Working Paper Series no. 631: Illiquid Collateral and Bank Lending during the European Sovereign Debt Crisis

We assess the effect of accepting illiquid assets as collateral at the central bank on banks’ lending activity. We study the lending activity of the 177 largest banks in the Euro area between 2011m1 and 2014m12 and the composition of their pool of collateral pledged with the Eurosystem. Panel regression estimates show that the banks that pledged more illiquid collateral with the Eurosystem increased their lending to non-financial firms and households: a one standard deviation increase in the volume of illiquid collateral increase lending by 0.6%.[3]

NON-TECHNICAL SUMMARY

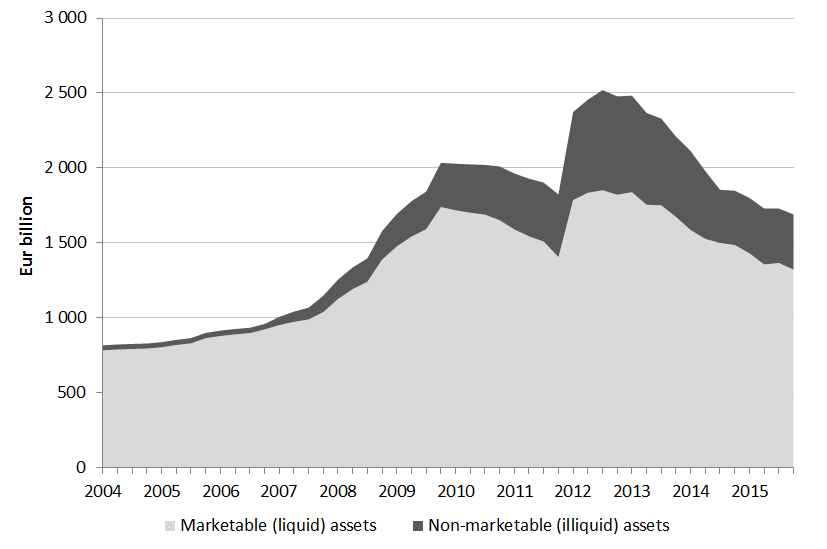

This paper studies the lending of last resort function of the Eurosystem in a time of bank funding stress, in relation to its underlying collateral policy. We show that the current collateral policy of the Eurosystem that allows banks to pledge credit claims of good quality as collateral, boosted lending activity for both banks that did and did not suffer a bank run during the euro debt crisis. The collateral framework of the Eurosystem is topical as central bank money is issued through temporary loans of reserves against collateral. The assets eligible as collateral comprise two categories: marketable assets which are traded in organized markets and non-marketable assets which consist mostly of credit claims such as mortgages and loans to non-financial companies of sufficiently low credit risk. Figure below plots the relative importance of the latter in the collateral pledged with the Eurosystem from 2004 to 2015.

Collateral pledged with the Eurosystem since 2004 Market value after haircut, EUR bn

Download the PDF version of this document

- Published on 06/02/2017

- 30 pages

- EN

- PDF (2.35 MB)

Updated on: 06/02/2017 17:24