Working Paper Series no. 893: House Price Convergence: Evidence from India

The “club convergence” of sub-national house prices has so far been studied in respect of a number of advanced economies and emerging markets, but not for India. As such, this study contributes to this gap in literature by analyzing long-run convergence of regional house prices for a major emerging market. This study finds that city house prices in India do not converge to a single steady state, rather they form at least three clusters and converge to their respective steady state paths. The house prices are found to display conditional convergence driven by several factors, which inter alia include initial price levels, mortgage loans, and population density. The outcome of this study could be useful for policy makers in designing cluster-specific policy measures. It could also be useful for real estate fund managers, in achieving better fund diversification strategies, and the mortgage market forecasters, in reduced forecasting and modelling efforts.

House prices at the sub-national level are characterised by marked heterogeneity. Nevertheless, they could form clusters portraying similar dynamics. In other words, regional house prices could display club convergence. This implies that city house prices could organize into clubs within each of which they achieve convergence with the decline in dispersion of house prices of constituent cities over time. This convergence might be conditional and could, inter alia, be due to commonality of dynamics facing them. In a country, there could be multiple convergence clubs of house prices.

The evidence of club convergence behaviour of sub-national mortgage markets could be useful for policy makers in designing cluster-specific policy measures, especially for large countries, including ways to reduce differences across “regional clubs”. For instance, identification of housing clusters and the associated common drivers could better guide policy makers in stabilizing demand-driven localized house price shocks through region-specific policy measures. Also, it could guide in better addressing the issue of housing shortages and affordability through apposite demand and supply-side interventions. The club convergence understanding could also be useful for the real estate investors/ fund managers/ investment trusts, etc. as they could implement better fund diversification strategies. Furthermore, this could also save modelling and forecasting efforts of the forecasters since they could study the groups together.

Though several house price club convergence studies have been conducted in the context of both advanced and emerging market economies, to the best of our knowledge, there is no study so far for India on this area. As such, this study contributes to the literature in the Indian context. It seeks to investigate the following issues: Do the sub-national residential house prices in India converge to a single long-run equilibrium?; If not, do they form respective convergence groups (‘convergence clubs’) wherein those with common trend converge; and what are the drivers of convergence in those groups?

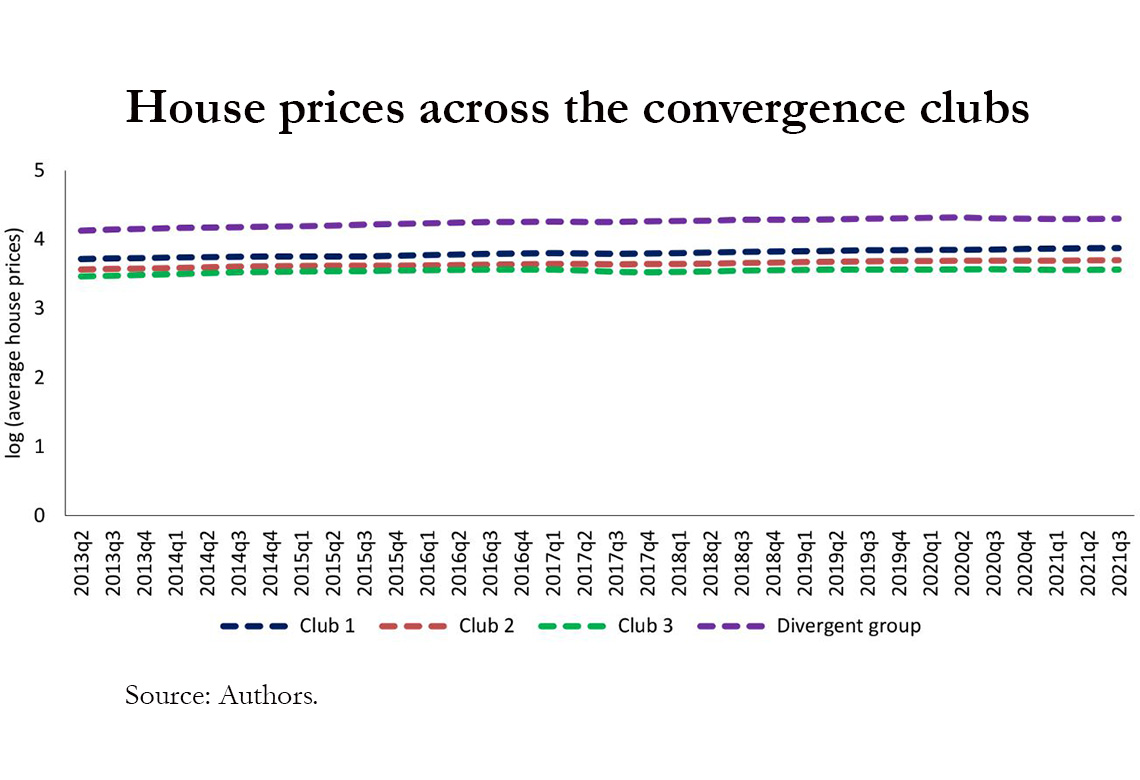

With these in hindsight, this study analyses the quarterly sub-national residential house prices data for 50 cities of India and implements tests on the shape of convergence (notably log test) and clustering algorithm as suggested by Phillips and Sul [(2007) and (2009)]. Our findings suggest that sub-national house prices in India do not converge to a single steady state. Rather, they form clusters, wherein they exhibit conditional convergence to the respective steady states. Of the 50 cities, residential house prices of 48 cities form three distinct convergence clubs. Two cities, with the highest residential price levels, form a divergent group. The clubs appear to differ in terms of price level. The transition path of cities within a club may be quite distinct from one another. However, they all display catching-up to the club-specific average transition path.

Furthermore, to understand the drivers of this club convergence, we estimated an ordered probit model. Initial residential price, house rent, home loans, population density, literacy and city inflation determined convergence club membership. Estimates suggest that the prospect of a city belonging to higher house price club improves with higher initial house price, home loan, rent, population density, and literacy. On the contrary, higher city inflation increase the chances of a city being associated with lower house price club. The findings of the study could be useful for policy makers, fund managers and the mortgage market forecasters.

Download the PDF version of this document

- Published on 12/07/2022

- 35 pages

- EN

- PDF (1.41 MB)

Updated on: 12/07/2022 18:23