Rue de la Banque no. 68: How does a euro/dollar exchange rate shock affect inflation in France?

In this paper, we analyse the impact of an exchange rate shock on inflation in France using the Model for Analysis and Projection of Inflation (MAPI) of the Banque de France (see Working Paper, No. 637). We show that the

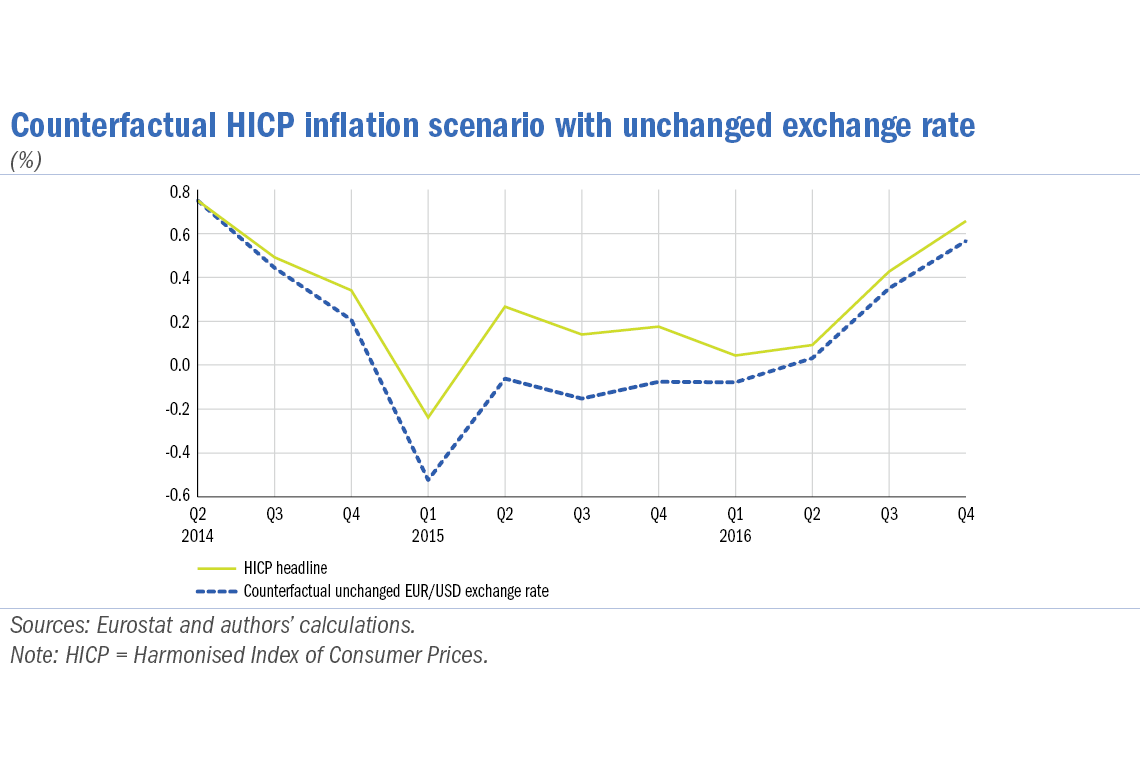

depreciation of the euro between 2014 and 2016 led to a rise in inflation of around 0.3 percentage point in 2015, before taking into account second-round effects, mainly via the impact of oil prices in euros on the energy component of inflation. Conversely, the appreciation of the euro in early 2017 contributed to reducing inflation by 0.1 percentage point in 2017. However, the impact on inflation excluding energy and food is more diffused.

By Louis de CHARSONVILLE et Caroline JARDET

The Model for Analysis and Projection of Inflation (MAPI) is the reference tool for forecasting consumer price inflation in France in the framework of the Eurosystem’s forecasting exercises. These exercises are conducted four times a year, in March, June, September and December. The June and December exercises are carried out with the help of national central banks.

MAPI is noteworthy in that it provides a disaggregated forecast of the price index. Twelve sub-components of the Harmonised Index of Consumer Prices (HICP) are projected, then aggregated to reconstitute headline inflation as measured by the HICP and its five main sub-components: processed and unprocessed food, manufactured goods, energy and services. The breakdown used (see Table 1) isolates goods and services whose prices are totally or partially regulated: tobacco, pharmaceuticals, gas, electricity and medical services.

These are projected on the basis of announcements made by the government, notably in the Finance Act.

For the other components, MAPI is a reduced-form model composed mainly of error correction equations (ECM).

These equations incorporate a set of exogenous variables obtained from two sources. On the one hand, MAPI includes so-called “technical” international assumptions common to the entire Eurosystem. These common assumptions are projections of exchange rates, interest rates, international trade prices, oil prices and other commodities.

Download the PDF version of this document

- Published on 09/28/2018

- 6 pages

- EN

- PDF (636.39 KB)

Updated on: 09/28/2018 12:14