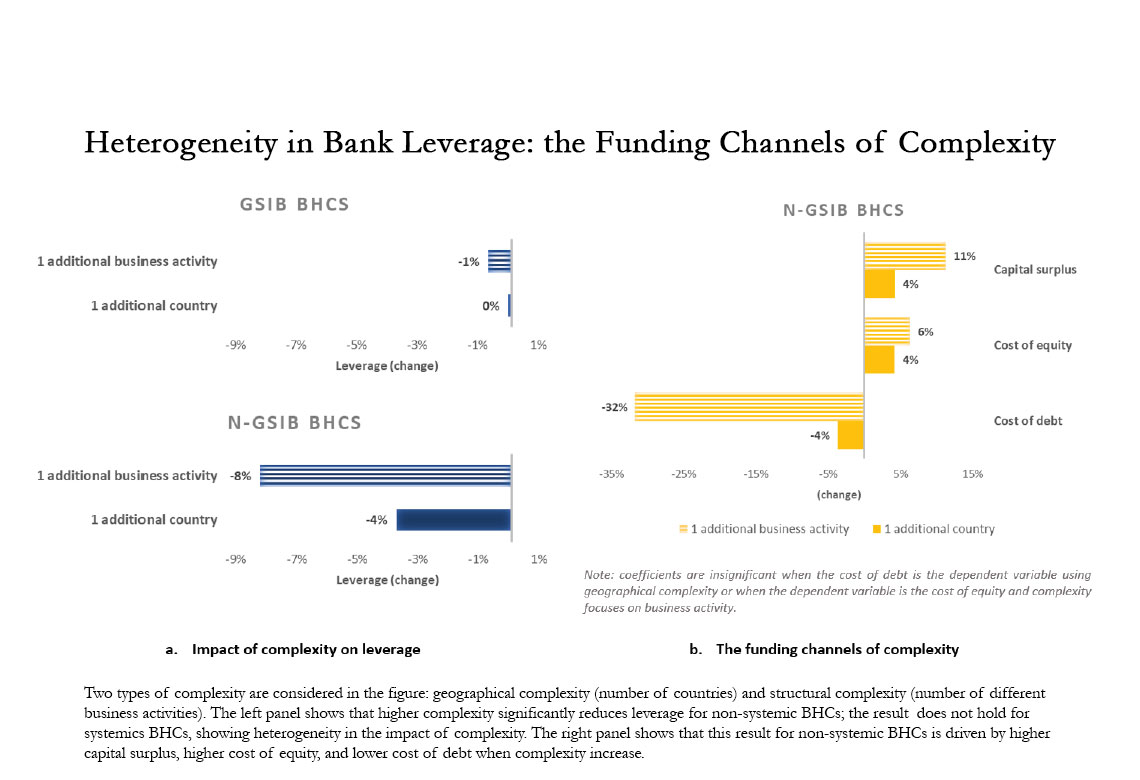

Our results, summarized in Figure 1)a), first indicate a non-monotonic relationship between leverage and complexity. Complexity implies lower leverage for non systemic BHCs than for systemic BHCs. It suggests that monitoring costs and agency problems outweigh diversification benefits for non systemic BHCs. Then, our results show that size, complexity and systemic importance add information on BHCs. Because they complement each other, omitting one of these dimension leads to misleading conclusions on leverage and the financial stability of BHCs. In a second time, we extend our analysis to the funding channels of complexity to explain our results on leverage. As reported in Figure 1)b), we focus on capital surplus and funding costs and we confirm the asymmetry between systemic BHCs and other BHCs. Due to complexity, non systemic BHCs are subject to additional capital constraints, implying both higher level of capital (i.e volume of capital) and larger cost of capital. Regarding systemic BHCs, they are only concerned by volumes and to a lesser extend than non-systemic BHCs. These additional capital constraints limit the development of leverage in the first place, especially as complexity implies limited benefits with regards to the cost of debt.

Download the PDF version of this document

- Published on 06/29/2020

- 36 pages

- EN

- PDF (2.25 MB)

Updated on: 06/29/2020 15:17